No Data

RWM250516C21000

- 0.25

- +0.08+47.06%

- 5D

- Daily

News

U.S. Treasury Secretary and USTR to Meet With Chinese Counterparts Amid Possible Break in Trade War

U.S. stocks closed: Trade uncertainty rises, and the three major Indexes collectively declined.

① The CEO of NVIDIA stated that the AI market in China is expected to reach 50 billion dollars; ② AMD's revenue in the first quarter was 7.44 billion dollars, a year-on-year growth of 36%; ③ Super Micro Computer's net sales in the third quarter were 4.6 billion dollars, falling short of expectations.

Wall Street giant Paul Tudor Jones: It is still very likely that the U.S. stock market will hit new lows, and AI poses a threat to survival.

Paul Tudor Jones expressed a pessimistic view. He stated that even if USA President Trump eases tariff policies, the US stock market is still likely to create new lows, unless the Federal Reserve is very dovish and significantly lowers interest rates. He is increasingly concerned about the dangers posed by AI and warns that this risk is not limited to impacts on the stock market and economy; he sees AI as a "survival threat."

Trade Deficit Widens to a Record $140.5 Billion

US Morning News Call | India Proposes Zero-For-Zero Tariffs On Steel, Auto Parts

JPMorgan traders "draw the line": U.S. stocks first break 6000, then hit a new low!

JPMorgan expects that, driven by factors such as the activation of CTA strategy and accelerated Share Buybacks, the S&P 500 Index will first challenge the 6000-point mark. However, afterwards, if investors hold a pessimistic view on the mid-term outlook under high tariffs, the market may retest low levels. JPMorgan agrees with the current widespread view of an economic recession and anticipates a significant decline in hard data such as non-farm employment and retail sales in the next 1-2 months.

Comments

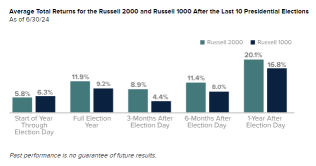

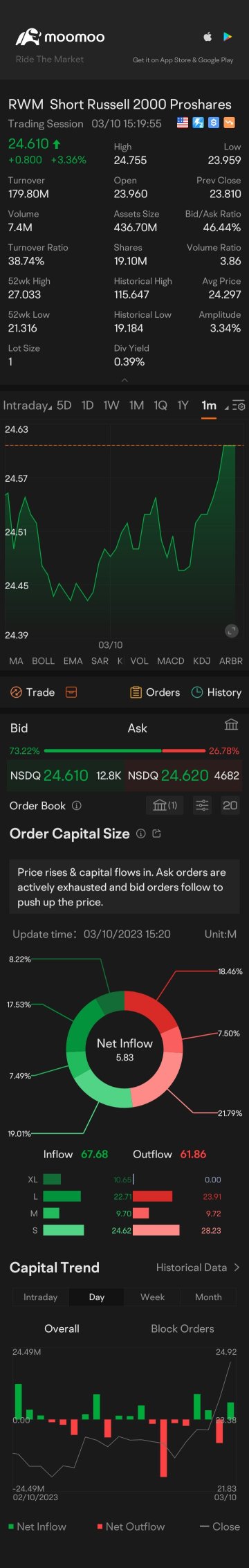

Bank Stocks Bolster Small-Cap Performance

The robust performance of small caps is largely attributed to the strong earnings reported by major U.S. banks. Financial institut...

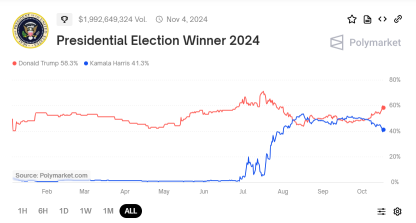

Trump:Low interest rates and taxes, low taxes, tremendous incentive toget things done, and to bring business back to our country. And if you haveto use tariffs and other economic means to do it, that's fine.We have to do to other countries what they've been doingg to us for 50 years, for 100 years. We have to bring business back to our country.

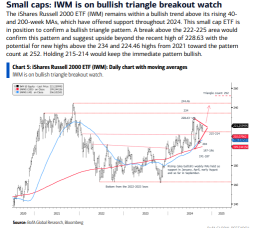

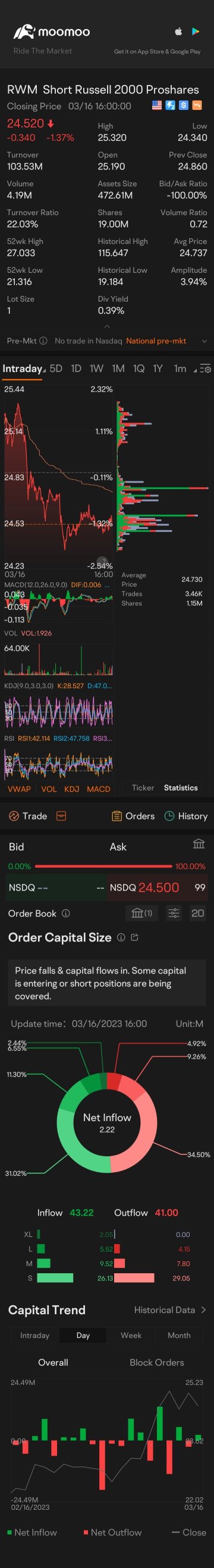

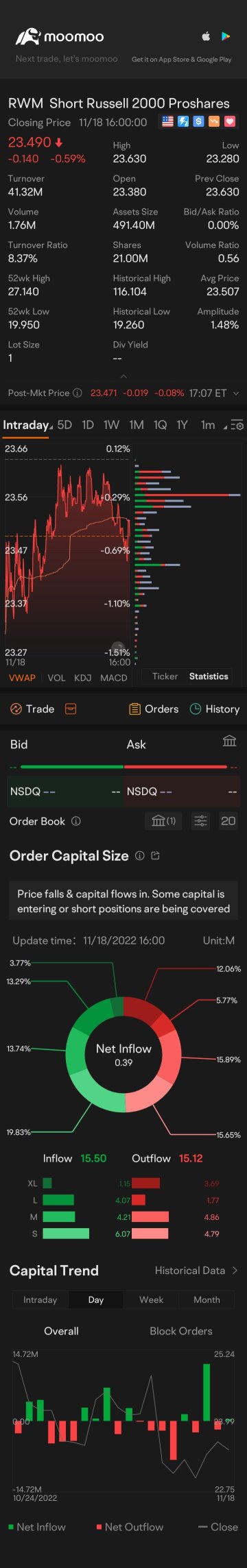

$S&P 500 Index (.SPX.US)$ $Short Russell 2000 Proshares (RWM.US)$

joemamaa : yes