No Data

HTHIY Hitachi (ADR)

- 26.710

- +0.040+0.15%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

The Nikkei Average rose by 574 points, significantly continuing its gains, recovering to 30,000 yen on a closing basis for the first time in about a month as of the afternoon of the 9th.

On the 9th, the Nikkei average stock price surged by 574.70 yen to 37,503.33 yen compared to the previous day. The TOPIX (Tokyo Stock Price Index) increased by 34.77 points to 2,733.49 points, continuing its rise for the 11th consecutive day. The Nikkei average, based on the closing price, surpassed the psychological threshold of 37,000 yen for the first time in about a month since March 28 (37,120 yen). The U.S. market on the 8th reacted positively to the agreement on customs negotiations between the UK and the USA, prompting buying to lead the Japanese market as well.

Hitachi GE Nuclear Energy is providing key equipment for the Darlington new Nuclear Power plant in Canada, OPG.

Hitachi GE Nuclear Energy is providing major equipment for the Darlington new Nuclear Power station in Canada. To view the PDF file, Adobe Acrobat Reader is required. The information in this news release (product prices, product specifications, service contents, release dates, contact information, URLs, etc.) is current as of the announcement date. Please be aware that it may change without notice and that the information may differ from what is available on the search date.

Market Chatter: Japan Share Buybacks Hit Record in April

The Nikkei average is down by about 70 yen, buying is leading but the upside is heavy, turning to decline = 8 days before the market.

On the 8th at around 10:01 AM, the Nikkei Index ETF is trading at around 36,700 yen, down about 70 yen compared to the previous day. At 9:52 AM, it reached 36,606.71 yen, down 172.95 yen. In the US stock market on the 7th local time, both the NY Dow and Nasdaq Index rebounded for the first time in three days on expectations of progress in US-China trade negotiations. The FOMC (Federal Open Market Committee) decided to maintain the policy interest rate at 4.25-4.50%, as was predicted by the market, and indicated that there is no urgency to lower the interest rate.

Patent focus = Hitachi: leak detection devices ETC.

Hitachi Ltd Sponsored ADR <6501.T> engages in digital systems and services that handle business systems and social infrastructure, Energy related to power grids and Nuclear Power, Railroads systems, building systems, etc. Leak detection devices and systems (WO/2025/088871), superconducting coils and superconducting magnet systems (WO/2025/088886), dangerous driving warning devices and Autos, dangerous driving warning methods (WO/2025/088887), injection molding condition generation devices, injection.

On the 6th, the trends of ADRs showed that Hitachi, Mitsubishi UFJ, Mizuho, ETC were high in yen conversion values.

On the 6th, the ADR (American Depositary Receipt) showed mixed results compared to the Tokyo closing prices on the previous week’s Friday, with values converted to yen. In yen terms, Hitachi <6501.T>, Mitsubishi UFJ <8306.T>, Mizuho <8411.T>, JAL <9201.T>, and Nitori HD <9843.T> were on the rise. On the other hand, Takeda Pharmaceutical <4502.T>, Sony Group Corp <6758.T>, Keyence <6861.T>, Nissan Motor <7201.T>, and Honda <7267.T> were also weak. Provided by Wealth.

Comments

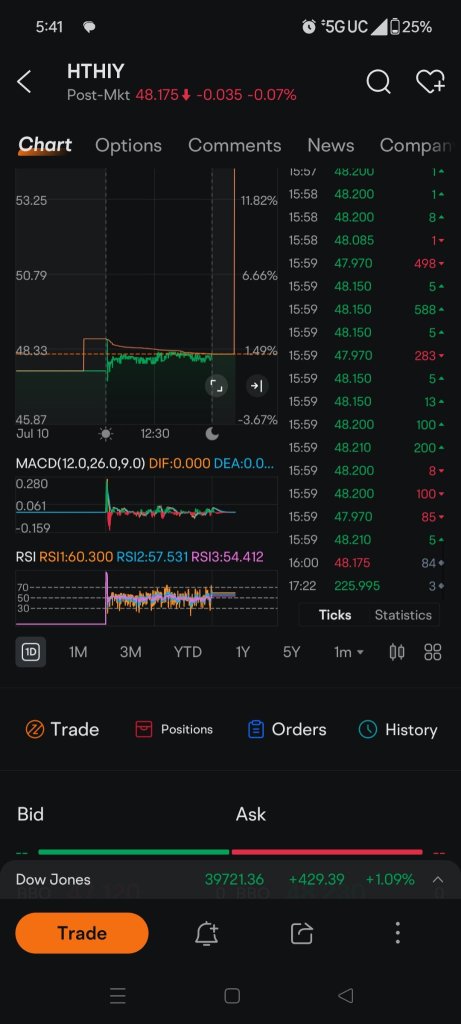

What's up with the ticker?

3 shares bought at 225 and the price jumps to 226 per Robinhood?

Monsta327 : Bro I bought this the other day because it pops up after hours. Nobody at Robinhood can explain why I can’t trade it after hours. Says it dosent trade after hours but that’s when it moves. Idk somebody smarter than me needs to help haha! I thought I found a slick one.

IDKWTFIMDOING OP Monsta327 : When I dug deeper, it has something to do with a trader overseas going through an American Depository or something like that. The rate hasn't been exchanged yet.