US Stock MarketDetailed Quotes

GES Guess

- 10.670

- -0.280-2.56%

Close May 6 16:00 ET

- 10.660

- -0.010-0.09%

Post 20:01 ET

553.11MMarket Cap13.86P/E (TTM)

10.872High10.590Low654.54KVolume10.810Open10.950Pre Close7.01MTurnover2.38%Turnover Ratio13.86P/E (Static)51.84MShares25.30352wk High1.10P/B293.27MFloat Cap8.21752wk Low1.20Dividend TTM27.49MShs Float28.063Historical High11.25%Div YieldTTM2.57%Amplitude0.731Historical Low10.709Avg Price1Lot Size

Guess Stock Forum

Columns Wall Street Today: Nasdaq, S&P 500 and DJIA All Give Up Early Gains and Sink on China Tariffs

The Nasdaq Composite, S&P 500 and Dow-30 all fell yet again Tuesday as a short-lived morning rebound for stocks petered out on word the United States will impose 104% tariffs on China overnight on Wednesday.

The $Nasdaq Composite Index (.IXIC.US)$ shed 335.35 points (2.2%) to a 15,267.91 close, while the $S&P 500 Index (.SPX.US)$ lost 79.48 ticks (1.6%) to 4,982.77 and the $Dow Jones Industrial Average (.DJI.US)$ gave back...

The $Nasdaq Composite Index (.IXIC.US)$ shed 335.35 points (2.2%) to a 15,267.91 close, while the $S&P 500 Index (.SPX.US)$ lost 79.48 ticks (1.6%) to 4,982.77 and the $Dow Jones Industrial Average (.DJI.US)$ gave back...

23

1

16

The Dow Jones Industrial Average and S&P 500 fell yet again on Monday, but the Nasdaq Composite index eked out a small gain as U.S. President Donald Trump's tariff moves continued to roil markets around the globe.

The $Dow Jones Industrial Average (.DJI.US)$ sank 349.26 points (1.9%) to a 37,965.60 close, while the $S&P 500 Index (.SPX.US)$ shed 11.83 ticks (0.2%) to 5,062.25. However, the $Nasdaq Composite Index (.IXIC.US)$ managed t...

The $Dow Jones Industrial Average (.DJI.US)$ sank 349.26 points (1.9%) to a 37,965.60 close, while the $S&P 500 Index (.SPX.US)$ shed 11.83 ticks (0.2%) to 5,062.25. However, the $Nasdaq Composite Index (.IXIC.US)$ managed t...

21

1

The Nasdaq Composite Index entered a bear market Friday and Dow industrials shed more than 2,000 points as China announced retaliation in response to U.S. President Donald Trump's new import duties on foreign goods.

The $Nasdaq Composite Index (.IXIC.US)$ tumbled 962.82 points (5.8%) to a 15,587.79 close, adding to a 6% slide on Thursday.

All in, the Nasdaq has shed 22.9% since hitting a 20,2...

The $Nasdaq Composite Index (.IXIC.US)$ tumbled 962.82 points (5.8%) to a 15,587.79 close, adding to a 6% slide on Thursday.

All in, the Nasdaq has shed 22.9% since hitting a 20,2...

26

14

13

$Guess (GES.US)$

Apr 03 (Reuters) - Guess Q4 Revenue USD 932 Million.

Q4 Adjusted Net Income USD 77.7 MillionQ4 Net Income USD 81.4 MillionQ4 EPS USD 1.16Q4 Adjusted EBIT USD 106.5 Million

Apr 03 (Reuters) - Guess Q4 Revenue USD 932 Million.

Q4 Adjusted Net Income USD 77.7 MillionQ4 Net Income USD 81.4 MillionQ4 EPS USD 1.16Q4 Adjusted EBIT USD 106.5 Million

1

Columns Wall Street Today: DJIA, S&P 500 and Nasdaq Composite All End in the Green on St. Patrick's Day

The Dow Jones Industrial Average, S&P 500 and Nasdaq Composite all ended in the green Monday for St. Patrick's Day, rising for a second straight session as markets continued to partially rebound from their recent tariff-induced sell-off.

The $Dow Jones Industrial Average (.DJI.US)$ led the way higher, gaining 353.45 points (0.9%) to end the day at 41.841.63. The $S&P 500 Index (.SPX.US)$ likewise added 3...

The $Dow Jones Industrial Average (.DJI.US)$ led the way higher, gaining 353.45 points (0.9%) to end the day at 41.841.63. The $S&P 500 Index (.SPX.US)$ likewise added 3...

27

1

5

$Guess (GES.US)$

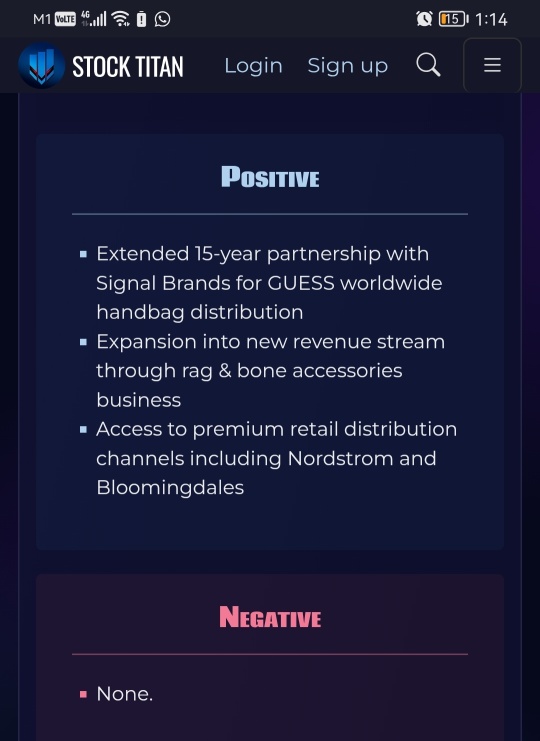

GUESS Strikes Major Luxury Deal: rag & bone Accessories Coming to Nordstrom, Bloomingdales

GUESS Strikes Major Luxury Deal: rag & bone Accessories Coming to Nordstrom, Bloomingdales

$Guess (GES.US)$

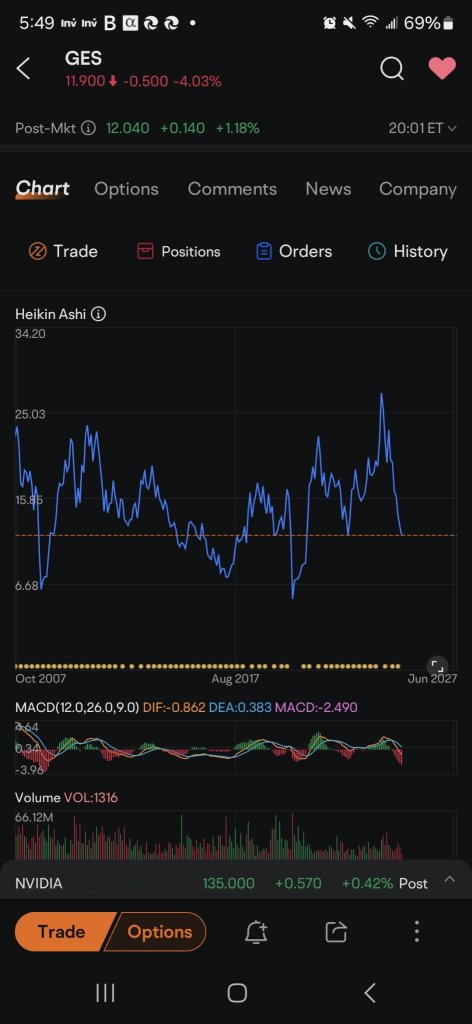

I like the chart here looks to have hit bottom on March 4th - 52 week low. Has shown positive price action since hitting bottom. Earning around the corner - March 19.

Not a penny so many may not be inertesed but I will be taking a starter position.

I like the chart here looks to have hit bottom on March 4th - 52 week low. Has shown positive price action since hitting bottom. Earning around the corner - March 19.

Not a penny so many may not be inertesed but I will be taking a starter position.

1

$Guess (GES.US)$

I'm going to try to narrow in on bottom do some digging around at how they're doing financially I feel like this isn't quite there yet but 9s down complete on monthly is potentially close

I'm going to try to narrow in on bottom do some digging around at how they're doing financially I feel like this isn't quite there yet but 9s down complete on monthly is potentially close

1

1

Columns Guess Inc. Falls 8% After Clothing Firm Misses on Adjusted EPS and Lowers Full-Year Guidance

Guess? Inc. fell some 8% after hours Wednesday after the clothing-and-accessories firm missed analyst estimates for fiscal Q2 earnings and lowered guidance for its fiscal year as a whole.

$Guess (GES.US)$ shed 8.3% to $18.54 shortly before 5:15 p.m. ET after the retailer said it earned an adjusted $0.42 per share in its fiscal Q2 ended Aug. 3. That's down 41.7% from the $0.72 per share that Guess rang up i...

$Guess (GES.US)$ shed 8.3% to $18.54 shortly before 5:15 p.m. ET after the retailer said it earned an adjusted $0.42 per share in its fiscal Q2 ended Aug. 3. That's down 41.7% from the $0.72 per share that Guess rang up i...

5

1

No comment yet

151825295 : so on a word. more institutional bullshit to short and distort the markets. manipulation prime. protestors should be attacking the like of blackrock, vanguard etc not musk or Trump. they are the real culprits behind drops. shame libs to braindead to see that as easily fooled by the narrative that same institutions put out.