No Data

TLH250516C110000

- 0.30

- 0.000.00%

- 5D

- Daily

News

Relief Rally or Calm Before the Storm? SA Analysts Weigh in on Tariffs

U.S. stock market outlook | All three Equity Index futures are up, and the Federal Reserve's interest rate decision is imminent.

On May 7th (Wednesday), in Pre-Market Trading, the three major U.S. equity index futures all rose.

What caused the rapid reversal of the latest sell-off in the USA? Deutsche Bank: The main reasons are policy easing and the economy not entering recession.

Deutsche Bank stated that this round of market reversal is mainly attributed to three points: macroeconomic data shows that the USA economy has not fallen into recession; the decline in oil prices has alleviated inflationary pressures, providing room for potential interest rate cuts. Finally, the policies of the USA government have softened, and the tendency for trade protectionism has weakened.

U.S. stock valuations have reached warning levels again! The market is treading carefully before the Federal Reserve's decision.

The recent rebound in the stock market has caused valuation levels to rise again, and with the Federal Reserve about to announce its MMF policy decision, the market cannot afford any mistakes.

The largest stock buyback frenzy in history has arrived! In the midst of uncertainty, companies choose to "buy the dip" on themselves.

According to Deutsche Bank, S&P 500 Index constituent companies are expected to buy back $192 billion worth of Stocks in the coming months, the highest single-week record since 1995. Under the shadow of uncertainties such as trade tariffs, companies prefer to deploy large Cash reserves through buybacks.

FOMC Preview: When Will Powell Turn Dovish Amid Tariff Tensions?

Comments

$SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $Ishares Trust 10-20 Year Treasury Bd Etf (TLH.US)$ $SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL.US)$ $ProShares UltraPro Short QQQ ETF (SQQQ.US)$ $Berkshire Hathaway-B (BRK.B.US)$

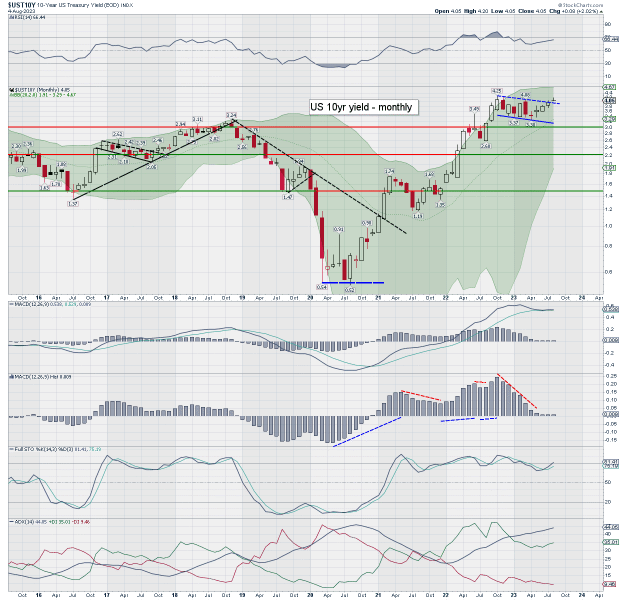

Multi-month structure on the US 10yr yield is a bull flag, and its playing out. Friday... was just some cooling. Soft target... around 4.70%, psy'5.00%, then 7.00%.

I'm starting to wonder if Buffett will live long enough to ever see the Fed cut rates again.

$Ishares Trust 10-20 Year Treasury Bd Etf (TLH.US)$ $iShares 1-3 Year Treasury Bond ETF (SHY.US)$ $SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Invesco QQQ Trust (QQQ.US)$ $S&P 500 Index (.SPX.US)$

$Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$ $S&P 500 Index (.SPX.US)$ $SPDR S&P 500 ETF (SPY.US)$ $Short-Treasury Bond Ishares (SHV.US)$ $SPDR Bloomberg Barclays 1-3 Month T-Bill ETF (BIL.US)$ $iShares 1-3 Year Treasury Bond ETF (SHY.US)$ $Ishares Trust 10-20 Year Treasury Bd Etf (TLH.US)$

TradingwithZT OP : DCA more at 102