US ETFDetailed Quotes

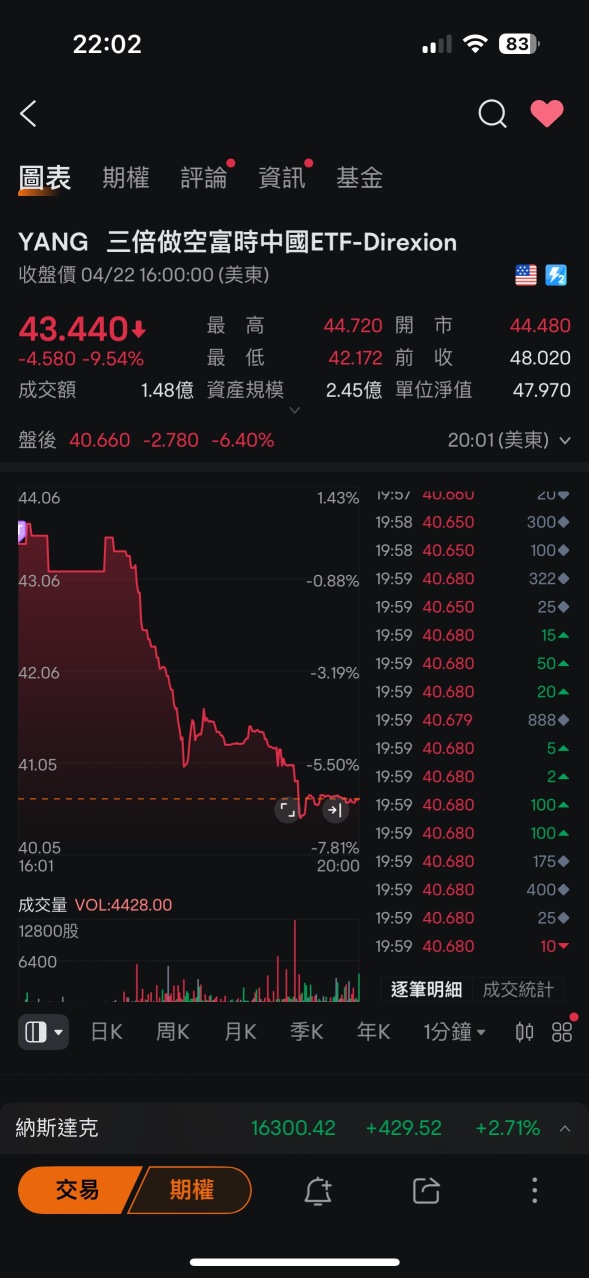

YANG Direxion Daily FTSE China Bear 3X Shares ETF

- 37.050

- -1.190-3.11%

Trading May 6 14:43 ET

37.325High36.370Low

37.325High36.370Low1.76MVolume37.210Open38.240Pre Close65.01MTurnover32.02%Turnover Ratio--P/E (Static)5.51MShares198.99152wk High--P/B204.14MFloat Cap31.50752wk Low4.94Dividend TTM5.51MShs Float43579.112Historical High13.32%Div YieldTTM2.50%Amplitude31.507Historical Low36.845Avg Price1Lot Size

$Direxion Daily FTSE China Bear 3X Shares ETF (YANG.US)$ daring you not in Yang so Sian I alone here 🤭 don't buy now, over already later see how

$ProShares UltraPro Short QQQ ETF (SQQQ.US)$

$ProShares UltraPro Short QQQ ETF (SQQQ.US)$

1

7

$Direxion Daily FTSE China Bear 3X Shares ETF (YANG.US)$ Yang, you are truly gifted. 😍

$Direxion Daily FTSE China Bear 3X Shares ETF (YANG.US)$ Yang, tell me why you so powerful and SPECIAL 😍

$Direxion Daily FTSE China Bear 3X Shares ETF (YANG.US)$ Just one more fight about a lot of things, and I will give up everything. To be on my own again, free again, yay!!!!!

$Direxion Daily FTSE China Bear 3X Shares ETF (YANG.US)$ Don't you leave me lonely tonight cuz I can't forget you x

3

$Direxion Daily FTSE China Bear 3X Shares ETF (YANG.US)$ When will we make up? Will we break up? 🥺

1

$Direxion Daily FTSE China Bear 3X Shares ETF (YANG.US)$ My solid gold, I know you're special, I can see it in my eyes... when they laugh at me and look down on me 😜

5

No comment yet

Daring Lu : The reports indicate that 11 countries—mostly from the Commonwealth of Independent States (CIS)—have announced plans to stop using the U.S. dollar for international trade starting in 2025. These nations include Armenia, Azerbaijan, Belarus, Kazakhstan, Kyrgyzstan, Moldova, Russia, Tajikistan, Turkmenistan, Uzbekistan, and Ukraine.

The shift is driven by a desire to reduce dependence on Washington, minimize exposure to U.S. sanctions, and strengthen financial sovereignty. Many of these countries have been gradually distancing themselves from dollar-based trade for years, particularly Russia, which has been moving away from the dollar since 2014.

This move is expected to reshape global financial dynamics, as alternative payment systems and digital currencies gain traction.

Daring Lu : I am here in SQQQ.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Cui Nyonya Kueh OP Daring Lu : here also same ma

Cui Nyonya Kueh OP Daring Lu : if don't use us dollar then how? what currency to use? yen?

Daring Lu Cui Nyonya Kueh OP : Instead of the USD, these nations are shifting towards local currencies, digital currencies, and alternative payment platforms. Russia, for example, has been promoting the use of the Russian ruble in trade agreements, while Kazakhstan and Belarus have explored bilateral trade settlements in their own national currencies. Additionally, some of these countries are integrating blockchain-based financial systems and alternative SWIFT-like platforms to facilitate transactions without relying on the dollar.

This move is largely driven by a desire for economic independence, reduced exposure to U.S. sanctions, and greater control over financial policies. It’s a significant shift in global trade dynamics

View more comments...