No Data

2127 Nihon M&A Center Holdings

- 650.6

- +67.6+11.60%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Koei Tecmo, Komeda ETC (addition) Rating

Upgrade - Bullish Code Stock Name Brokerage Firm Previous After---------------------------------------------------- <8968> Fukuoka REIT Mizuho "Hold" "Buy" Downgrade - Bearish Code Stock Name Brokerage Firm Previous After---------------------------------------------------- <3481> Mitsubishi Logistics Mizuho "Buy" "Hold" <7752> Ricoh Daiwa

The Nikkei average is up about 70 yen, after a round of buying, it is heavy on the upside due to selling while waiting for a pullback = morning of May 1.

On May 1st at 10:18 AM, the Nikkei Average was trading around 36,110 yen, up about 70 yen from the previous day. At 9:13 AM, it reached 36,341.62 yen, up 296.24 yen. In the US market on April 30th local time, while the Nasdaq Composite Index fell, the NY Dow rebounded after an early decline, marking its seventh consecutive day of gains. The impact of the negative growth in Q1 GDP (Gross Domestic Product) was countered. The effect on the Nikkei Average is significant from the SOX (Philadelphia Semiconductors).

Nihon M&A Center Holdings To Go Ex-Dividend On March 30th, 2026 With 12 JPY Dividend Per Share And 3 JPY Special Dividend Per Share

May 1st (Japan Standard Time) - $Nihon M&A Center Holdings(2127.JP)$ is trading ex-dividend on March 30th, 2026.Shareholders of record on March 31st, 2026 will receive 12 JPY dividend per share and 3

Nihon M&A Center Holdings To Go Ex-Dividend On September 29th, 2025 With 11 JPY Dividend Per Share And 3 JPY Special Dividend Per Share

May 1st (Japan Standard Time) - $Nihon M&A Center Holdings(2127.JP)$ is trading ex-dividend on September 29th, 2025.Shareholders of record on September 30th, 2025 will receive 11 JPY dividend per

MUFG revises net profit upward for fiscal year 25/3 to 1 trillion 860 billion yen, up from 1 trillion 750 billion yen.

Mitsubishi UFJ <8306> announced a revision of its financial forecast for the fiscal year ending March 2025. The net profit was revised upwards from 1 trillion 750 billion yen to 1 trillion 860 billion yen. This was due to the recording of one-time gains such as profits from the sale of policy-held Stocks and the reversal of costs related to L's credit relationships, utilizing these gains to conduct a restructuring of the Bond portfolio from a balance sheet management perspective, implementing measures for future enhanced profitability. The year-end Dividend per share was raised by 4 yen from the previous forecast to 39 yen (the previous period was 20 yen).

The focus points for the PTS on the 30th are Tobu, Sanoyasu HD, Goldclay, ETC.

▽ Tobu <9001.T>, announced a revision of its long-term management vision, an increase in the year-end Dividends plan, in line with the Earnings Reports for the fiscal year ending March 2025. ▽ Goldcre <8871.T>, announced an upward revision of its performance plan for the fiscal year ending March 2025. Consolidated operating profit increased from 6.3 billion yen to 7.5 billion yen (30.8% increase compared to the previous term). The sales of condominiums progressed better than expected. ▽ Upexi Inc <7990.T>, announced a revision of its performance plan for the fiscal year ending March 2025. While revenue was revised downwards, operating profit was adjusted from 5.5 billion yen to 6.

Comments

Do you find it

Yes?

No worries!

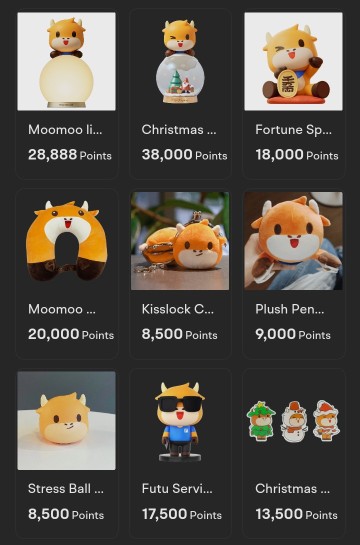

Why not try these methods to get rewards bigger

To get rewards bigger than the yield coupon, Mooers may exchange 400 coins for 1000 MooMoo points.

Let's assume Mooers managed to collect 4000 coins. This would mean that Mooers could exchange f...

Cui Nyonya Kueh : simi up down game ?![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Cui Nyonya Kueh :

Mars Mooo OP Cui Nyonya Kueh :

Cui Nyonya Kueh : chey![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

Mars Mooo OP Cui Nyonya Kueh :

View more comments...