No Data

SymbolStock Name

PriceChg% ChgVolumeTurnoverOpenPre CloseHighLowMarket CapFloat CapSharesShs Float5D % Chg10D % Chg20D % Chg60D % Chg120D % Chg250D % Chg% Year-to-dateDiv YieldTTMTurnover RatioP/E (TTM)P/E (Static)AmplitudeIndustry

WatchlistPaper Trade

⭕北美深蓝 OP : Unfortunately, mine is. $WEBULL CORPORATION C/WTS 10/04/2030(TO PUR COM) (BULLW.US)$ The main position is all in the registered Account, and this stock cannot be Short Sold, however, all the warrants I bet on have already made a significant profit.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

cakesifuLim ⭕北美深蓝 OP : Ha... so this stock is suitable for Short Sell? I thought it had potential, so I invested.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36) Will it go up to 40+?

Will it go up to 40+?

⭕北美深蓝 OP : $Webull (BULL.US)$ The company's fundamentals are not optimistic (see another post, with images and comparisons), profits are at a low level compared to USA Brokerages, the only slightly interesting aspect is that the number of users in the USA ranks high, but making money is the key to the company's survival and the rise in stock prices! … new stocks/meme stocks have risks, operations should be cautious!

cakesifuLim ⭕北美深蓝 OP : Alright. Thank you. I will set the loss first.![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

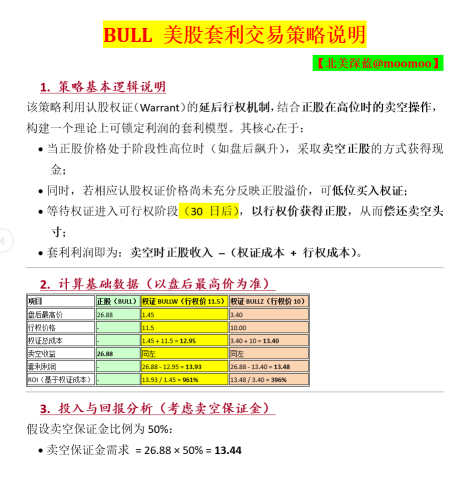

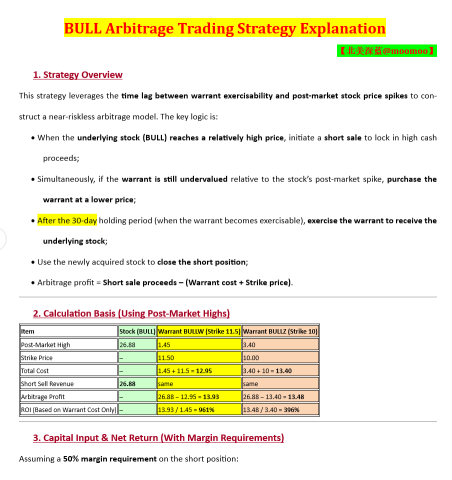

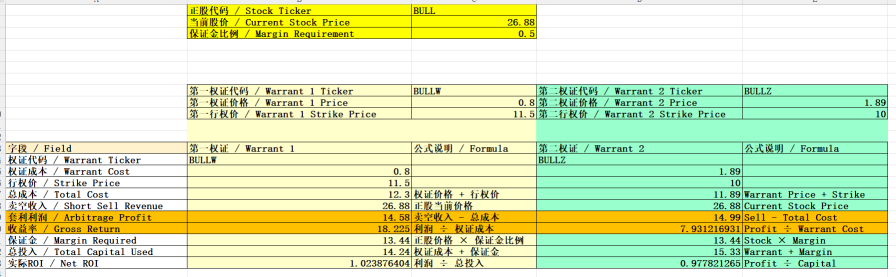

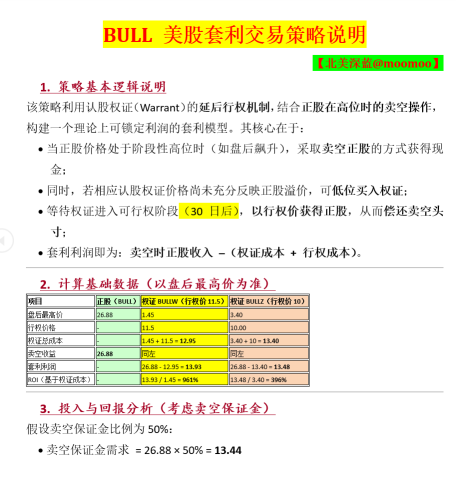

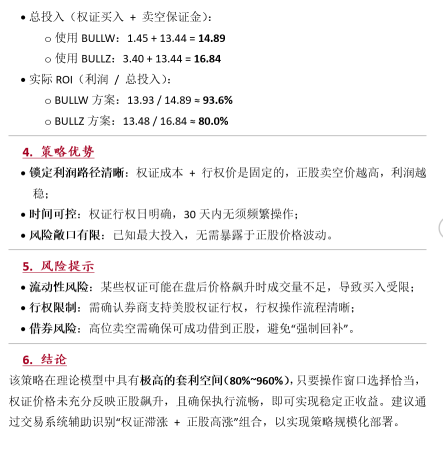

⭕北美深蓝 OP cakesifuLim : Short sell the underlying stock at a high point, while buying call warrants. Exercise the call warrants after 30 days to obtain the underlying stock and repay the borrowed stock, ensuring stable profits. There are detailed explanations of the strategy. As for the company's fundamentals, they are not very good, at least for now. Everything can be found in my other posts.

Short sell the underlying stock at a high point, while buying call warrants. Exercise the call warrants after 30 days to obtain the underlying stock and repay the borrowed stock, ensuring stable profits. There are detailed explanations of the strategy. As for the company's fundamentals, they are not very good, at least for now. Everything can be found in my other posts.

At the same time, it is worth considering that the funds in the SKGR REITs Account are not substantial. During the merger, the promoters of SKGR agreed to potentially relinquish up to 2 million shares (representing 38.17% of total shares) in exchange for additional "Non-Redemption Agreements" to indicate that the merger transaction is facing financial pressure. However, there was no PIPE participation in the merger, which gives a glimpse into the attractiveness of the company's fundamental prospects.

View more comments...