No Data

GS250502C675000

- 0.01

- 0.000.00%

- 5D

- Daily

News

Overview of international financial hot topics from last night to this morning_ May 3, 2025_ Financial news.

To view more global financial News, please move to the 7×24 hour real-time financial news market close: the S&P index has set a record for the longest consecutive rise in 20 years, with market attention on data and trade negotiation prospects. On May 2, the top 20 trading volumes of US stocks: Apple fell 3.7%, and the Earnings Reports highlight tariff and growth concerns. On Friday, China Concept Stocks rose broadly, with Taiwan Semiconductor up 3.81% and Alibaba up 4.35%. This week, Brent crude oil plummeted 8.3%, and Crude Oil fell 7.5%. Spot Gold fell 2.4% this week, and the Philadelphia Gold and Silver Index cumulatively declined over 3.5%. European stocks rose for nine consecutive days, nearing recovery of losses since the announcement of US tariffs.

Overnight news: U.S. stocks closed higher, Trump announced the 2026 budget plan, Bezos plans to sell $4.8 billion worth of Amazon stocks, Barclays and Goldman Sachs expect the Federal Reserve to lower interest rates in July.

To view more global financial News, please move to the 7×24 hour real-time financial news market close: the S&P index has set a record for the longest consecutive rise in 20 years, with market attention on data and trade negotiation prospects. On May 2, the top 20 trading volumes of US stocks: Apple fell 3.7%, and the Earnings Reports highlight tariff and growth concerns. On Friday, China Concept Stocks rose broadly, with Taiwan Semiconductor up 3.81% and Alibaba up 4.35%. This week, Brent crude oil plummeted 8.3%, and Crude Oil fell 7.5%. Spot Gold fell 2.4% this week, and the Philadelphia Gold and Silver Index cumulatively declined over 3.5%. European stocks rose for nine consecutive days, nearing recovery of losses since the announcement of US tariffs.

10-Q: Quarterly report

USA bond market: Treasury bonds fell as the probability of the Federal Reserve cutting interest rates decreased due to strong employment data.

U.S. Treasury bonds fell further near closing, ending at intraday lows. This was after the stronger-than-expected U.S. employment data for April resulted in significant sell-offs in Treasury futures, weakening expectations for a Federal Reserve rate cut. Both Goldman Sachs and Barclays pushed back their expectations for a rate cut by the Fed from June to July, increasing short-end selling pressure. Shortly after 3 PM New York time, the yield curve flattened, with all yields rising by 6 to 13 basis points. The 2s10s and 5s30s spreads narrowed by 4 and nearly 6 basis points respectively during the day; the U.S. 10-Year Treasury Notes Yield ended at this week's high of about 4.31%, rising by 9 basis points during the day. More than half of the drop occurred in the U.S.

Dow's 600-Point Rally Highlighted By Gains In Shares Of 3M, American Express

This week, Brent crude oil plummeted by 8.3% and WTI crude oil fell by 7.5%.

On Friday, international oil prices fell by more than 1%. This week, Brent Crude Oil has accumulated a decline of 8.3%, and Crude Oil has dropped by 7.5%, both marking the largest weekly drop since the end of March. The Organization of the Petroleum Exporting Countries and its allies (OPEC+) held an early meeting on production, preparing to discuss the plan to increase output in June, which has made the market sentiment tense. On Friday, the June Crude Oil contract on the New York Exchange fell by 1.6%, closing at $58.29 per barrel. The July Brent Crude Oil contract fell by 1.35%, closing at $61.29 per barrel. This week, Brent Crude Oil has declined by over 8.3%, and Crude Oil has dropped by 7.5%, both.

Comments

If you’re investing or trading right now, you need to be mentally prepared for that.

Stocks covered in my video (technical analysis) – SPY, Apple, Tesla, Google, Meta, Microsoft, Nvidia + Option trades

$Salesforce (CRM.US)$ $Visa (V.US)$ $MasterCard (MA.US)$ $Starbucks (SBUX.US)$ $McDonald's (MCD.US)$ $PepsiCo (PEP.US)$ $Target (TGT.US)$ $Walmart (WMT.US)$ $Costco (COST.US)$ $iShares Bitcoin Trust (IBIT.US)$ $Arm Holdings (ARM.US)$ $JPMorgan (JPM.US)$ $Goldman Sachs (GS.US)$ $Bank of America (BAC.US)$ $Disney (DIS.US)$ $Grab Holdings (GRAB.US)$ $Sea (SE.US)$

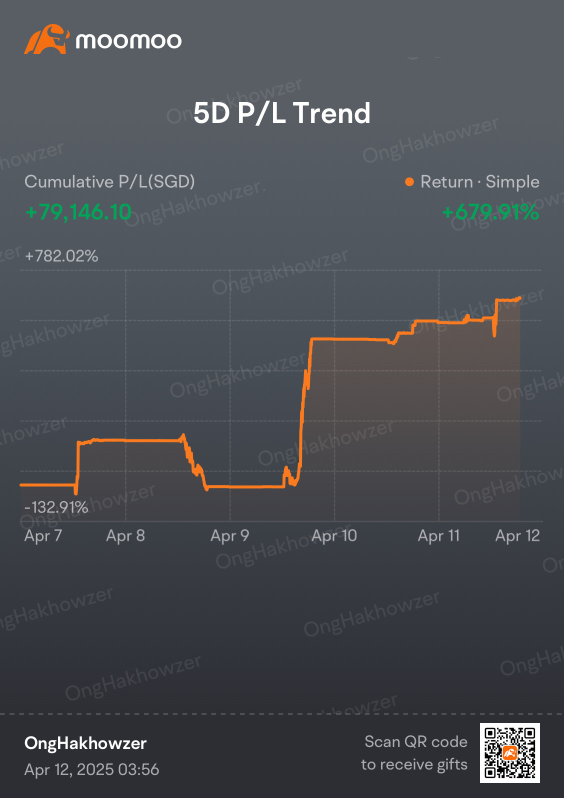

This show a positive trend in early trading and buying interest was fueled by the reports that President Trump exempted items like smartphones, semiconductors, and other electronics from tariffs.

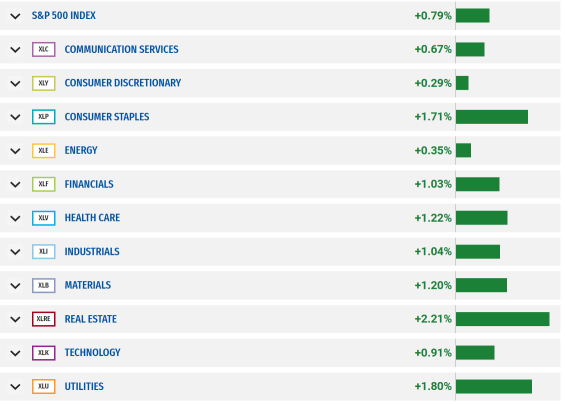

But S&P 500 only managed to close 0.8% higher than previous week Friday after it went negative brie...

Gapping Up

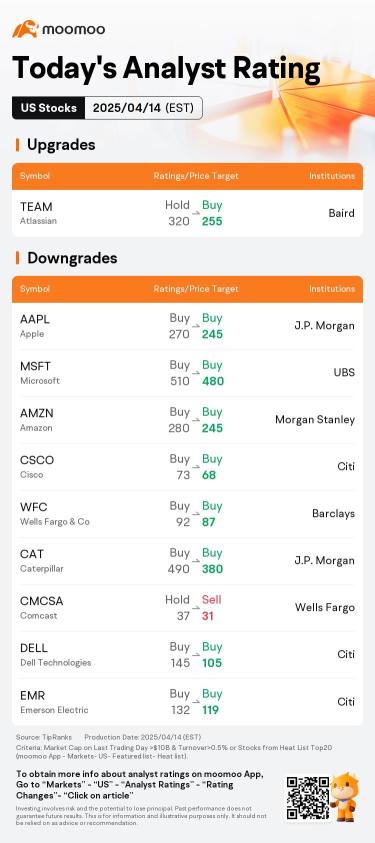

$Apple (AAPL.US)$ gained 6.3% after the Trump administration temporarily exempted smartphones, laptops, and key electronic components from new 145% tariffs on Chinese goods. Issued late Friday by U.S. Customs and Border Protection, these exemptions boosted tech stocks. Nonetheless, President Trump and Commerce Secretary Howard Lutnick warned that the relief might be temporary.

$Intel (INTC.US)$ shares incr...

What a wild week it has been! The markets were rocked by tariff news and a series of dramatic twists and turns. Last week kicked off with a sharp sell-off, as $E-mini NASDAQ 100 Futures(JUN5) (NQmain.US)$ plummeted over 4%. The fear index spiked as investors braced for another wave of trade tensions. However, the story quickly took a strange turn when rumors circulated that Trump was considering a 90-day suspension of tariffs. Th...

️

️ , Tariffs Exempt Apple, Nvidia: Can Buy Now? Hope this helps a little in navigating the volatility!

, Tariffs Exempt Apple, Nvidia: Can Buy Now? Hope this helps a little in navigating the volatility!