No Data

C250509P72000

- 1.97

- -0.23-10.45%

- 5D

- Daily

News

Overview of international financial hotspots last night and this morning _ May 6, 2025 _ Financial news

For more global financial News, please visit 24/7 real-time financial news. Market Close: US stocks closed lower on Monday, ending the 9-day rise of the S&P Index. On May 5, the top 20 trading amounts of US stocks: Skechers USA is about to be (Delisted), with a stock price increase of 24%. On Monday, China Concept Stocks fluctuated; Alibaba rose by 0.64%, while Taiwan Semiconductor fell by 1.61%. US Crude Oil fell by 2%, with OPEC+ June production increase expectations putting pressure. New York gold futures rose over 3%, returning to $3340. European stock markets have seen the longest consecutive rise since 2021, with trade and economic outlook improving. Macroeconomically, US hiring slowed down in April, affected by tariff concerns, and the USA rejected a complete exemption.

New York foreign exchange market: the dollar fell and trading was light due to uncertainty in USA trade policy.

As uncertainty surrounds USA trade policy, the USD has fallen against most G-10 currencies. Tokyo and London are closed for holidays, resulting in thin spot trading. The Bloomberg USD index has decreased by 0.2%, with Options Trading traders collectively increasing their Put exposure. According to DTCC data, the Options Trading volume is around 50% of the recent average level. USA President Donald Trump indicated that a trade agreement may be reached with some countries as early as this week. "Despite Bearish selling pressure on the USD being asymmetrical, the risk of this being a position unwinding against some G10 Forex currencies may persist," stated Citigroup strategist Daniel Tobon.

Citigroup Options Spot-On: On May 5th, 47,442 Contracts Were Traded, With 1.97 Million Open Interest

Trump's deceptive tariff strategies leave Powell trapped in a quandary.

Recently, retailer Jim Tackler in the Chicago area and Federal Reserve Chair Jerome Powell have found themselves with many similarities. Tackler stated that the turmoil over tariffs has pushed him into a crazy game of "who is the coward," leaving him completely unsure about how high the import taxes will ultimately be. The e-commerce website that Tackler operates just ordered a batch of "long socks worth $0.08 million." He expressed his concerns, saying, "Will the cost of these socks eventually rise to $0.2 million? If so, how am I supposed to do business?" When viewed on a larger scale, the problems faced by Powell are quite similar. If thousands of companies...

Sector Update: Financial Stocks Edge Up in Afternoon Trading

J.P. Morgan Maintains Citigroup(C.US) With Hold Rating

Comments

Visa Inc. (V), a global leader in digital payments, is set to report its fiscal Q2 2025 earnings on April 29, 2025, after market close, with a conference call at 5:00 PM ET. With a market capitalisation of approximately $625.30 billion as of April 20, 2025, Visa facilitates transactions across over 200 countries, proce...

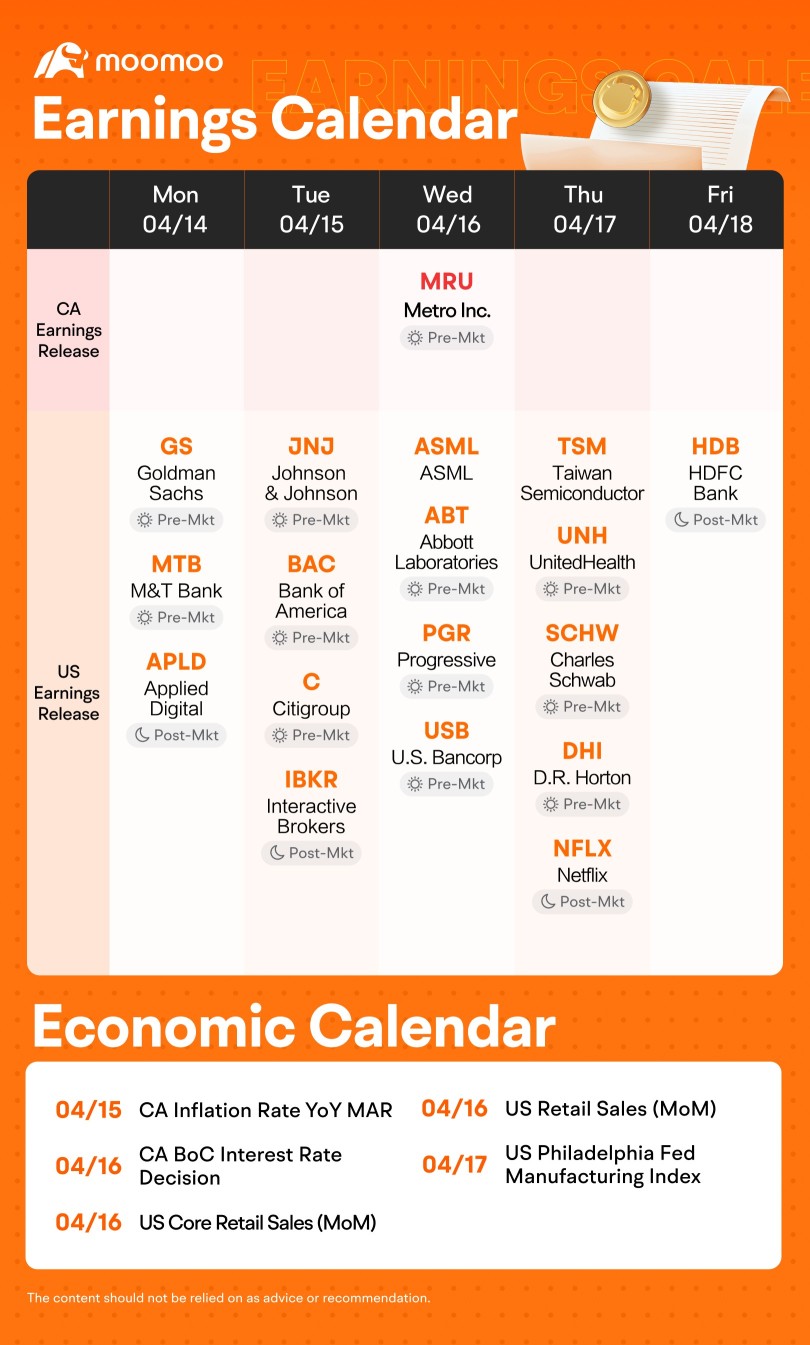

As the earnings season progresses, attention is focused on reports from companies such as $Goldman Sachs (GS.US)$, $Citigroup (C.US)$, $ASML Holding (ASML.US)$, $Taiwan Semiconductor (TSM.US)$ and $Netflix (NFLX.US)$. These reports are anticipated to provide valuable insights into how market volatility and tariff uncertainties are influencing their operations.

$Taiwan Semiconductor (TSM.US)$ is schedu...

Deezy_McCheezy : I get the growth story, but isn’t Visa’s valuation already sky-high?

Wendyfbe : I’m also eyeing that 0.74% dividend as a safety net. Thoughts?