No Data

9201 Japan Airlines

- 2629.5

- +30.0+1.15%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Aftermarket [Stocks that moved and stocks that were traded]

* Itoham Yonekyu <2296> 4945 +440 Financial Estimates for the fiscal year ending March 2026 forecast an increase of 35.4% in operating profit. * JAL <9201> 2629.5 +30 Financial and corporate income tax pre-profit is expected to increase by 18.7% compared to the previous period and by 16.0% for the current period. The upper limit is heavy. * Ricoh Leasing <8566> 5280 -190 Financial Estimates for the fiscal year ending March 2026 forecast a decrease of 12.6% in operating profit. * Fuji Residence <8860> 686 -14 Financial Estimates for the fiscal year ending March 2026 forecast a decrease of 8.8% in operating profit. * Benefit J <3934> 1295

JAL has turned around, with an increase in revenue and profits expected for the fiscal year ending March 2026, along with a rise in Dividends.

JAL <9201.T> has turned around to rise, temporarily hitting 2,659.5 yen, an increase of 60 yen. At noon on the 2nd, the company announced its consolidated financial estimates for the fiscal year ending March 2026. The outlook for increased revenue and net profit, along with plans to raise Dividends, were positively received. For the fiscal year ending March 2026, the performance is forecasted to be operating revenue of 1.977 trillion yen (a 7.2% increase from the previous period) and net profit of 115 billion yen (a 7.4% increase). The underlying Exchange Rates are set at 145 yen per dollar, and the indicator for aviation fuel costs is Singapore kerosene at 90 dollars per barrel. Dividends are

Japan Airlines Boosts Dividends Amid Strong Earnings

Japan Airlines Reports Strong Financial Results for FY2024

Japan Airlines: Notice regarding dividends from surplus

Japan Airlines: Summary of financial results for the fiscal year ending March 2025 [IFRS] (consolidated)

Comments

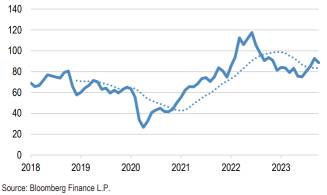

With oil prices continuing to decline, differing views on the outlook have emerged. On the one hand, the IEA believes the market will remain well supplied with the organisation expecting surpluses into next year even if OPEC+ production cuts are extended. However, with demand growth relatively robust, the expectation from

other news sources is that the cartel could actu...