No Data

7741 Hoya

- 18055.0

- +500.0+2.85%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Hoya's Fiscal 2024 Profit Up 11% Despite Profit Slips in Q4

Japan M&A, strawberries ETC (additional) Rating

Target Price Change Code Stock Name Securities Company Previous Change After ---------------------------------------------------- <2127> Japan M&A Daiwa 750 yen 800 yen <2337> Ichigo Morgan Stanley 390 yen 430 yen <2579> Coca BJH Morgan Stanley 2200 yen 2400 yen <3479> TKP Morgan Stanley 1500 yen 1700 yen <6301> Komatsu City 4400 yen 4500 yen <9022> JR East.

The Nikkei average is up about 440 yen, showing strength mainly in export-related stocks = two days ago.

On the 2nd at around 10:07 AM, the Nikkei average stock price was trading at around 36,890 yen, up about 440 yen from the previous day. At 9:47 AM, it reached 36,976.51 yen, an increase of 524.21 yen. In the US market on the 1st local time, supported by strong earnings from Microsoft and Meta (formerly Facebook), the NY Dow rose for the seventh consecutive day while the Nasdaq Composite Index rebounded. Japanese stocks were buoyed by the rise in US stocks and the yen moving toward a depreciation direction on the Foreign Exchange market, leading to initial buying. Regarding US tariff policies, Bessent, the US Treasury ...

Hoya Q4 EPS $0.98 Beats $0.91 Estimate, Sales $1.42B Inline

<Individual Stock Trends> Sinple HD, HOYA, Metapra, Mitsui, Emplas = One day after the market.

SIMPLE HD <4373.T> - For the consolidated results for the fiscal year ending March 2026, a significant increase in profits and an increase in the year-end consolidated dividends are expected. HOYA <7741.T> - The basic policy is to implement progressive dividends aimed at a payout ratio of 40%, showing a commitment to stable and sustainable dividends. Metapura <3350.T> - As part of the Global Strategy and Bitcoin treasury operations, it has been resolved to establish a wholly-owned subsidiary in Florida, USA. Mitsui & Co. <8031.T> - Consolidated results for the fiscal year ending March 2026.

The Nikkei average rose by 406 points, continuing its significant six-day gain, as the awareness of a delay in policy interest rate increases grew due to the downward revision of GDP growth rate = the afternoon of the 1st.

On the closing day, the Nikkei average stock price increased by 406.92 yen from the previous day to 36,452.30 yen, marking a significant six-day winning streak. The TOPIX (Tokyo Stock Price Index) also rose by 12.15 points to 2,679.44 points, continuing its upward trend for seven days. Following the movement of the NY Dow Inc, which rebounded after a morning dip on April 30, Japanese stocks were initially favored by buyers. However, as the announcement of the Bank of Japan's monetary policy meeting results approached, a wait-and-see mood strengthened, although the meeting decided to maintain the current monetary market adjustment policy.

Comments

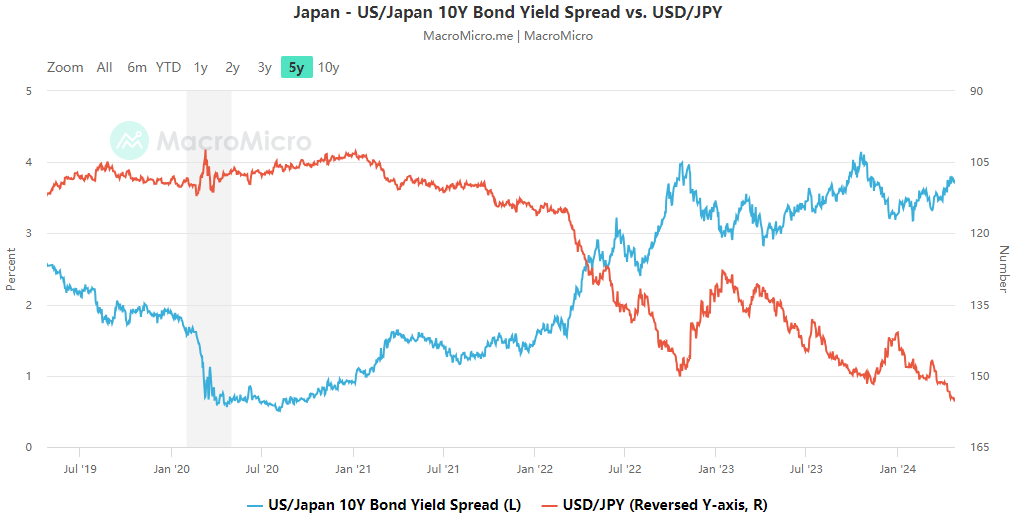

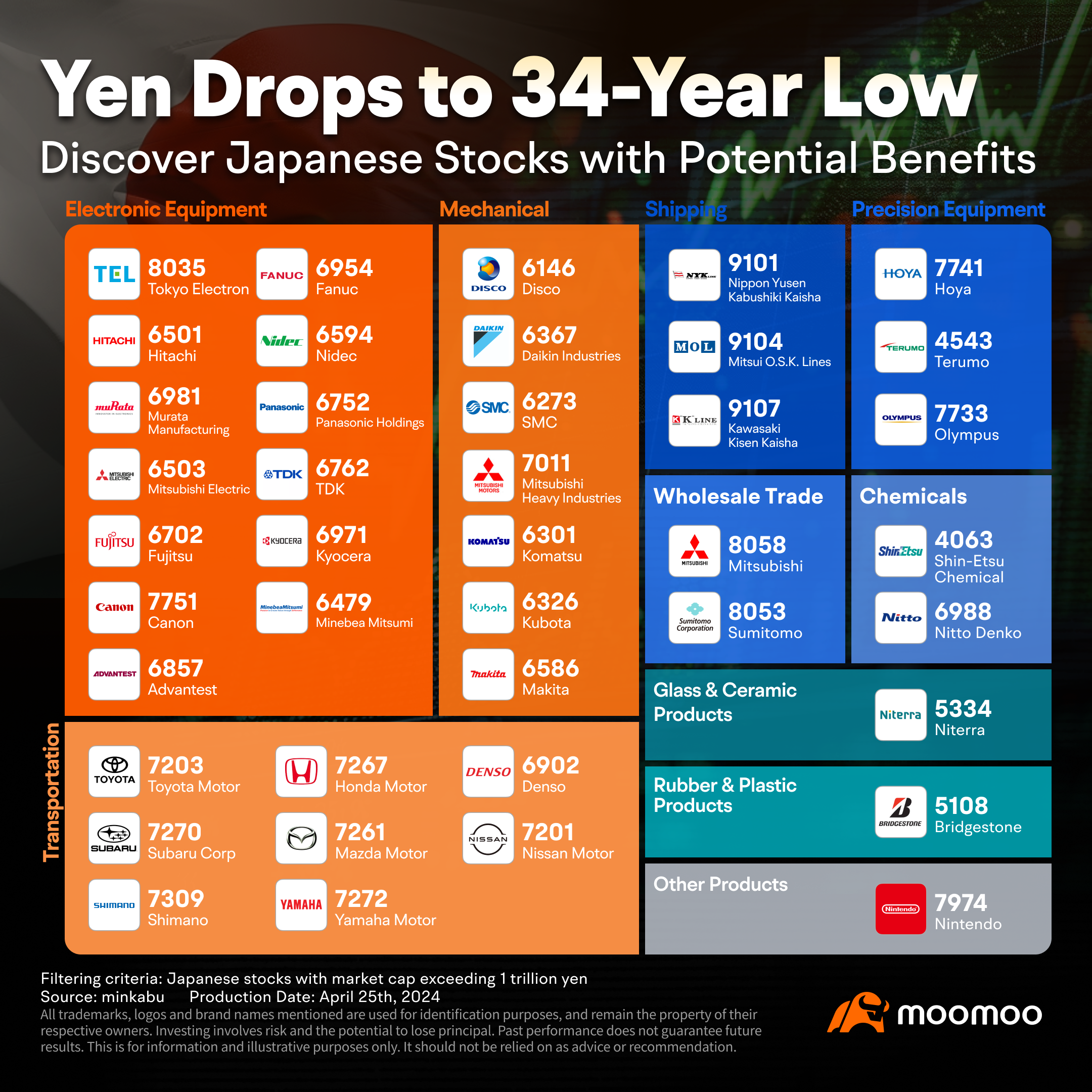

On April 24th, the Japanese yen continued its slump against the US dollar, breaching the key level of 155 fo...

The year 2023 is going to be an exciting year for the artificial intelligence industry as well as the semiconductor industry. After many years of rapid innovation and billions of dollars invested into research and development in these fields, we are now able to experience endless possibilities such as self-driving cars to personal assistants.

Companies such as OpenAI, Apple ( $Apple (AAPL.US)$ ), Microsoft ( $Microsoft (MSFT.US)$ ), Google...