No Data

.N225 Nikkei 225

- 36241.700

- +196.320+0.54%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

Murata Manufacturing is ranked, and this period's guidance is significantly below consensus.

Murata Manufacturing Co., Ltd. <6981> has ranked in (as of 9:32 AM). A sharp decline. The company announced its financial results for the fiscal year ending March 2025 the previous day, reporting an operating profit of 279.7 billion yen, which is a 29.8% increase compared to the previous year, but the market estimates fell short by nearly 30 billion yen. For the fiscal year ending March 2026, the forecast is 220 billion yen, a 21.3% decrease, significantly below the consensus of approximately 345 billion yen. A Share Buyback has been announced, but negative perception toward the substantial downward revision of guidance is prevailing. Top changes in Volume [May 1, 09:

May 1st [Today's Investment Strategy]

[Fisco Selected Stocks]【Material Stocks】 Roadstar Capital <3482> 2530 yen (4/30) engages in Real Estate Investment using its own funds. The first quarter financial results have been announced. The operating profit is 5.55 billion yen (2.1 times that of the same period last year). A hotel property in Tokyo was sold, and three new office buildings, etc., were acquired. The assets under management in the asset management business have exceeded 130 billion yen, significantly surpassing the 90 billion yen at the end of the same period last year. The operating profit for the fiscal year ending December 2025 is

Rating [Securities companies rating]

Upgraded - Bullish Code Stock Name Securities Company Previous Changed After -------------------------------------------- <8968> Fukuoka REIT Mizuho "Hold" "Buy" Downgraded - Bearish Code Stock Name Securities Company Previous Changed After -------------------------------------------- <7752> Ricoh Daiwa "2" "3" <3481> Mitsubishi Logistics Mizuho "Buy" "Hold" <9602> Toho.

Pay attention to Strike and Mitsubishi Warehouse, while M&A Research Institute and Emplus may be sluggish.

In the US stock market on the 21st, the Dow Jones Industrial Average rose by 141.74 points to 40,669.36, the Nasdaq Composite Index fell by 14.98 points to 17,446.34, and the Chicago Nikkei 225 Futures increased by 135 yen compared to the Osaka daytime to 36,165 yen. The exchange rate is 1 dollar = 143.00-10 yen. In today's Tokyo market, Roadstar <3482> announced that its operating profit in the first quarter increased 2.1 times compared to the same period last year, and Simplex HD <43> projected an operating profit increase of 22.1% from the previous period and 17.5% for the current period.

List of cloud penetration stocks [Ichimoku Kinko Hyo - List of cloud penetration stocks]

○ List of stocks breaking through the clouds Market Code Stock Name Closing Price Leading Span A Leading Span B Main Board <1835> Toei Iron Works 3155 3082.25 3129.5 <1899> Fukuda Corporation 5320 5287.55 127.5 <1946> Toenek 1130 1003.59 97.5 <1964> Chugai Boiler 3780 3752.53 590 <1975> Asahi Corporation 2139 2043.25 213

Murata Manufacturing and others announced a Share Buyback on April 30.

The companies that announced the acquisition of their own shares on April 30 (Wednesday) are as follows: <6981> Murata Manufacturing 77 million shares (4.1%) 100 billion yen (from 25/5/7 to 25/10/29) <9022> JR Tokai 45 million shares (4.6%) 100 billion yen (from 25/5/1 to 26/2/27) <6770> Alps Alpine 20 million shares (9.7%) 20 billion yen (from 25/5/1 to 26/3/31) <9301> Mitsubishi Warehouse 33 million shares (9.2%) 20 billion yen (from 25/5/1 to 26/.

Comments

News Corp (NWS US) $News Corp-B (NWS.US)$

Daily Chart - [BULLISH ↗ **] NWS US is holding above support at 29.1 and we expect price to push towards 35.14 resistance level. A daily candlestick close above 35.14 will push price higher to the next resistance at 38.0. Technical indicators are advocating for a bullish scenario as well, with the MACD starting to show a buildup in positive momentum.

Alternatively: A daily candlestick c...

Hess Corporation (HES US) $Hess Corp (HES.US)$

Daily Chart -[BULLISH ↗ **]HES US is holdingabove support at 128.5 and we expect price to push towards 138.35 resistance level. Stochastics has bounced off support level where price reacted in the past.

Alternatively: A daily candlestick closing below 128.5 support will open a drop towards the next support at 124.4.

Monolithic Power Systems (MPWR US) $Monolithic Power Systems (MPWR.US)$

D...

🥊The US slapped Japan with a 24% tariff across Japanese imports - currently on a 90-day pause - although the 10% baseline charge as well as 25% tariff on cars, steel and aluminum is still being ap...

Links to their Live Matrix where you can see how the warrants move alongside the underlying stock/index futures:

City Dev call $CityDev MBeCW251229 (RVLW.SG)$ : Singapore Warrants | Trading Stocks and Index Warrants | Macquarie

Keppel call $KeppelMBeCW251229 (VKJW.SG)$ : Singapore Warrants | Trading Stocks and Index Warrants | Macquarie

OCBC put $OCBC Bk MB ePW251104 (Z4TW.SG)$ : ...

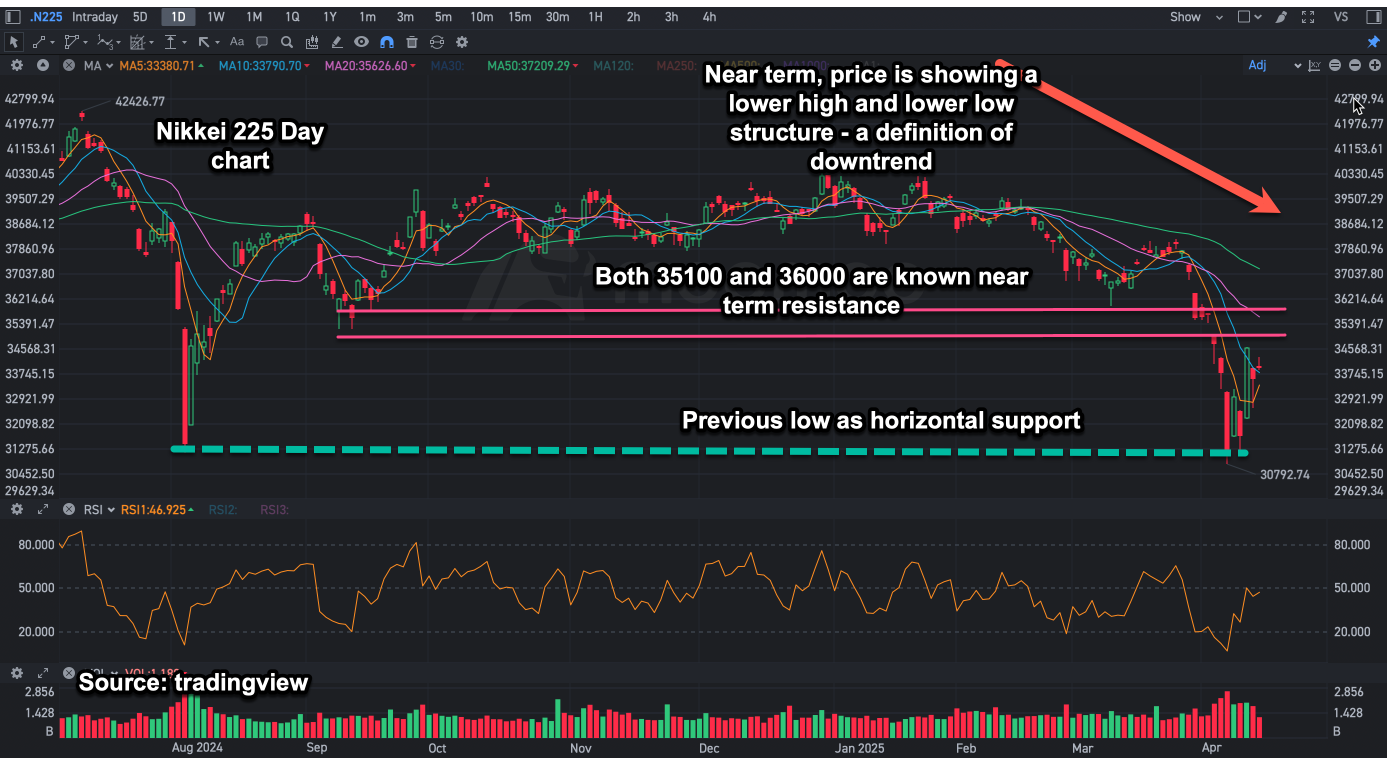

Day Chart Overview

– Price structure is currently forming a series of lower highs and lower lows — indicative of a near-term downtrend.

– Immediate resistance zones are seen around 35,100 and 36,000, which were previous support zones now acting as resistance

– Horizontal support lies around the 30,828 level, marked by a previous low.

1-Hour Chart Overview

– Recent price action shows a rebound from the 32,700 level, forming ...

Cui Nyonya Kueh : Thank you see you tomorrow !