No Data

4063 Shin-Etsu Chemical

- 4528.0

- +113.0+2.56%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Expectations for the progress of the weak yen and tariff negotiations are driving prices close to 37,000 yen.

The Nikkei average has risen for seven consecutive trading days, finishing at 36,830.69 yen, up 378.39 yen (with an estimated volume of 1.9 billion 70 million shares). The depreciation of the yen, driven by the retreat of speculation regarding additional interest rate hikes by the Bank of Japan, combined with expectations of progress in tariff discussions with the USA, led to a bullish start. Autos stocks were bought, reaching as high as 36,976.51 yen in the middle of the morning session, approaching the significant level of 37,000 yen. However, ahead of the four-day holiday, profit-taking selling is likely to occur, and the USA is awaiting the announcement of the employment statistics for April.

The Nikkei average is up 378 yen, extending gains for seven consecutive days, with aggressive buying being limited ahead of the four-day holiday.

Two days later, the Nikkei average stock price rose by 378.39 yen to 36,830.69 yen, marking the seventh consecutive increase. The TOPIX (Tokyo Stock Price Index) also rose by 8.34 points to 2,687.78 points, continuing its eighth consecutive rise. With the backdrop of rising US stocks and a weaker yen, the trading started with buying pressure. At 9:47 AM, the Nikkei average reached 52,421 yen, marking a high of 36,976.51 yen. Afterward, as the market had been rising consecutively and with the upcoming four-day holiday from the 3rd, active buying was limited. The trading ended.

Shin-Etsu Chemical and Mito Securities have been upgraded to "A".

Mito Securities upgraded the rating of Shin-Etsu Chemical Co., Ltd. <4063.T> from "B+" (slightly Bullish) to "A" (Bullish) effective from the 1st. The Target Price remains at 5,800 yen. Financial Estimates indicate that the demand for PVC in the USA will remain strong in the medium term. There are expectations for contributions from the new facilities of Shintec and improvements in the spread. Provided by Wealth Advisor Company.

The Nikkei average is about 230 yen higher, with positive contributions from Fast Retailing, Daikin, and Shin-Etsu Chemical leading the way.

At 12:47 PM on the 2nd, the Nikkei Stock Average is trending around 36,680 yen, up about 230 yen from the previous day. In the afternoon session, trading started near the morning's closing price. After that, it seems that active trading is limited due to the upcoming consecutive holidays. The foreign exchange market is at 145.20 yen to the dollar, and the yen is strengthening in the afternoon. In terms of the contributions of the stocks included in the Nikkei Stock Average, Fast Retailing <9983.T>, Daikin <6367.T>, and Shin-Etsu Chemical <4063.T> rank among the top positives.

Japan M&A, strawberries ETC (additional) Rating

Target Price Change Code Stock Name Securities Company Previous Change After ---------------------------------------------------- <2127> Japan M&A Daiwa 750 yen 800 yen <2337> Ichigo Morgan Stanley 390 yen 430 yen <2579> Coca BJH Morgan Stanley 2200 yen 2400 yen <3479> TKP Morgan Stanley 1500 yen 1700 yen <6301> Komatsu City 4400 yen 4500 yen <9022> JR East.

The Nikkei average is up about 440 yen, showing strength mainly in export-related stocks = two days ago.

On the 2nd at around 10:07 AM, the Nikkei average stock price was trading at around 36,890 yen, up about 440 yen from the previous day. At 9:47 AM, it reached 36,976.51 yen, an increase of 524.21 yen. In the US market on the 1st local time, supported by strong earnings from Microsoft and Meta (formerly Facebook), the NY Dow rose for the seventh consecutive day while the Nasdaq Composite Index rebounded. Japanese stocks were buoyed by the rise in US stocks and the yen moving toward a depreciation direction on the Foreign Exchange market, leading to initial buying. Regarding US tariff policies, Bessent, the US Treasury ...

Comments

United States

Goldman Sachs expects US companies to achieve their highest quarterly profits in 3 years, which will ultimately lead to an increase in the performance of US stock market indices.

US Labor Market Losing Steam As Unemployment Rate Climbs To 4.1%

The U.S. Department of Labor reported robust job growth in June, with non-farm payrolls increasing by 206,000, compared to an estimated 190,000. Average hourly earnings rose by 0.3% month-ove...

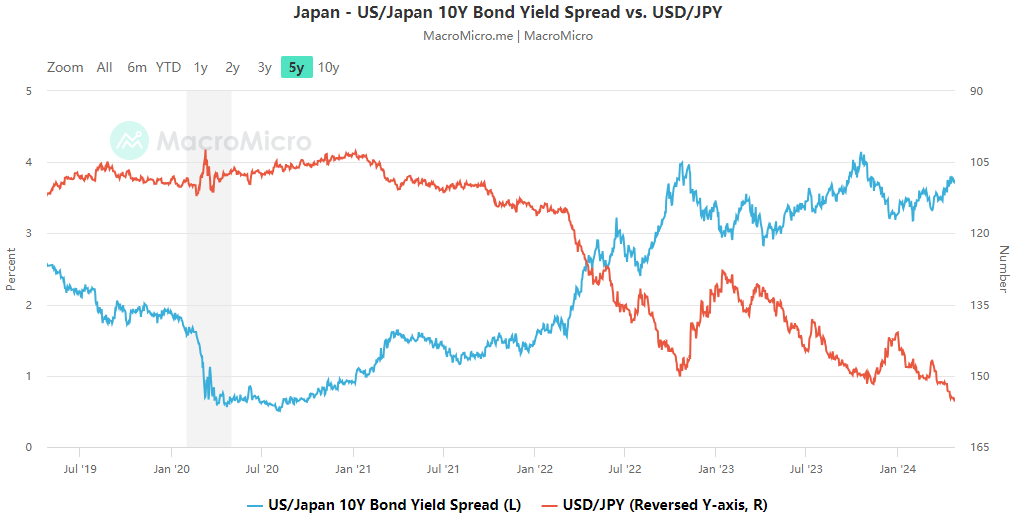

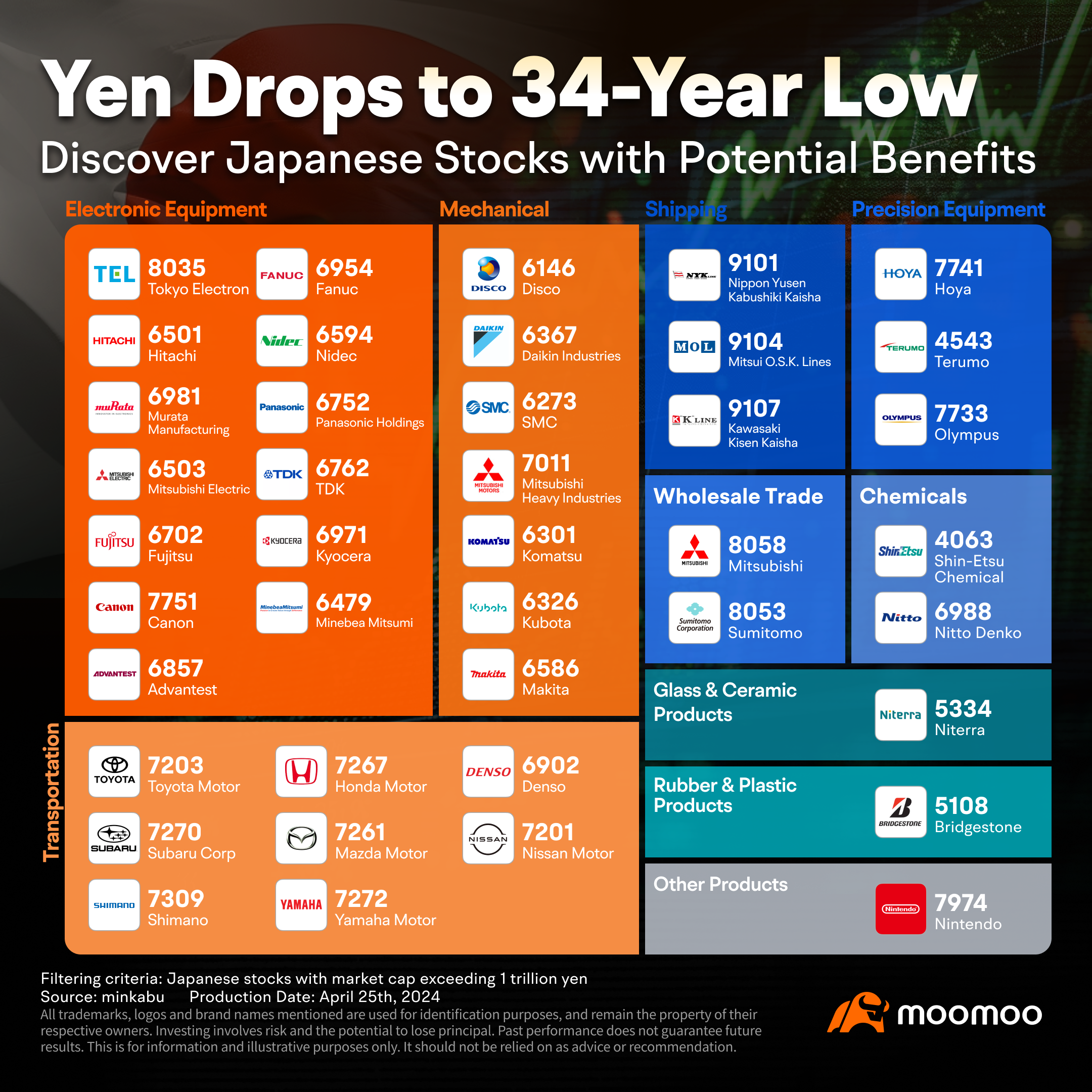

On April 24th, the Japanese yen continued its slump against the US dollar, breaching the key level of 155 fo...

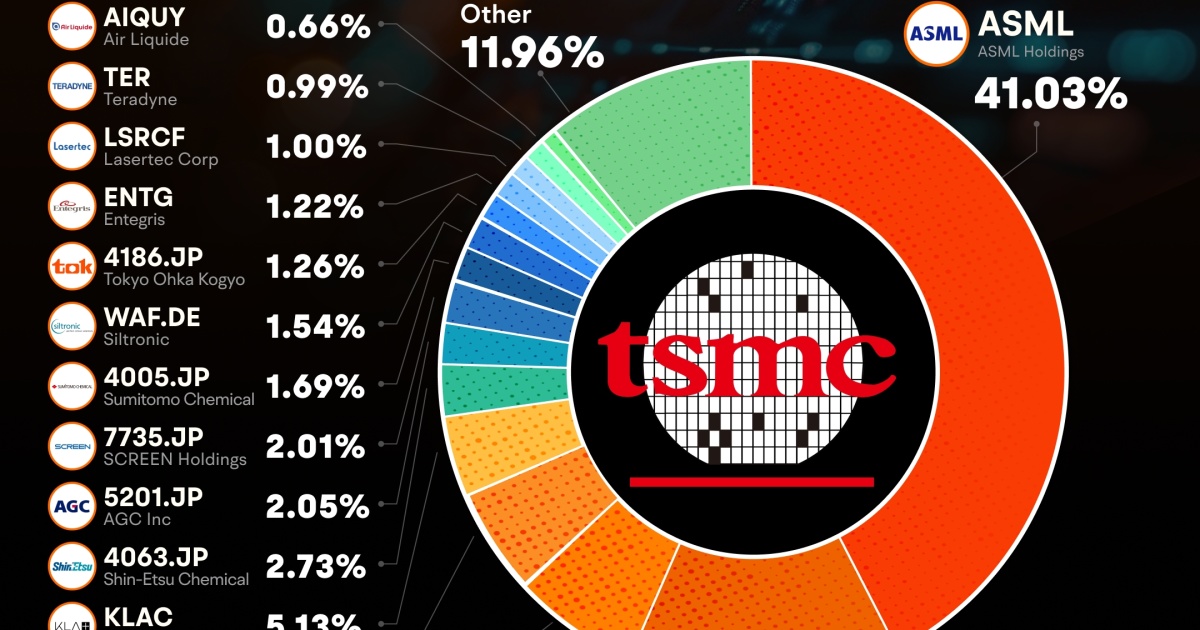

Equipment Suppliers:

$ASML Holding (ASML.US)$: A leadin...