No Data

601995 China International Capital Corporation

- 32.85

- -0.05-0.15%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

CICC's Q1 Profit Balloons 65%

Market Chatter: CICC to Further Expand Global Reach Amid Trade Wars

CICC: CHINA TELECOM's B-end revenue growth may slow down. Currently maintaining a "Outperform Industry" rating for Listed in Hong Kong.

China International Capital Corporation released a Research Report stating that CHINA TELECOM (00728) experienced a B-end revenue growth in the first quarter of this year that was below expectations, resulting in revenue slightly falling short of market expectations. Additionally, due to the impact on revenue, first-quarter profits might also grow slower than the annual performance. Considering the group's control over accounts receivable and the quality of projects, B-end revenue growth may slow down; thus, the revenue forecasts for A-shares for 2025 and 2026 are adjusted slightly downwards to 534 billion and 543.4 billion yuan, respectively, while net profit forecasts are lowered by 1% and 1.3% to 34.7 billion yuan and 36.3 billion yuan, respectively. The Listed in Hong Kong rating of 'Outperform Industry' and a Target Price of 6 Hong Kong dollars are maintained.

CICC: Consolidate the stable situation in Real Estate, focus on urban renovation and reserve progress, Bullish on CHINA RES LAND and others.

China International Capital Corporation released a Research Report stating that on April 25, the Political Bureau of the Central Committee held a meeting to emphasize that the Real Estate sector should "continuously make efforts to prevent and resolve risks in key areas... enhance the implementation of urban renewal actions, and effectively and orderly promote the transformation of urban villages and the renovation of dilapidated houses. Accelerate the construction of a new model for Real Estate development, increase the supply of high-quality Residences, optimize the policies for acquiring existing Commodities, and continuously consolidate the stability of the Real Estate market." China International Capital Corporation believes that the meeting's statements on the transformation of urban villages and existing housing storage generally align with previous expectations, focusing on the progress of urban transformation in key cities, the autonomy regarding the use of existing housing storage, and the price tre

CICC: Downgrade Great Wall Motor's Target Price to HKD 15.5, maintain "outperform the industry" rating.

China International Capital Corporation released a research report stating that it has lowered the Target Price for Great Wall Motor (02333) H shares by 18% to HKD 15.5, and also reduced the A share Target Price by 14%, maintaining a rating of "outperforming the Industry" for both. Based on a conservative expectation of the company's overseas market performance in terms of volume and profit, China International Capital Corporation has lowered its earnings forecast for the company in 2025 by 6% to 14.5 billion yuan (the same below), while maintaining the earnings forecast for 2026. Great Wall Motor's revenue in the first quarter of 2025 was 40.02 billion yuan, a year-on-year decrease of 6.6%, and a quarter-on-quarter decrease of 33.2%; net profit attributable to parent was 1.75 billion yuan, a year-on-year decrease of 45.7%, and a quarter-on-quarter decrease of 22.7%, gross

Zhitong Hong Kong Stock Early Knowledge | The Ministry of Industry and Information Technology released the key points of automotive standardization work for 2025, ahead of schedule conducting research on the standardization needs of new business formats s

The Ministry of Industry and Information Technology released the key points for vehicle standardization work in 2025. It proposed to proactively layout standards research in cutting-edge fields. Analyzing and assessing the development trends of cutting-edge technologies and potential application scenarios, identifying and evaluating the future direction of vehicle standardization development, promoting the formulation and release of standard sub-systems for automotive AI, Solid State Battery, electric vehicle battery swapping, and initiating the construction of standard systems for new fields such as data governance and application, while conducting advanced research on standardization needs for new business formats like flying cars.

Comments

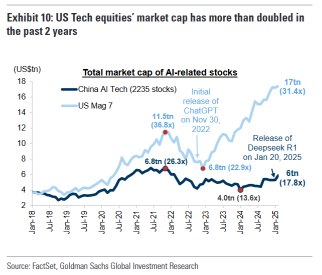

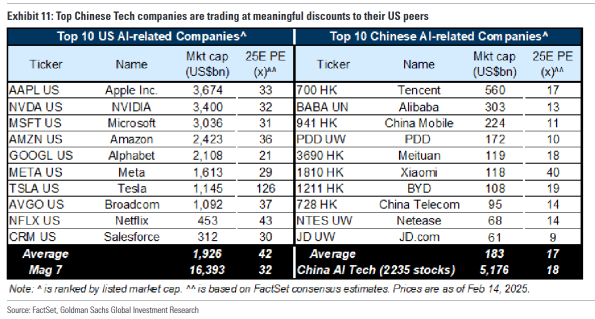

Wall Street banks have issued optimistic reports on Chinese tech stocks, signaling potential revaluation.

Goldman Sachs analyst Kinger Lau published a report titled “AI Changes the Ga...

China International Capital Corporation: Conducted First Stock Purchase via Securities, Fund and Insurance Company Swap Facility on Tuesday - Statement