No Data

MSFT250502P472500

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

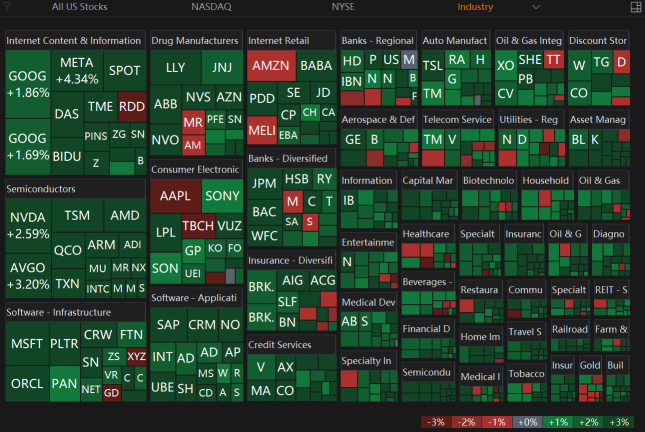

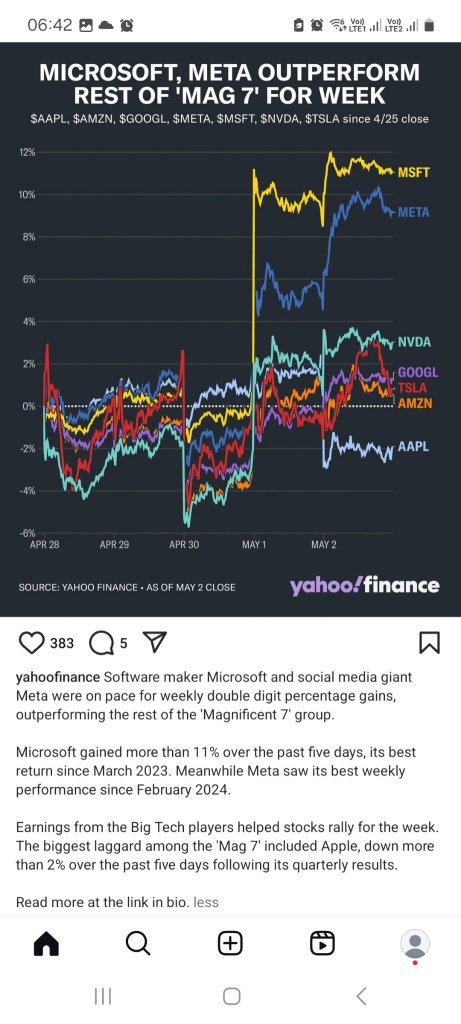

Mag 7 Quarterly Report: Apple and Amazon both lost, Microsoft is the biggest winner.

With the support of AI and tariff resilience, Microsoft leads among technology giants.

Microsoft Bulls Lead Big Buyers of Magnificent Seven Call Options: Options Chatter

Microsoft Beats Apple to Become Largest U.S. Company by Market Cap

Coca-Cola and PepsiCo May Look Alike. Why They Don't Trade Alike. -- Barrons.com

Overview of international financial hot topics from last night to this morning_ May 3, 2025_ Financial news.

To view more global financial News, please move to the 7×24 hour real-time financial news market close: the S&P index has set a record for the longest consecutive rise in 20 years, with market attention on data and trade negotiation prospects. On May 2, the top 20 trading volumes of US stocks: Apple fell 3.7%, and the Earnings Reports highlight tariff and growth concerns. On Friday, China Concept Stocks rose broadly, with Taiwan Semiconductor up 3.81% and Alibaba up 4.35%. This week, Brent crude oil plummeted 8.3%, and Crude Oil fell 7.5%. Spot Gold fell 2.4% this week, and the Philadelphia Gold and Silver Index cumulatively declined over 3.5%. European stocks rose for nine consecutive days, nearing recovery of losses since the announcement of US tariffs.

Overnight news: U.S. stocks closed higher, Trump announced the 2026 budget plan, Bezos plans to sell $4.8 billion worth of Amazon stocks, Barclays and Goldman Sachs expect the Federal Reserve to lower interest rates in July.

To view more global financial News, please move to the 7×24 hour real-time financial news market close: the S&P index has set a record for the longest consecutive rise in 20 years, with market attention on data and trade negotiation prospects. On May 2, the top 20 trading volumes of US stocks: Apple fell 3.7%, and the Earnings Reports highlight tariff and growth concerns. On Friday, China Concept Stocks rose broadly, with Taiwan Semiconductor up 3.81% and Alibaba up 4.35%. This week, Brent crude oil plummeted 8.3%, and Crude Oil fell 7.5%. Spot Gold fell 2.4% this week, and the Philadelphia Gold and Silver Index cumulatively declined over 3.5%. European stocks rose for nine consecutive days, nearing recovery of losses since the announcement of US tariffs.

Comments

Ninth Straight Day Of Wins For SPY Streak In 20 Years

This week have given investors a good cl...