No Data

6857 Advantest

- 6337.0

- +70.0+1.12%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Shin Yamamoto's "Stock Research File": Is the announcement day of tariffs by sector in the Semiconductors field the starting signal for the bubble reignition?

In the previous discussion, it was mentioned that the current market closely resembles the early stages of the COVID bubble. If President Trump is seriously considering ensuring victory for the Republican Party in next year's midterm elections, the re-emergence of the bubble is quite possible. The Nikkei average and TOPIX (Tokyo Stock Price Index) have already regained levels that were seen before the 'USA Liberation Day' (the day the mutual tariffs were announced), significantly surpassing the closing prices at the end of March. In that sense, it can be said that the shock from the mutual tariffs has been overcome, but the year-to-date high during trading hours.

Expectations for the progress of the weak yen and tariff negotiations are driving prices close to 37,000 yen.

The Nikkei average has risen for seven consecutive trading days, finishing at 36,830.69 yen, up 378.39 yen (with an estimated volume of 1.9 billion 70 million shares). The depreciation of the yen, driven by the retreat of speculation regarding additional interest rate hikes by the Bank of Japan, combined with expectations of progress in tariff discussions with the USA, led to a bullish start. Autos stocks were bought, reaching as high as 36,976.51 yen in the middle of the morning session, approaching the significant level of 37,000 yen. However, ahead of the four-day holiday, profit-taking selling is likely to occur, and the USA is awaiting the announcement of the employment statistics for April.

The Nikkei average is about 230 yen higher, with positive contributions from Fast Retailing, Daikin, and Shin-Etsu Chemical leading the way.

At 12:47 PM on the 2nd, the Nikkei Stock Average is trending around 36,680 yen, up about 230 yen from the previous day. In the afternoon session, trading started near the morning's closing price. After that, it seems that active trading is limited due to the upcoming consecutive holidays. The foreign exchange market is at 145.20 yen to the dollar, and the yen is strengthening in the afternoon. In terms of the contributions of the stocks included in the Nikkei Stock Average, Fast Retailing <9983.T>, Daikin <6367.T>, and Shin-Etsu Chemical <4063.T> rank among the top positives.

Rating information (changes in investment determination) = Mitsukoshi Isetan, GENDAX ETC.

◎Morgan Stanley MUFG Securities (three tiers: Overweight > Equal Weight > Underweight) Mitsukoshi Isetan <3099.T> --- "Overweight" → "Equal Weight", 3,200 yen → 2,200 yen ◎Tokai Tokyo Securities (three tiers: Outperform > Neutral > Underperform) GENDTA <9166.T> --- New "Outperform", 1,410 yen Shinmetrics H <6086.T> --- "Outperform" → "Neutral"

<Rating Change Observation> Upgraded to new - GENDA / Shin-Etsu Chemical, downgraded to Shinmente H, etc.

◎ New and resumed GENGDA <9166.T> - Domestic semi-large company upgraded to the highest tier in three stages. ◎ Upgrade Shin-Etsu Chemical <4063.T> - Domestic mid-sized company upgraded to the highest tier in five stages. Advantest <6857.T> - Domestic mid-sized company upgraded to the highest tier in five stages. ◎ Downgrade Mitsukoshi Isetan <3099.T> - Bank-affiliated downgraded to the middle of three stages. Symantec H <6086.T> - Domestic semi-large company downgraded to the middle of three stages. Provided by Wealth Advisor.

Rating [Securities companies rating]

Upgraded - Bullish Code Stock Name Securities Company Previous After --------------------------------------------------------- <6857> Advanta Mito "B+" "A" <4063> Shin-Etsu Chemical Mito "B+" "A" Downgraded - Bearish Code Stock Name Securities Company Previous After --------------------------------------------------------- <6086>

Comments

American Intl Group Inc (AIG US) $American International Group (AIG.US)$

Daily Chart - [BULLISH ↗ **] AIG US has shaped a bullish breakout of a channel and as long as price holds above 77.85 support, we remain bullish. We expect the price to push towards 87.20 resistance level. Technical indicators are advocating for a bullish scenario as well.

Alternatively: A daily candlestick closing below support at 7...

Intercontinental Exchange Inc (ICE US) $Intercontinental Exchange (ICE.US)$

Daily Chart - [BULLISH ↗ **] ICE US has shaped a bullish breakout and as long as price is holding above 166.35 support, a bullish push higher towards 183.0 resistance is expected. A daily candlestick close above 183.0 resistance will push price higher to the next resistance at 189.7.

Alternatively: A daily candlestick closing below 166.35 support...

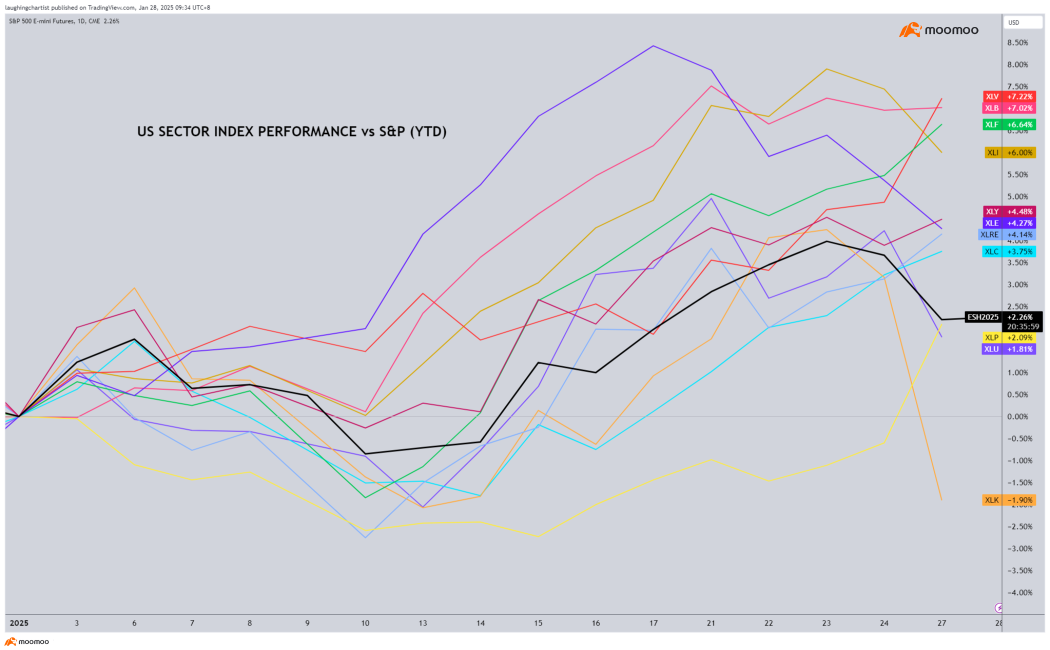

US Market

US markets ended last week on a positive note, with the $E-mini S&P 500 Futures(JUN5) (ESmain.US)$ and $E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$ posting their first weekly gains since Donald Trump's inauguration on Monday, rising by 0.81% and 0.93%, respectively. The S&P 500 even closed at a record high after Trump advocated for lower interest rates and reduced oil prices. Howe...

$E-mini S&P 500 Futures(JUN5) (ESmain.US)$(4 Hour Chart) -[BULLISH↗ *]We stay slightly bullish as we expect price to push towards 6000 resistance level. A 4 hour candlestick closing above 6000 resistance level would open a push towards 6035 resistance level. Technical indicators have yet to indicate a bullish scenario.

Alternatively: A 4 hour candlesti...

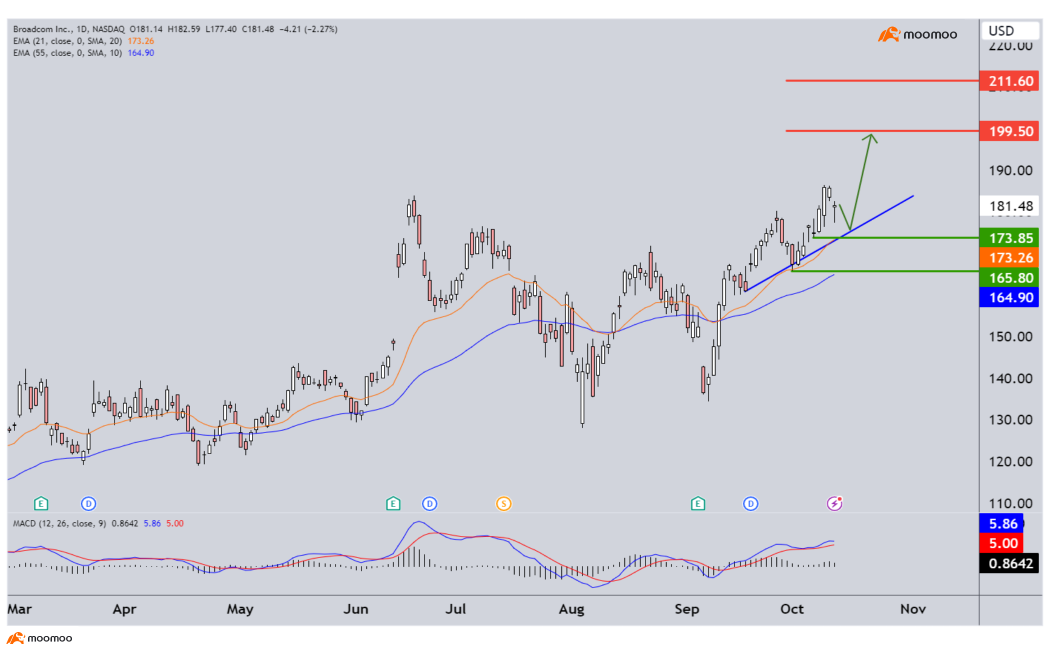

Broadcom Inc (AVGO US) $Broadcom (AVGO.US)$

Daily Chart -[BULLISH ↗ *]AVGO US is holding above its ascending trendline support. As long as price is holding above 173.85 support level, we expect price to drift down towards its ascending trendline support before drifting towards 199.50 resistance level. Technical indicators advocate for a bullish scenario as well.

Alternatively: A daily candlestick closing below 173.85 su...

102640653 : any update on hangseng index,alibaba,Tencent,byd.nio

Trader’s Edge OP 102640653 : Hi, i covered a couple of them during the weekly trader's edge webinar... If you missed the webinar, feel free to watch the replay! Cheers!