No Data

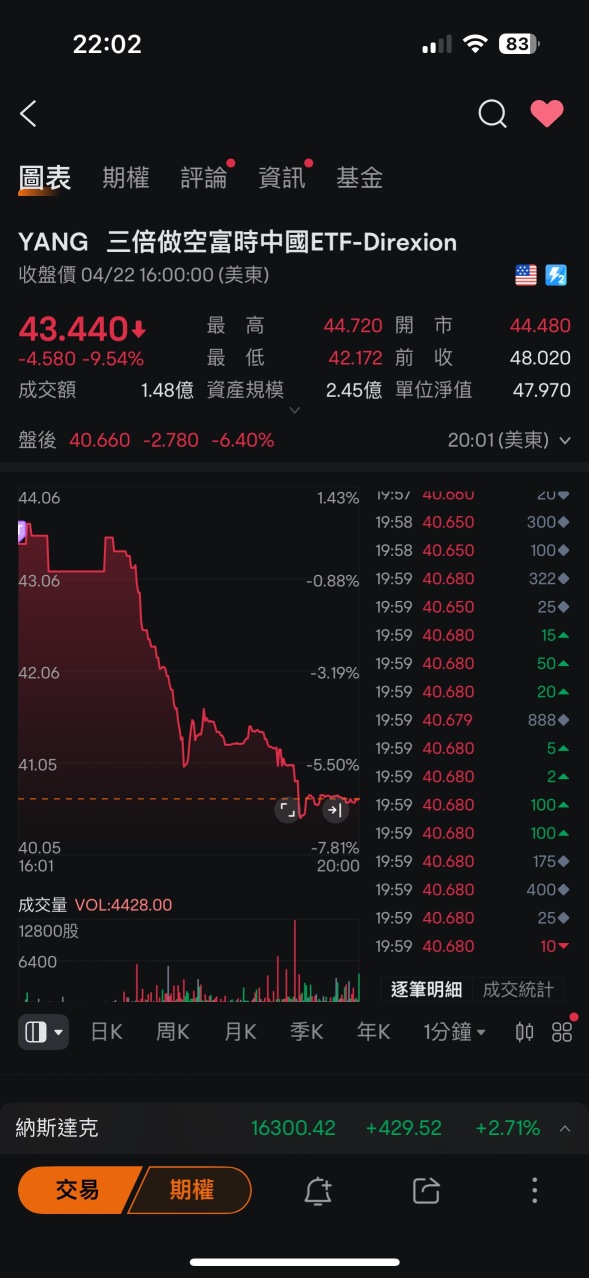

YANG Direxion Daily FTSE China Bear 3X Shares ETF

- 36.660

- -1.580-4.13%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

JPMorgan traders "draw the line": U.S. stocks first break 6000, then hit a new low!

JPMorgan expects that, driven by factors such as the activation of CTA strategy and accelerated Share Buybacks, the S&P 500 Index will first challenge the 6000-point mark. However, afterwards, if investors hold a pessimistic view on the mid-term outlook under high tariffs, the market may retest low levels. JPMorgan agrees with the current widespread view of an economic recession and anticipates a significant decline in hard data such as non-farm employment and retail sales in the next 1-2 months.

China Service Growth Hits 7-month Low as Trade Disruptions Weighs on New Business Orders

Asia Stocks Gain on China's Potential U.S. Trade Talks, U.S. Futures Edge Lower to Start the Week

The most profitable investment Buffett made in his life came from the "changes" in the last ten years of his career.

Buffett stated that the wealth created for Berkshire by Apple's CEO Cook far exceeds his own. Previously, Buffett had consistently avoided technology stocks until he made an exception and invested in Apple in 2016, resulting in significant returns for Berkshire.

Asia Markets Surge on China's U.S. Trade Talk Signals; U.S. Futures Steady After Apple, Amazon Earnings

Asia-Pacific Markets Rise in Thin Holiday Trade After BOJ Stands Pat, U.S Futures Rise Amid Robust Earnings From Two Major Tech Giants

Comments

$ProShares UltraPro Short QQQ ETF (SQQQ.US)$

Daring Lu : The reports indicate that 11 countries—mostly from the Commonwealth of Independent States (CIS)—have announced plans to stop using the U.S. dollar for international trade starting in 2025. These nations include Armenia, Azerbaijan, Belarus, Kazakhstan, Kyrgyzstan, Moldova, Russia, Tajikistan, Turkmenistan, Uzbekistan, and Ukraine.

The shift is driven by a desire to reduce dependence on Washington, minimize exposure to U.S. sanctions, and strengthen financial sovereignty. Many of these countries have been gradually distancing themselves from dollar-based trade for years, particularly Russia, which has been moving away from the dollar since 2014.

This move is expected to reshape global financial dynamics, as alternative payment systems and digital currencies gain traction.

Daring Lu : I am here in SQQQ.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Cui Nyonya Kueh OP Daring Lu : here also same ma

Cui Nyonya Kueh OP Daring Lu : if don't use us dollar then how? what currency to use? yen?

Daring Lu Cui Nyonya Kueh OP : Instead of the USD, these nations are shifting towards local currencies, digital currencies, and alternative payment platforms. Russia, for example, has been promoting the use of the Russian ruble in trade agreements, while Kazakhstan and Belarus have explored bilateral trade settlements in their own national currencies. Additionally, some of these countries are integrating blockchain-based financial systems and alternative SWIFT-like platforms to facilitate transactions without relying on the dollar.

This move is largely driven by a desire for economic independence, reduced exposure to U.S. sanctions, and greater control over financial policies. It’s a significant shift in global trade dynamics

View more comments...