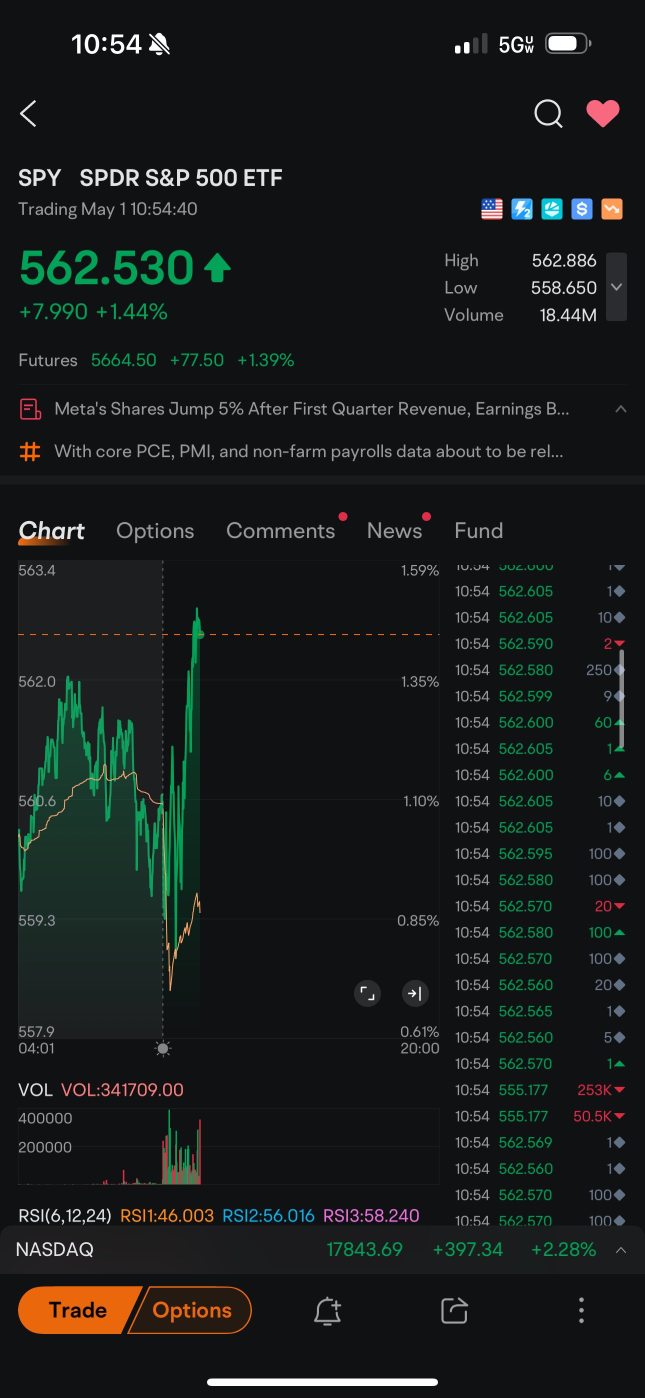

US ETFDetailed Quotes

SPY SPDR S&P 500 ETF

- 558.470

- +3.930+0.71%

Close May 1 16:00 ET

564.070High557.860Low

564.070High557.860Low63.19MVolume560.370Open554.540Pre Close35.39BTurnover6.12%Turnover Ratio--P/E (Static)1.03BShares611.39152wk High--P/B576.33BFloat Cap481.80052wk Low7.17Dividend TTM1.03BShs Float611.391Historical High1.28%Div YieldTTM1.12%Amplitude35.409Historical Low560.067Avg Price1Lot Size

$SPDR S&P 500 ETF (SPY.US)$ spy double kill

2

$SPDR S&P 500 ETF (SPY.US)$ spy pumping right now

2

$SPDR S&P 500 ETF (SPY.US)$ what is happening anyone knows?

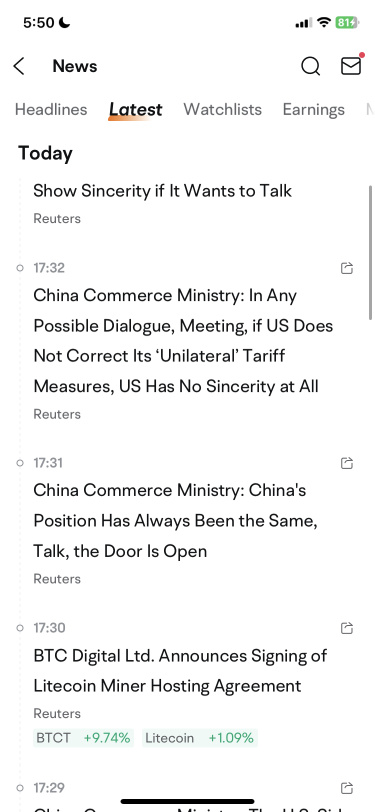

$SPDR S&P 500 ETF (SPY.US)$ I don’t understand. This means unless the US cancels unilateral tariffs, there will be no talks right? why is a reason to pump?

4

$SPDR S&P 500 ETF (SPY.US)$ overnight pump ?

1

$SPDR S&P 500 ETF (SPY.US)$ Its gapping up boys gg. Puts will be worth nothing on open.

2

$SPDR S&P 500 ETF (SPY.US)$ question to more experienced traders, is it the wrong thought process to set a goal of “I want to make X amount for this month” or having a number figure in mind? thanks

1

4

$SPDR S&P 500 ETF (SPY.US)$

even the hedge funds getting wrecked by this insane market or they were just way to levered and didnt expect a rally that high….?

even the hedge funds getting wrecked by this insane market or they were just way to levered and didnt expect a rally that high….?

1

3

$SPDR S&P 500 ETF (SPY.US)$ I have a feeling my puts are gonna print tomorrow

100 contracts at 530 strike - a 1% drop at open will net enough profit to cover

100 contracts at 530 strike - a 1% drop at open will net enough profit to cover

4

9

$SPDR S&P 500 ETF (SPY.US)$ it’s interesting to see all those big tech AI companies like meta msft nflx are winning, beat earnings and strong guidances, while the more sales related companies are lowering their guidances like amazon, airlines, estee lauder etc. It’s reasonable that the first round of hits from tariffs arrives early on sales. And it will slowly transfers to the whole economy.

No comment yet

74874782 : man everyone loaded up on put before close too

Nifedipine OP 74874782 : still too early to say