Steel

- 632.665

- +13.775+2.23%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

The gross margin of the main products is negative, and Angang Steel lost over 7 billion yuan last year | Interpretations

1. Angang Steel's net income for 2024 is 7.122 billion yuan, a year-on-year decline of 118.8%, possibly setting a new high for losses in the Steel industry. 2. The gross margin for the company's main products, including cold-rolled, hot-rolled, and medium-thick plates, is all negative.

Brokerage morning meeting highlights: remain bullish on Publishing and AI+Education investment opportunities.

In today's Brokerage morning meeting, Zhongtai stated that it remains Bullish on Publishing and AI+Education investment opportunities; CITIC SEC pointed out that it is important to focus on the valuation increase of the Education Sector; China Securities Co.,Ltd. noted that the price increase of Cement and fiberglass continues, and the timing for allocating cyclical sectors has arrived.

Cailian Press Venture Capital: In February, the financing in the Carbon Neutrality sector reached 1.835 billion yuan, an increase of 13.98% month-on-month. New Stoneware completed 1 billion yuan in Series C+ financing.

According to data from the financial news agency Venture Capital Tong, in February, there were a total of 52 private equity investment events in the Carbon Neutrality sector, a decrease of 24.64% compared to last month's 69 events; The total disclosed financing amount was approximately 1.835 billion yuan, an increase of 13.98% compared to last month's 1.61 billion yuan.

The main line of Technology continues to evolve, and the AI computing power sector is expected to gain strength.

Track the entire lifecycle of the main Sector.

Can a new round of Steel supply-side reform be fully initiated?

East China Futures believes that, considering the current state of the industry, the uncertainty of hedging external demand, and the achievement of the energy consumption targets set in the 14th Five-Year Plan, the discussion on this round of Supply-side Reform 2.0 is not without basis. Once the policy is implemented, the most direct impact will be a temporary expansion of industry profits, but the extent of this expansion may be lower than in the previous round of policies, expected to be between 300 to 400 yuan per ton.

Finance Associated Press Venture Capital: In January, financing in the Carbon Neutrality sector totaled 1.61 billion yuan, a decrease of 95.03% month-on-month. Li Chuang Autos Electronics completed its first round of financing of nearly 0.5 billion yuan.

According to data from the China Finance Association's Venture Capital platform, in January, there were a total of 69 private equity investment events in the domestic Carbon Neutrality sector, a decrease of 28.13% from 96 events last month; The total disclosed financing amounted to approximately 1.61 billion yuan, down 95.03% from 32.404 billion yuan last month.

Comments

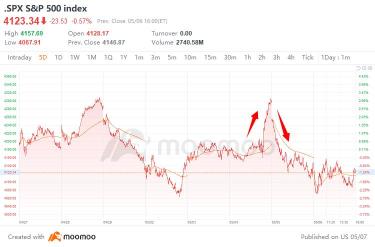

On Wednesday, May 4, the US stock market surged as investors looked at the expected and more pronounced interest rate policy, and those gains were erased by hawkish voices from some Fed officials late Thursday, May 5.

Some investors got caught up in dumping all their holdings, while others stuck to their dip-buying strategy. Being a risk-taker or risk-ave...

$Steel (LIST1075.HK)$

$Steels (LIST1247.HK)$

The steel sector in Hong Kong stockmarkerts plummets over 9%, dragged by the Angang Steel, Maanshan Iron.

$Steel (LIST1075.HK)$

$Steels (LIST1247.HK)$

Iron ore spot and swaps surge over the weekend, soar over 10%.

$Steel (LIST1075.HK)$

$Steels (LIST1247.HK)$

SpyderCall : Good article. Main point to take from this article is that some of the best buying opportunities in stock market history are immediately after a stock market crash.