No Data

6954 Fanuc

- 3720.0

- +54.0+1.47%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The index has recovered to the 36,000 yen range for the first time in a month.

The Nikkei average has risen for five consecutive trading days. It ended with a gain of 205.39 yen at 36,045.38 yen (with an estimated Volume of 2.2 billion 80 million shares), recovering the 36,000 yen mark for the first time in about a month. Increased expectations for a rise due to the strong US stock market and progress in US tariff negotiations led the buying. The Nikkei average briefly returned above 36,000 yen right after trading began. However, as it surpassed the key level of 36,000 yen, opposing sentiments emerged, and gradually a wait-and-see mood spread, resulting in consolidation around 35,900 yen. Toward the end of the afternoon session, index buying is expected from pension funds at the end of the month.

Innovating Tomorrow: FANUC to Showcase Cutting-Edge Robotics and Automation Solutions at Automate 2025

Japanese stock buybacks this week (4/21~4/25)

――――4/21――――$Shinwa(7607.JP)$ will cancel 600K shares, 4.16% of its outstanding shares, with a cancellation date of 5/12.――――4/23――――$Fanuc(6954.JP)$ will buy back up to 12.5 million shares, 1.34%

Stock News Premium = Pay attention to Machinery and Trump tariffs - There is strong demand for electric vehicles in China.

The machinery industry is likely to be greatly affected by Trump's tariffs. The currently strong order trend may vary depending on the outcome of trade negotiations among various countries centered around the US and China. On the other hand, the demand for electric vehicles within China and the robust capital investment in IT in Asia seem to have a lasting impact. <On March 30, exceeding 150 billion yen for the first time in 30 months, India records its highest ever> The Japan Machine Tool Builders' Association (Chairman Yoshiharu Inaba = Chairman of FANUC CORP <6954.T>) announced on the 24th that the total value of machinery orders in March is.

<Rating Change Observation> Upgrade of new, quick / Seria, ETC.

◎ New and resumed ratings for Kakaku.com <2371.T> -- U.S. firms have given a middle rating of three levels. Quick <4318.T> -- Domestic mid-sized firms have given the top rating of five levels. Mercari <4385.T> -- U.S. firms have given a middle rating of three levels. Cyber <4751.T> -- U.S. firms have given the highest rating of three levels. Recruit Holdings <6098.T> -- U.S. firms have given the highest rating of three levels. ◎ Upgraded Seria <2782.T> -- Domestic major firms have rated it second in a five-level rating. Fukuoka REIT <8968.T> -- Internet firms have given the top rating of three levels. ◎ Downgraded Mitsubishi.

Jefferies Adjusts Fanuc's Price Target to 3,700 Yen From 4,400 Yen, Keeps at Hold

Comments

$E-mini S&P 500 Futures(JUN5) (ESmain.US)$ (4 Hour Chart) -[BEARISH ↘ *]We turn bearish as price is nearing 5830 resistance level. As long as price holds below 5830 resistance level, we expect price to push to resistance-turned-support level at 5720. Technical indicators have yet to indicate a bullish scenario.

Alternatively: A 4 hour candlestick closing below 5720 support level could open a dro...

In February, $Microsoft (MSFT.US)$ , OpenAI, ...

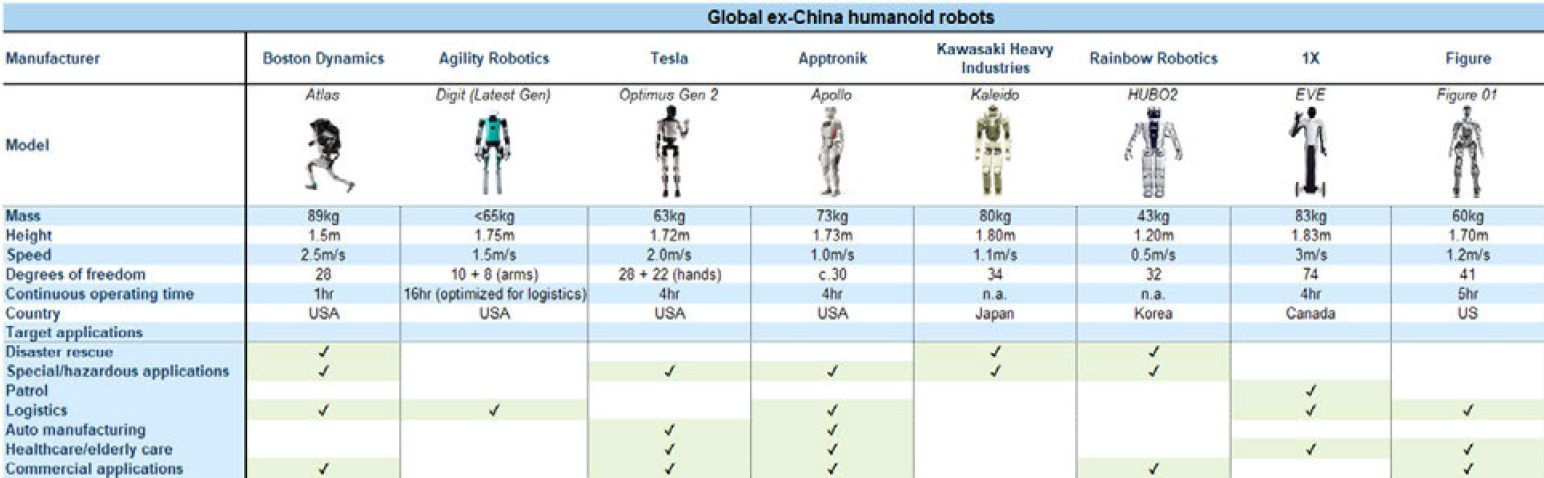

The year 2023 is going to be an exciting year for the artificial intelligence industry as well as the semiconductor industry. After many years of rapid innovation and billions of dollars invested into research and development in these fields, we are now able to experience endless possibilities such as self-driving cars to personal assistants.

Companies such as OpenAI, Apple ( $Apple (AAPL.US)$ ), Microsoft ( $Microsoft (MSFT.US)$ ), Google...

101550592 :