US OptionsDetailed Quotes

TECK250516P27000

- 0.30

- 0.000.00%

15min DelayClose May 12 16:00 ET

0.00High0.00Low

0.30Open0.30Pre Close0 Volume111 Open Interest27.00Strike Price0.00Turnover234.18%IV29.12%PremiumMay 16, 2025Expiry Date0.00Intrinsic Value100Multiplier4DDays to Expiry0.30Extrinsic Value100Contract SizeAmericanOptions Type-0.0676Delta0.0143Gamma125.57Leverage Ratio-0.1413Theta-0.0003Rho-8.48Eff Leverage0.0051Vega

Teck Resources Stock Discussion

$Energy Fuels (UUUU.US)$ $Teck Resources (TECK.US)$ $Sibanye Stillwater (SBSW.US)$ $Hecla Mining (HL.US)$ $The Chemours (CC.US)$ There was also two OTC traded companies that i did not include ![]()

8

8

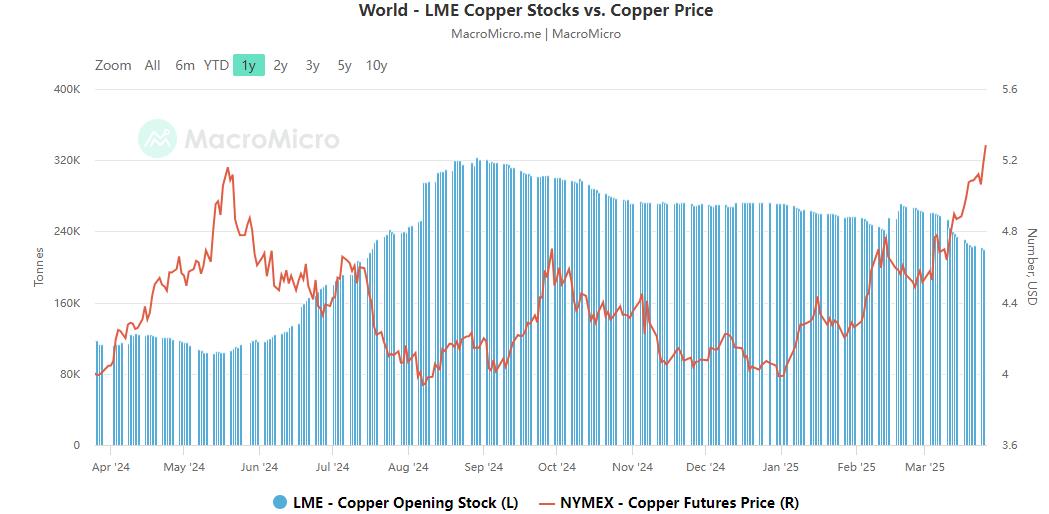

$Copper Futures(JUL5) (HGmain.US)$ on New York's Comex exchange soared to unprecedented levels, driven by market anticipation of significant import tariffs on this vital industrial metal.

Since the beginning of this year, Comex copper futures have surged over 30%, hitting historical high, while prices on the London Metal Exchange (LME) have also climbed by 13%, surpassing the critical threshold of $10,000 per ton. Copper minin...

Since the beginning of this year, Comex copper futures have surged over 30%, hitting historical high, while prices on the London Metal Exchange (LME) have also climbed by 13%, surpassing the critical threshold of $10,000 per ton. Copper minin...

8

1

3

$Copper Futures(JUL5) (HGmain.US)$ on New York's Comex exchange soared to unprecedented levels, driven by market anticipation of significant import tariffs on this vital industrial metal.

Since the beginning of this year, Comex copper futures have surged over 30%, hitting historical high, while prices on the London Metal Exchange (LME) have also climbed by 13%, surpassing the critical threshold of $10,000 per ton. Copper minin...

Since the beginning of this year, Comex copper futures have surged over 30%, hitting historical high, while prices on the London Metal Exchange (LME) have also climbed by 13%, surpassing the critical threshold of $10,000 per ton. Copper minin...

20

1

23

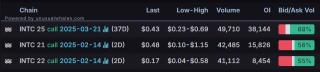

Columns Options Market Statistics: Intel Shares Jump on Potential US Chip Manufacturing Push; Options Pop

News Highlights

1. $Intel (INTC.US)$ shares jumped 6% on Tuesday, with the most traded calls contracts of $25 strike price that expire on Mar 21 and the total volume reaching 49,710 with the open interest of 38,144.

"To safeguard America's advantage, the Trump administration will ensure that the most powerful AI systems are built in the U.S. with American-designed and -manufactured chips," Vance said ...

1. $Intel (INTC.US)$ shares jumped 6% on Tuesday, with the most traded calls contracts of $25 strike price that expire on Mar 21 and the total volume reaching 49,710 with the open interest of 38,144.

"To safeguard America's advantage, the Trump administration will ensure that the most powerful AI systems are built in the U.S. with American-designed and -manufactured chips," Vance said ...

+1

17

22

$Hallador Energy (HNRG.US)$ oh that's good 👍

if you want a happy Christmas 🎄

fill your bag with coal 🎅🚂 $Hallador Energy (HNRG.US)$

not this on a big green days, but there are others.

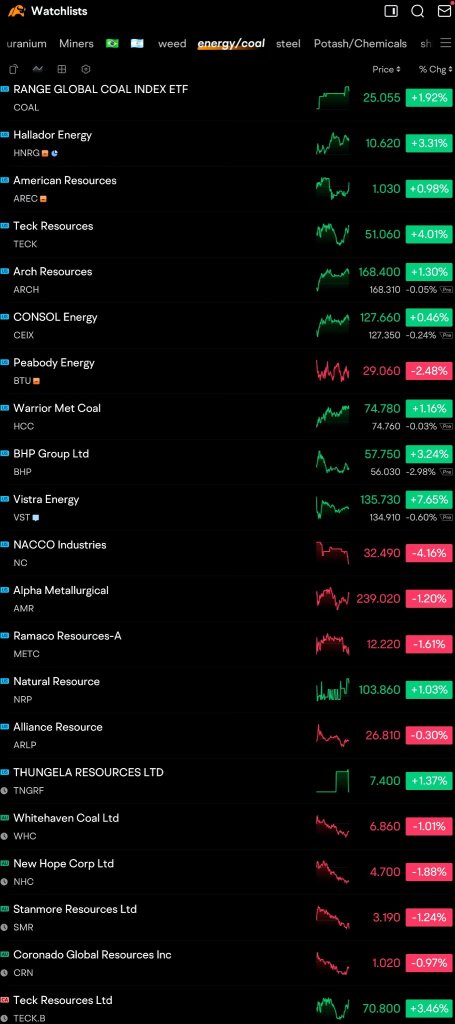

from my nov 6 post:

my favorite

$Hallador Energy (HNRG.US)$

my best cheapest

$American Resources (AREC.US)$

beast

$Teck Resources (TECK.US)$

most held (most liquid)

$BHP Group Ltd (BHP.US)$

$Peabody Energy (BTU.US)$

sneaky, lots of room to run

$Ramaco Resources-A (METC.US)$

$Hallador Energy (HNRG.US)$

if you want a happy Christmas 🎄

fill your bag with coal 🎅🚂 $Hallador Energy (HNRG.US)$

not this on a big green days, but there are others.

from my nov 6 post:

my favorite

$Hallador Energy (HNRG.US)$

my best cheapest

$American Resources (AREC.US)$

beast

$Teck Resources (TECK.US)$

most held (most liquid)

$BHP Group Ltd (BHP.US)$

$Peabody Energy (BTU.US)$

sneaky, lots of room to run

$Ramaco Resources-A (METC.US)$

$Hallador Energy (HNRG.US)$

6

4

Coal: So 🔥 right now

my favorite

$Hallador Energy (HNRG.US)$

my best cheapest

$American Resources (AREC.US)$

beast

$Teck Resources (TECK.US)$

most held (most liquid)

$BHP Group Ltd (BHP.US)$

$Peabody Energy (BTU.US)$

sneaky, lots of room to run

$Ramaco Resources-A (METC.US)$

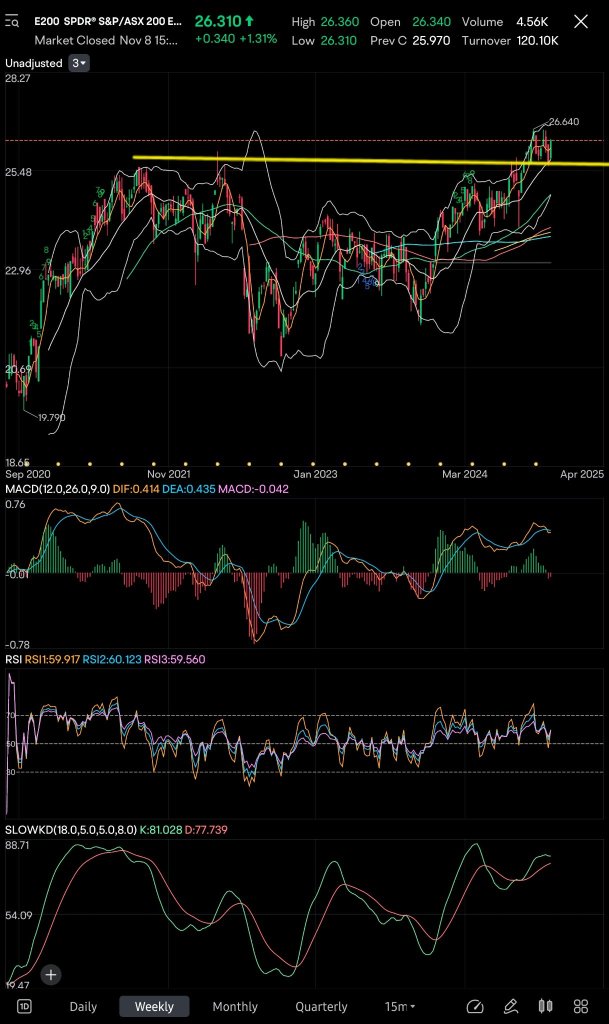

Australia produces the most coal. They sell it mostly to China. Australia is mostly commodities and banks, and it's breaking out. This means inflation is coming back 😉

$SPDR® S&P/ASX 200 ESG ETF (E200.AU)$

averaging up now 😁

my favorite

$Hallador Energy (HNRG.US)$

my best cheapest

$American Resources (AREC.US)$

beast

$Teck Resources (TECK.US)$

most held (most liquid)

$BHP Group Ltd (BHP.US)$

$Peabody Energy (BTU.US)$

sneaky, lots of room to run

$Ramaco Resources-A (METC.US)$

Australia produces the most coal. They sell it mostly to China. Australia is mostly commodities and banks, and it's breaking out. This means inflation is coming back 😉

$SPDR® S&P/ASX 200 ESG ETF (E200.AU)$

averaging up now 😁

+1

8

4

Stanley Druckenmiller says he's ‘licking my wounds’ from selling Nvidia too soon

-Billionaire investor Stanley Druckenmiller told Bloomberg on Wednesday that selling all his Nvidia stock this year was a “big mistake.”

-Nvidia was Druckenmiller's top holding a year ago, but he sold it after the stock tripled in 2023.

-The shares are up another 174% this year, and Druckenmiller has missed much of the continuing rally.

Stanley Druckenmiller is an American billionair...

-Billionaire investor Stanley Druckenmiller told Bloomberg on Wednesday that selling all his Nvidia stock this year was a “big mistake.”

-Nvidia was Druckenmiller's top holding a year ago, but he sold it after the stock tripled in 2023.

-The shares are up another 174% this year, and Druckenmiller has missed much of the continuing rally.

Stanley Druckenmiller is an American billionair...

6

3

No comment yet

dunbegreedy : what would be a good diffentiator to choose the one to buy?

Trytosaveabit OP dunbegreedy : Thats such a broad question! Sorry but thats the truth. The majority of the tickers you see me comment on here are me looking at as a possible day/short swing trade. Unless i otherwise say. And there is a big difference between that and if someone is planning on making a longer term swing trade. Or looking at a ticker as a investment type trade.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

This isn’t popular. And believe me i get a lot that argue and tell me im wrong. And they are entitled to their opinion. Hehehe. But i always come back with proof on my side! Here is a example to show, and see if it makes sense to you!

So a investment is taken after looking, doing DD. Looking at financial health. Seeing what guidance is. Looking at how the company compares is the same sector with other companies. Along with some other things. Then you go back to study the chart and make sure you are getting in at a good spot! Now the chart is about the only thing the different trades have that are the same. Reading the chart to get in and out of the trade.

Now a trade! So no one in their right mind would ever “invest” in a company that is fixing to delist because of bankruptcy. But yet myself and actually lotsa day traders will still take a trade and can make really great ROI! ( If the chart and volume indicates that it can be a good day trade ) But like i said, no one would “invest” in a bankrupt company!

Im actually pretty awful at explaining things by writing! Im more of a in person ( Actually talking ) communicator. Hehehe. But i hope my long winded answer explains to you why i need more information on what you are looking for with your question? And also hope that I’ve explained well enough why IMO the big difference in types of trades and why they are vastly different answers to which you’re doing!

Trailside22 : yeah buddy![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

dunbegreedy Trytosaveabit OP : omg. wasn't expecting you going such length @Trytosaveabit . really appreciate it! not only i learn something from you but also earn from your tips. God bless.

Trytosaveabit OP dunbegreedy : You’re welcome

View more comments...