US OptionsDetailed Quotes

AMD250502C94000

- 5.10

- 0.000.00%

15min DelayClose May 2 16:00 ET

0.00High0.00Low

0.00Open5.10Pre Close0 Volume1.71K Open Interest94.00Strike Price0.00Turnover2949.85%IV0.49%PremiumMay 2, 2025Expiry Date4.62Intrinsic Value100Multiplier-4DDays to Expiry0.48Extrinsic Value100Contract SizeAmericanOptions Type0.9743Delta0.0235Gamma19.34Leverage Ratio-254.3170Theta0.0000Rho18.84Eff Leverage0.0001Vega

Advanced Micro Devices Stock Discussion

$Advanced Micro Devices (AMD.US)$ Has AMD turn the corner?

I suppose if you lower the bar far enough you can beat the street.

it appears that the year plus of decline of AMD has subsided at this point. I'm pleasantly surprised that she didn't guide lower and while I have not been a fan of AMD for the better part of nine months at this point I needed to go up because I have a large position and a leveraged ETF where it's a holding inside of it.

so I will add AMD to my list of income ge...

I suppose if you lower the bar far enough you can beat the street.

it appears that the year plus of decline of AMD has subsided at this point. I'm pleasantly surprised that she didn't guide lower and while I have not been a fan of AMD for the better part of nine months at this point I needed to go up because I have a large position and a leveraged ETF where it's a holding inside of it.

so I will add AMD to my list of income ge...

2

6

$Advanced Micro Devices (AMD.US)$ on Tuesday forecast a $1.5 billion hit to revenue this year due to new U.S. curbs on chips, which require the company to obtain a license to ship advanced artificial-intelligence processors to China.

But it issued a second-quarter revenue forecast that topped Wall Street estimates, which analysts attributed to customers buying more chips ahead of tariffs. It shares rose 2.25% in premarket trading.

But it issued a second-quarter revenue forecast that topped Wall Street estimates, which analysts attributed to customers buying more chips ahead of tariffs. It shares rose 2.25% in premarket trading.

$Advanced Micro Devices (AMD.US)$ First purchase since Q1 2024, AMD is 3.49% of their portfolio, paid 102-120 and definitely paid over 106 for most of it.

net/CIK-0001018...

net/CIK-0001018...

7

$Advanced Micro Devices (AMD.US)$ folks, it’s time to be bullish on amd, the reasons:

1. mi350, mi400 in the pipeline. Mi325 is going well with a new large foundation model company adoption.

2. very strong momentum in data center cpu and clients

3. xlinx high margin business is recovering, especially the second half of the year.

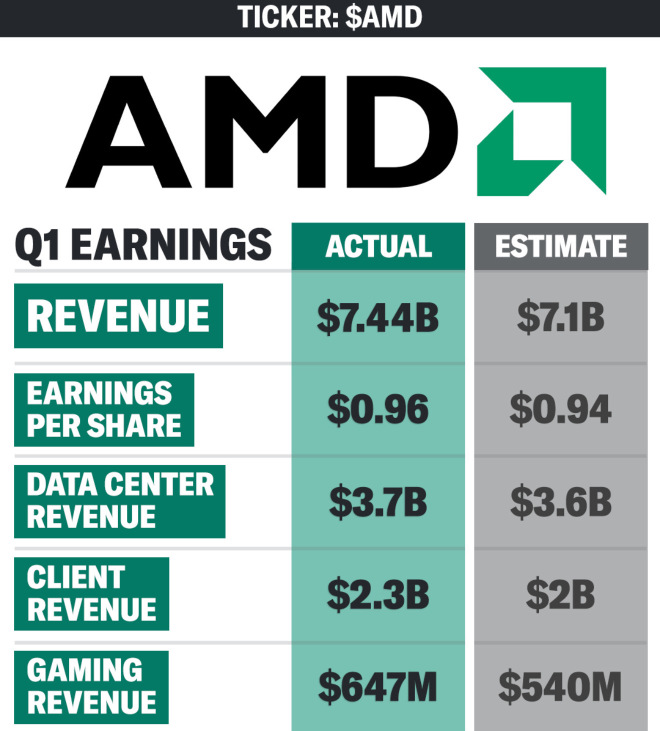

AMD beat Q1 expectations and raised Q2 guidance despite big China export headwinds!

there is nothing I don’t like. ZT acqusition was very smart with a reasonabl/bargin pr...

1. mi350, mi400 in the pipeline. Mi325 is going well with a new large foundation model company adoption.

2. very strong momentum in data center cpu and clients

3. xlinx high margin business is recovering, especially the second half of the year.

AMD beat Q1 expectations and raised Q2 guidance despite big China export headwinds!

there is nothing I don’t like. ZT acqusition was very smart with a reasonabl/bargin pr...

$Advanced Micro Devices (AMD.US)$ how much will it drop today 不要跳楼机

3

The S&P 500’s Tuesday session ended on a soft note, slipping into the close to finish just above its opening level at 5,605. While the late-day fade lacked conviction, it did little to disrupt the broader technical uptrend. Momentum remains firmly positive, and the path of least resistance still points higher.

Key Takeaways from Tuesday’s Action

- No Technical Damage Done: The index held above critical support, keeping the near-term bullish structure intact....

No comment yet

1947499474 - Danny : just DCA AMDL will do

10baggerbamm OP 1947499474 - Danny : you absolutely can dollar cost average in if you're planning on buying and holding..

I've got cash sufficient that permits me to sell puts at a strike that I'm comfortable owning. and I'll just keep selling puts a few percent below the market on a weekly basis and capture the premium so I'm already cash flow positive even without the stock trading higher I'm making money. and then if I'm put the stock I will immediately start selling calls against the long position that I was put. this again generates positive cash flow and lowers my cost basis so I'm able to capture profits both ways on the put side and on the call side. the risk to me would be it goes on a 45° run. I don't see that happening at least not yet not now. we still have all the uncertainty with regard to tariffs we have interest rates we still have 6 trillion dollars and needs to be refinanced we need this big beautiful bill that's hanging over Congress to pass. we still have chip tariffs that are coming president Trump has stopped talking about them over the past couple of weeks but that doesn't mean it's not going to happen. so there's still a significant amount of headwinds for the broader Market as well as tech stocks. additionally I've said this before and I believe this to be the case, if you listen to the treasury secretary months ago he described three buckets green yellow and red and that's how they're going to negotiate with countries and Nations we have friendly allies that are in the green we have countries and Nations that we work with on a limited basis and then we have what are perceived to be enemies and they're in the red bucket. The sovereign Nations the countries that are allies of the US if they don't agree to terms in the tariff negotiations that are to president Trump's liking he's going to use every pawn on the chessboard to leverage the pain and suffering that he can inflict on these other nations and countries. one of the leading pawns on the chessboard are gpus so that's Nvidia and that's AMD. and what he will do is take the leading gpus from each company and restrict these nations and countries from buying as much as they want to he will put them into what's now called a tier 2 versus a tier 1 level or he will put them into a tier 3 or red bucket which is an outright ban. this is the variable this is The X Factor that Jensen and Lisa cannot account for. their projections and their guidance are based off of current markets that they can sell to if there's further restrictions it will slow their growth.

so there's a lot of headwinds and then you have the bull case which is the stocks have had the hell kicked out of them and the contrarians are going to buy with a perceived to be value at a reasonable price.

lastly this quarter pretty much put a nail in the coffin for any concern that the hyperscalers would cut back. if at any point in time they had a reason to slow the rate of spend or to cancel and cut back it would be this quarter because of the uncertainty of tariffs. the fact of the matter is their foot is on the throttle they are not slowing down the AI revolution and evolution is alive is well and tech is going to lead the way. there's many like Dan Ives that believes it's going to be on the software side more so than the hardware the hardware being AMD and Nvidia were the first round of winners if you can say AMD was a winner ever and now it's on to software such as Dan's favorite which is palantir.

at any rate I think at the current levels with AMD selling puts will yield a very nice return I think for the most part the stock has been de-risked at these levels based off of the most recent quarter and I think they're approach of selling puts combined with selling calls against your long position on a very short term weekly basis will significantly outperform a buy and hold approach

nice Moose_7054 : do you think current AMD price alrdy priced in the earnings?

10baggerbamm OP nice Moose_7054 : absolutely I mean the the move that you're seeing now takes into consideration the earnings and the projection. the first half hour of the market is really erratic across the board with any stock the highs that you see on the print that's what retails willing to pay and then I think you'll have some institutional selling just someone that's had AMD on their books they just want to close it out take the loss and move on I think you might have some short sellers covering their position whatever is out there so I wouldn't read into a half a point or a dollar swing one way or another in the first half hour of the market..

obviously we have the Federal reserve that's front and center and right now aside from president Trump there's really no one that is pounding the table that there needs to be a rate cut right this very second it would be nice but the market's not factoring in a rate cut this week they're factoring in a rate cut for July.

so this is where all of the bobbleheads are going to be looking at what's called The Dot plot which is the hawkish or dovish sentiment of all of the heads of the various federal reserves around the country to see what their stances on rate cuts and when the balance of this year. so it's very possible because we have no resolution to tariffs that they're going to push off a July rate cut and push it down to August.. if this happens I think the market rolls I think we get a one or two day event of selling. so I would not go all in I certainly don't have amd's my top pick I don't own any of it directly unfortunately I have Nvidia which is a thorn in my side.. I would categorize AMD as if you're already invested in what you perceive to be great companies and you don't want to buy more of those companies you're looking to diversify elsewhere and you already have Bank stocks which you need to own either directly or an ETF because they're going to outperform tech at this point then towards the bottom of the list I would say yeah you can pick at AMD. I don't think it's going to take a leadership position I still think broadcom I think Taiwan semiconductor are vastly superior they have proven themselves to beat the street to raise guidance.. so let me say if you have $100,000 portfolio I think you could put $5,000 in AMD and I would buy the leveraged ETF but that's just me I can take more risk than others I've been in leverage ETFs when the trade goes against you and it's absolutely brutal it's miserable it's the worst pain you've ever felt for guys it ranks right up there with getting kicked in the balls and the minute you stand up you get kicked again that's the only way I can describe it it's brutal pain.. but I think at this point you could pick at AMD, and either use the approach that I'm going to do which is selling puts or to those that have the ability to take more risk I would buy and hold the AMDL everage ETF. if we get a big resolution to tariffs at some point in time over the next 30-60 days the tech stocks are going to be off to the races the whole Market will Gap and run, I think at that point you probably could see like $112-115 so maybe $10 movement on AMD. so again it's not my first pick it's down the list but because I have zero direct ownership only indirectly through soxl I'm going to put a small percentage of monies into the strategy that I'm advocating which is selling puts and then if I get put it so calls against it.

so after this long convoluted twisted answer you can see the upgrades and the downgrades that have come out these were the analysts several of them that were on the conference call and that's why I'm saying I think it's been de-risked at this point I think the storm has passed AMD now what they do in the future will they have the ability to execute and beat and raise going forward that's your risk

nice Moose_7054 10baggerbamm OP : thanks for your comprehensive reply!

View more comments...