No Data

00981 SMIC

- 47.850

- +0.350+0.74%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

After ongoing fluctuations, the market may be nearing a directional choice, with the AI, Siasun Robot&Automation, and other Technology growth sectors likely to rebound.

Looking back at the market situation before the festival, the market has been in a state of fluctuating consolidation, and the atmosphere of market observation remains quite strong.

【Brokerage Focus】 Galaxy Securities: The USA's tariff policy has limited impact on China's Semiconductors Industry. In the long term, domestic substitution and autonomous controllability are expected to benefit.

Goldwing Financial News | A research report from Galaxy Securities states that by the end of the fourth quarter of 2024, the allocation of actively managed public fund holdings in the electronics industry will reach 9.63% of the fund's stock investment market cap, indicating an overweight position. Year-to-date, influenced by multiple factors such as Deepseek's exploration of new paths for large model development, the central government's meeting with private entrepreneurs, and leading domestic cloud companies increasing capital expenditures, the electronics industry index has risen further. However, affected by USA tariff policies, the global industry chain 'blockification' will accelerate. It is expected that tariff policies will have a huge impact on global manufacturing. The report indicates that among them, some semiconductor products,

The Siasun Robot&Automation industry is experiencing a rise with a noticeable increase in entrants, and the Sector is expected to continue to be in the spotlight.

① According to Statistics from the new strategy humanoid robot research institute, as of December 2024, the number of Global humanoid robot Ontology companies has surpassed 220. Among them, companies from China account for half, exceeding 110. ② Shanghai Securities stated that the Industry Chain for humanoid robots has entered a phase of "a hundred flowers bloom, a hundred schools of thought contend," and the commercialization of humanoid robots is promising. It is recommended to pay attention to domestic component manufacturers that will benefit.

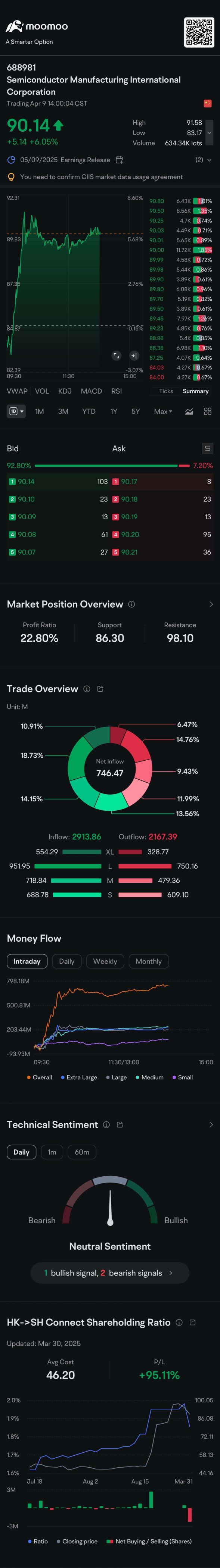

Hong Kong stock market news preview for this week|The Federal Reserve's interest rate decision is approaching, and Semiconductor Manufacturing International Corporation and other companies will disclose their performance.

① The Federal Reserve's interest rate decision is approaching, what other significant events are worth paying attention to? ② Semiconductor Manufacturing International Corporation and other companies will disclose their performance, what are the highlights?

China Merchants: The A-share market in May may present a pattern of "weight index recovery and active technology growth."

China Merchants stated that looking ahead to May, the market may present a pattern of "weight index rebound and active Technology growth."

Next week's important schedule: Federal Reserve interest rate decision, China CPI, import and export, and financial data, AMD Semiconductor Manufacturing International Corporation Earnings Reports.

The Federal Reserve and the Bank of England announced their interest rate decisions, Canadian Prime Minister Carney will meet Trump for the first time in the United States, Musk's Grok 3.5 large model was unveiled, and Auntie in Shanghai plans to list on the Hong Kong Stock Exchange on May 8. In terms of data, pay attention to China's CPI and PPI inflation, foreign reserves, imports and exports, and financial data, while regarding Earnings Reports, focus on AMD, ARM, Semiconductor Manufacturing International Corporation, and others.

Comments

Yesterday, Hong Kong's stock market experienced a historic sell-off. The $Hang Seng TECH Index (800700.HK)$ plummeted 17.16%, marking its second-largest single-day drop since 1990. Meanwhile, the $Hang Seng Index (800000.HK)$ and $Hang Seng China Enterprises Index (800100.HK)$ tum...