No Data

03150 Global X Japan Global Leaders ETF

- 69.000

- -0.440-0.63%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Mitsui & Co. Ltd. (MITSY) Q4 2025 Earnings Call Transcript Summary

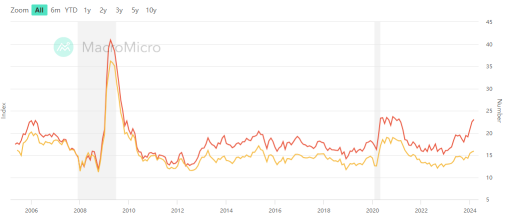

Expectations for the progress of the weak yen and tariff negotiations are driving prices close to 37,000 yen.

The Nikkei average has risen for seven consecutive trading days, finishing at 36,830.69 yen, up 378.39 yen (with an estimated volume of 1.9 billion 70 million shares). The depreciation of the yen, driven by the retreat of speculation regarding additional interest rate hikes by the Bank of Japan, combined with expectations of progress in tariff discussions with the USA, led to a bullish start. Autos stocks were bought, reaching as high as 36,976.51 yen in the middle of the morning session, approaching the significant level of 37,000 yen. However, ahead of the four-day holiday, profit-taking selling is likely to occur, and the USA is awaiting the announcement of the employment statistics for April.

List of cloud breakout stocks (Part 2) [Ichimoku Kinko Hyo - List of cloud breakout stocks]

○ List of stocks breaking below clouds Market Code Stock Name Closing Price Leading Span A Leading Span B Tokyo Main Board <1301> Kyokuyo 4120 4280 4182.5 <1375> Yukiguni 1140 1178.25 1155.5 <1930> Hokuriku Electric Works 1161 1225 1174 <1945> Tokyo Enesis 1101 1134.75 1111.5 <1968> Taihei Electric 4840 4882.54

M3, Itochu, Mitsubishi Corporation, JAL (2nd).

※ The above Calendar is just a schedule and may be subject to change due to corporate circumstances.--------------------------------------- May 2 (Friday) <1878> Daito Kentaku <2296> Itoham Yonekyu Holdings <2413> M3 <2480> Sysrock <2908> Fujicco <3191> JOYY Inc. American Depositary Shares <4565> So-sei <4772> Digiad

Mitsui & Co Q4 EPS $11.25 Down From $15.14 YoY, Sales $24.13B Up From $22.42B YoY

After the delayed interest rate hike by the Bank of Japan, the Nikkei average stock price temporarily recovered to 36,500 yen.

The Nikkei average continued to rise significantly for six consecutive trading days, closing up 406.92 yen at 36,452.30 yen (Volume estimated at 1.8 billion 60 million shares). Amid the sharp surge in the after-hours trading of U.S. Microsoft and Meta Platforms Inc, buying started to lead in the Tokyo market, particularly in the Semiconductors sector. Additionally, the depreciation of the yen to the 144 yen level against the dollar following the announcement of the Bank of Japan's monetary policy decision was also viewed as favorable, increasing the number of export-related stocks that gained in value.

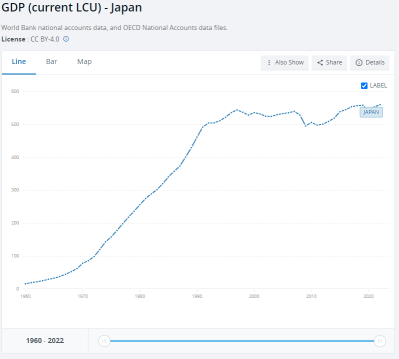

Comments

The Japanese stock market has experienced a significant narrative shift, with robust and enticing performance since 2023. The Nikkei Index has recorded its largest gains since 1989, consistently benefiting from growing corporate profits, enhanced capital efficiency, and supportive policy environments for market liquidity. As of today, the Nikkei 225 index closed up 0.5%, at 40,109.23 points, marking the fi...