No Data

RWM250516C13000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

U.S. Treasury Secretary and USTR to Meet With Chinese Counterparts Amid Possible Break in Trade War

Goldman Sachs outlook for the May Federal Reserve meeting: the threshold for interest rate cuts is higher than in 2019, and it is necessary to wait for employment and other hard data to weaken.

Analysts including Jan Hatzius from Goldman Sachs have stated that inflation and inflation expectations based on surveys are currently much higher, and decision-makers need to see more compelling evidence of an economic slowdown before taking action. The strongest argument for interest rate cuts would be if Federal Reserve officials believe that data indicates the unemployment rate may continue to rise, which means that other signs such as rising unemployment, weak wage growth, and companies becoming cautious or weak demand growth need to be observed.

U.S. stocks closed: Trade uncertainty rises, and the three major Indexes collectively declined.

① The CEO of NVIDIA stated that the AI market in China is expected to reach 50 billion dollars; ② AMD's revenue in the first quarter was 7.44 billion dollars, a year-on-year growth of 36%; ③ Super Micro Computer's net sales in the third quarter were 4.6 billion dollars, falling short of expectations.

Wall Street giant Paul Tudor Jones: It is still very likely that the U.S. stock market will hit new lows, and AI poses a threat to survival.

Paul Tudor Jones expressed a pessimistic view. He stated that even if USA President Trump eases tariff policies, the US stock market is still likely to create new lows, unless the Federal Reserve is very dovish and significantly lowers interest rates. He is increasingly concerned about the dangers posed by AI and warns that this risk is not limited to impacts on the stock market and economy; he sees AI as a "survival threat."

Trade Deficit Widens to a Record $140.5 Billion

US Morning News Call | India Proposes Zero-For-Zero Tariffs On Steel, Auto Parts

Comments

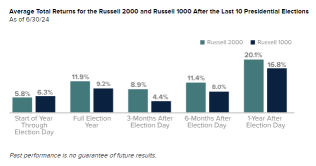

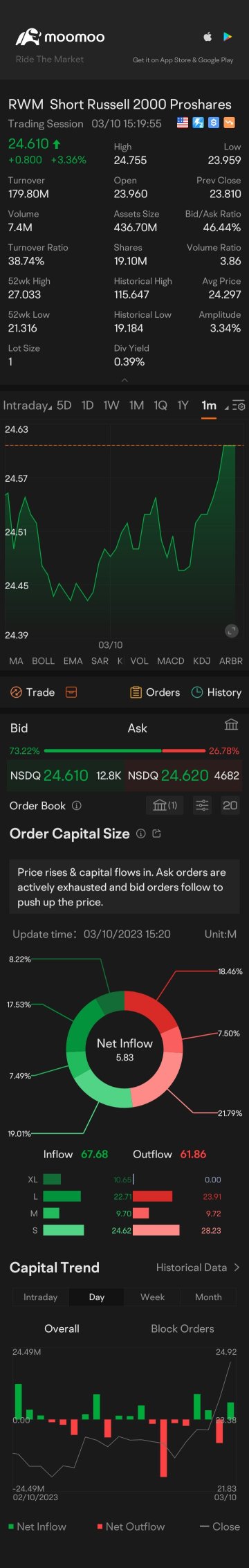

Bank Stocks Bolster Small-Cap Performance

The robust performance of small caps is largely attributed to the strong earnings reported by major U.S. banks. Financial institut...

Trump:Low interest rates and taxes, low taxes, tremendous incentive toget things done, and to bring business back to our country. And if you haveto use tariffs and other economic means to do it, that's fine.We have to do to other countries what they've been doingg to us for 50 years, for 100 years. We have to bring business back to our country.

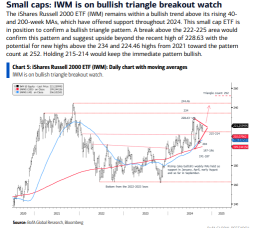

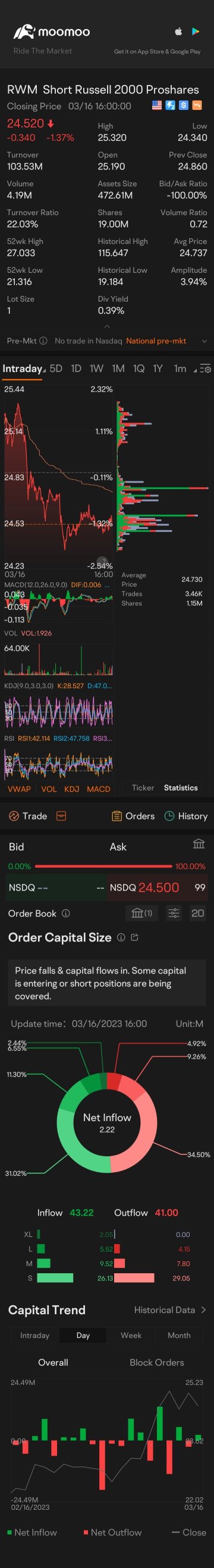

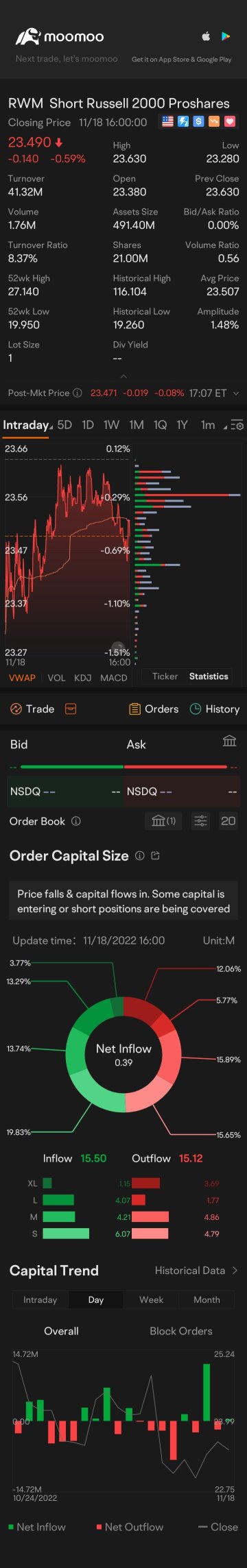

$S&P 500 Index (.SPX.US)$ $Short Russell 2000 Proshares (RWM.US)$

joemamaa : yes