US Stock MarketDetailed Quotes

BRK.A Berkshire Hathaway-A

- 809350.000

- +13950.000+1.75%

Close May 2 16:00 ET

- 809350.000

- 0.0000.00%

Post 16:14 ET

1.16TMarket Cap13.08P/E (TTM)

812855.000High802875.001Low531Volume803783.351Open795400.000Pre Close428.87MTurnover0.04%Turnover Ratio13.08P/E (Static)1.44MShares812855.00052wk High1.79P/B991.42BFloat Cap601500.00052wk Low--Dividend TTM1.22MShs Float812855.000Historical High--Div YieldTTM1.26%Amplitude35350.000Historical Low807655.472Avg Price1Lot Size

Berkshire Hathaway-A Stock Forum

$Berkshire Hathaway-A (BRK.A.US)$ CEO said Warren Buffett said Saturday the U.S. fiscal deficit is "unsustainable," adding that the pace of government spending can't continue at its current state.

"We're operating at a fiscal deficit now that is unsustainable," Buffett said at the company's annual meeting. "It gets uncontrollable to a certain point."

Buffett was responding to a question about his thoughts on the net benefit of ...

"We're operating at a fiscal deficit now that is unsustainable," Buffett said at the company's annual meeting. "It gets uncontrollable to a certain point."

Buffett was responding to a question about his thoughts on the net benefit of ...

4

2

4

listening to the old man’s 2 cents on making money key points

-surround yourself with people better than you because they show you things you haven’t and from there you’ll learn.

- if you like making money.. you continue doing it…

-the world has changed dramatically, the world never adapts for your,,, to remain profitable you have to adapt with change.

- you have to be lucky in life having goodhealth is one. And to be living in this century is already lucky compared to 100 ye...

-surround yourself with people better than you because they show you things you haven’t and from there you’ll learn.

- if you like making money.. you continue doing it…

-the world has changed dramatically, the world never adapts for your,,, to remain profitable you have to adapt with change.

- you have to be lucky in life having goodhealth is one. And to be living in this century is already lucky compared to 100 ye...

…pretty much all ( $SPDR S&P 500 ETF (SPY.US)$, $Berkshire Hathaway-B (BRK.B.US)$, $Palantir (PLTR.US)$, $Broadcom (AVGO.US)$,…) save for keeping most of my $Archer Aviation (ACHR.US)$ (long term position).

Will it continue going up today, and into next week? Likely, buUut… when all this excitement wears off, I can buy it again (and this is the important part) with what I’ve *not* lost *plus* what I’ve gained.

My belief is that the market has turned, buUut… I can count upon cash with far great...

Will it continue going up today, and into next week? Likely, buUut… when all this excitement wears off, I can buy it again (and this is the important part) with what I’ve *not* lost *plus* what I’ve gained.

My belief is that the market has turned, buUut… I can count upon cash with far great...

2

2

In April, Trump's tariff policy was erratic, exacerbating the fragile sentiment in the market, and the overall financial market showed signs of turmoil.

As May approaches, there will be many significant events in the US stock market:

May 1

Tech giants $Apple (AAPL.US)$ and $Amazon (AMZN.US)$ will release their earnings reports after market close, attracting considerable attention.

May 3

The...

As May approaches, there will be many significant events in the US stock market:

May 1

Tech giants $Apple (AAPL.US)$ and $Amazon (AMZN.US)$ will release their earnings reports after market close, attracting considerable attention.

May 3

The...

47

1

26

The Grand Event: Buffett’s Wisdom on Display

On May 3, 2025, the investment world converges on Omaha (and globally via live stream) for the Berkshire Hathaway Annual Shareholders’ Meeting—a pilgrimage for value investors, novices, and billionaires alike. This isn’t just a meeting; it’s a masterclass in patience, discipline, and contrarian thinking.

Legendary Moves: Buffett’s Greatest Hits

Let’s revisit three mo...

On May 3, 2025, the investment world converges on Omaha (and globally via live stream) for the Berkshire Hathaway Annual Shareholders’ Meeting—a pilgrimage for value investors, novices, and billionaires alike. This isn’t just a meeting; it’s a masterclass in patience, discipline, and contrarian thinking.

Legendary Moves: Buffett’s Greatest Hits

Let’s revisit three mo...

72

27

8

$Berkshire Hathaway-A (BRK.A.US)$ $Berkshire Hathaway-B (BRK.B.US)$

Ready to ride the investing tsunami with the maestro of markets? Fasten your seatbelts — May 3, 2025 is the date when Warren Buffett wisdom will beam straight into your living room. 🌊📅

🍎 Tech Titans vs. Value Vanguard

After trimming Apple by 30% in 2024, Buffett’s tech exit has investors scratching their heads. Is he betting on a “new era of regulation” or pivoting to biotech’s longevity...

Ready to ride the investing tsunami with the maestro of markets? Fasten your seatbelts — May 3, 2025 is the date when Warren Buffett wisdom will beam straight into your living room. 🌊📅

🍎 Tech Titans vs. Value Vanguard

After trimming Apple by 30% in 2024, Buffett’s tech exit has investors scratching their heads. Is he betting on a “new era of regulation” or pivoting to biotech’s longevity...

Berkshire's 2025 Annual Shareholders Meeting

May 3 08:00

Live

Live 15

8

3

$Berkshire Hathaway-B (BRK.B.US)$is about to release its Q1 2025 earnings. According to Zacks data, analysts expect the earnings per share (EPS) to be $4.81, which is a 7.32% decrease from the same period last year. The revenue is projected to be $92.21 billion, showing a 2.6% increase YoY. The average target price set by analysts is $557, while the current share price is $534.57. Based on the analysts' forecasts, this implies...

+5

42

5

22

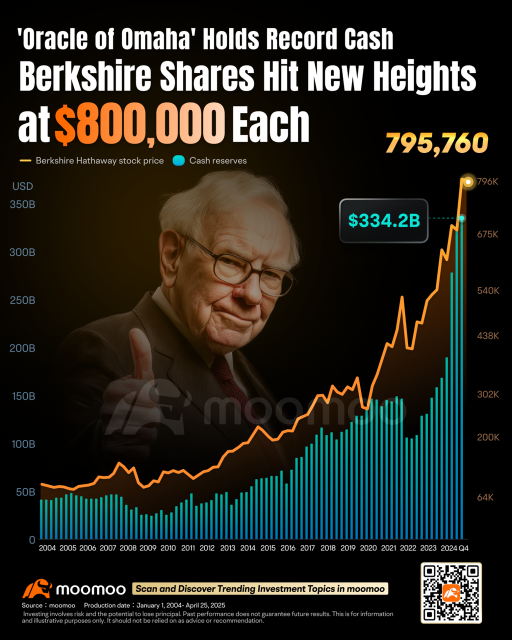

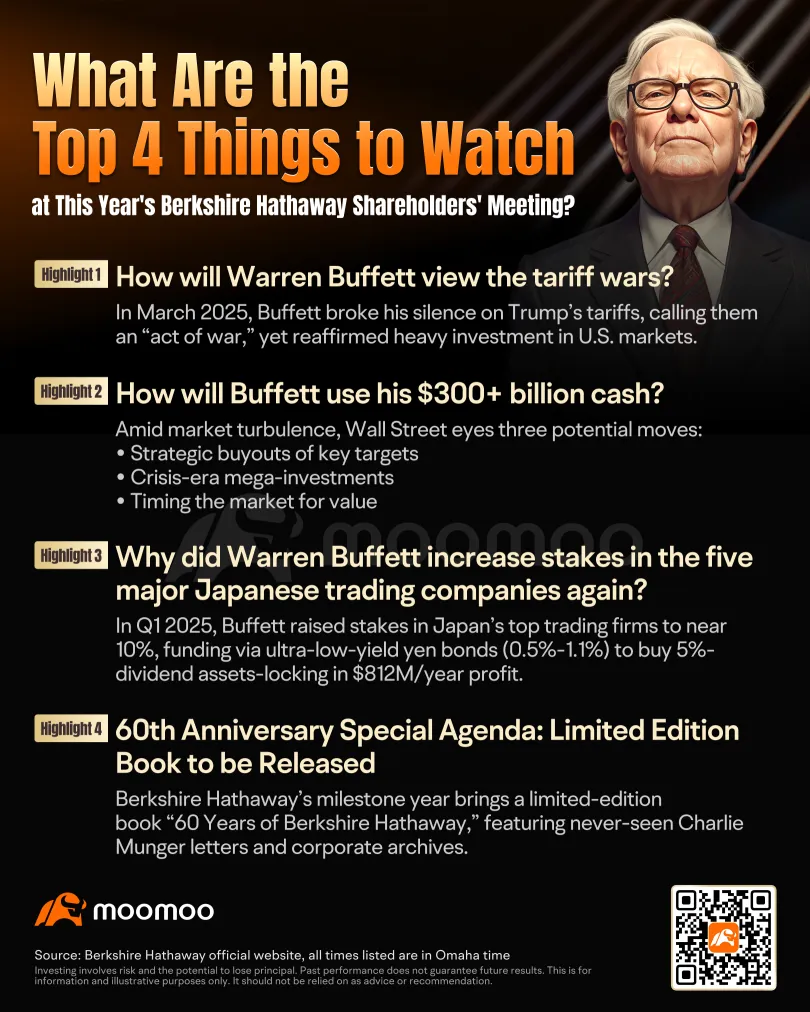

Columns Warren Buffett's 60-Year Legacy: What to Watch for at Berkshire Hathaway Shareholders Meeting?

The annual major investment event, Berkshire Hathaway's Annual Shareholder Meeting, will be held on May 3rd in Omaha, Nebraska, the hometown of Warren Buffett.

This year marks the 60th anniversary of Buffett's leadership at Berkshire. Dubbed the 'Diamond Shareholder Meeting,' this event is expected to shed light on the succession plans of the investment legend and delve into Buffett's recent strategic i...

This year marks the 60th anniversary of Buffett's leadership at Berkshire. Dubbed the 'Diamond Shareholder Meeting,' this event is expected to shed light on the succession plans of the investment legend and delve into Buffett's recent strategic i...

+2

56

7

40

*stup!d ‘truths’ aside ~;-)

I’d already opened $SPDR S&P 500 ETF (SPY.US)$ to end last week, but closed $JPMorgan (JPM.US)$ to open $Berkshire Hathaway-B (BRK.B.US)$… might lose a little, if Buffett stays in cash too long, buUut I’da lost less had I stayed in cash back when I said, “the SKY is falling!” (just before the sky fell ~;-)

$Berkshire Hathaway-B (BRK.B.US)$

I’d already opened $SPDR S&P 500 ETF (SPY.US)$ to end last week, but closed $JPMorgan (JPM.US)$ to open $Berkshire Hathaway-B (BRK.B.US)$… might lose a little, if Buffett stays in cash too long, buUut I’da lost less had I stayed in cash back when I said, “the SKY is falling!” (just before the sky fell ~;-)

$Berkshire Hathaway-B (BRK.B.US)$

No comment yet

Here are some potential ideas for the most remarkable moments:

Here are some potential ideas for the most remarkable moments:

that subdued their own hunger.

that subdued their own hunger.

Ttowbin23 : so buy where there are no forests located

Thomas Roell : I agree