No Data

BRK.A Berkshire Hathaway-A

- 809350.000

- +13950.000+1.75%

- 809350.000

- 0.0000.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Catalyst Watch: Powell Presser, AMD Earnings, IBM Event, and Lions Gate Splits in Two

Buffett Poised to Take Center Stage Again at Berkshire Hathaway Annual Meeting

"The Buffett Indicator" is showing a Call signal! After experiencing severe turmoil, is the U.S. stock market facing a historical bottom-buying opportunity?

The Indicators are currently at 180%, close to the levels after last year's brief severe sell-off, indicating that the stock market is relatively cheap in terms of valuation. However, in comparison, this valuation indicator is still higher than the general levels observed during past market bottoms, including the sell-off triggered by the COVID-19 pandemic in early 2020, when the indicator dropped to nearly 100%.

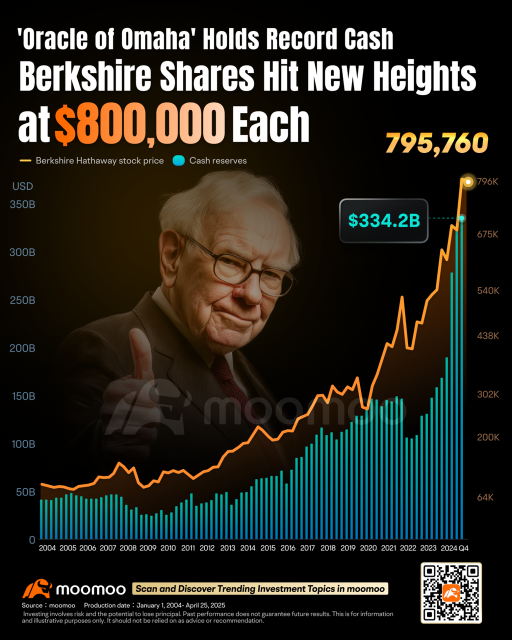

Focusing on the Berkshire Hathaway Shareholder Meeting: Buffett has been steering Berkshire for 60 years. How has Berkshire performed?

In a year of turbulence in the stock market, Berkshire Hathaway has shown stability. As tariff fluctuations impact the USA business community, Shareholders will seek reassurance from Warren Buffett this weekend, confirming that the company remains under his reliable management. At the annual Shareholder meeting held this Saturday in Omaha, Nebraska, the 94-year-old billionaire will mark his 60th year at the helm of this 1.15 trillion dollar Conglomerate that he has built. Buffett will spend four and a half hours answering Shareholder questions, which typically focus on Berkshire's Operation Business, market trends, economic conditions, life philosophy, and this "Omaha.

The newly appointed CEO of Buffett's residence service company stated that buyers and sellers are able to cope with tariffs and market changes.

The new CEO of HomeServices of America, a residential service company under Berkshire Hathaway, stated that concerns about tariffs affecting mortgage rates are troubling home buyers and sellers, but are unlikely to significantly suppress existing home sales. 'When mortgage rates fluctuate due to changes in economic fundamentals, both buyers and sellers often take a wait-and-see approach,' said Chris Kelly, who took over the largest residential Real Estate brokerage in the USA on April 15, in a recent interview. The rising cost of borrowing led to a seasonally adjusted year-on-year decline in existing home sales in the USA in March.

Investing Pros Haven't Been This Worried About the Stock Market in at Least 28 Years, Our Exclusive Poll Finds

Comments

Will it continue going up today, and into next week? Likely, buUut… when all this excitement wears off, I can buy it again (and this is the important part) with what I’ve *not* lost *plus* what I’ve gained.

My belief is that the market has turned, buUut… I can count upon cash with far great...

As May approaches, there will be many significant events in the US stock market:

May 1

Tech giants $Apple (AAPL.US)$ and $Amazon (AMZN.US)$ will release their earnings reports after market close, attracting considerable attention.

May 3

The...

On May 3, 2025, the investment world converges on Omaha (and globally via live stream) for the Berkshire Hathaway Annual Shareholders’ Meeting—a pilgrimage for value investors, novices, and billionaires alike. This isn’t just a meeting; it’s a masterclass in patience, discipline, and contrarian thinking.

Legendary Moves: Buffett’s Greatest Hits

Let’s revisit three mo...

Ready to ride the investing tsunami with the maestro of markets? Fasten your seatbelts — May 3, 2025 is the date when Warren Buffett wisdom will beam straight into your living room. 🌊📅

🍎 Tech Titans vs. Value Vanguard

After trimming Apple by 30% in 2024, Buffett’s tech exit has investors scratching their heads. Is he betting on a “new era of regulation” or pivoting to biotech’s longevity...

Book

Book

Here are some potential ideas for the most remarkable moments:

Here are some potential ideas for the most remarkable moments:

Tonyco : It's a trap!

Dan’l OP Tonyco : Ain’t everything, though?

BuUut, seriously: even under the best circumstances, all this built-up desire to invest coupled with the fear of missing out pushes prices too far, and they fall back.

Under these circumstances, with talk of tariffs and stup!d so-called truths? The whole thing can get squirrelly at any moment… best to buy as it’s going up, and sell when it stops climbing; then, repeat. ~;-)