No Data

JDHMAIN JDH Futures(MAY5)

- 36.80

- 0.000.00%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

News

The market may reach a critical juncture in the short term, with Banks and Electrical Utilities showing repeated activity, and the Technology Sector poised to take off.

Track the entire lifecycle of the main Sector.

Direct coverage of the Star medical instruments industry collective Earnings Conference: Multiple companies are laying out AI medical Business, and key segments in innovation fields may accelerate the development of domestic production.

① Attending companies believe that tariff policies will bring some cost pressures and market challenges to enterprises, but at the same time, it has accelerated the localization process in relevant fields; ② Some attending companies disclosed the latest developments in their Business during the earnings briefing and the planning for related lines by 2025.

2024 Annual Report

[Brokerage Focus] Tianfeng maintains a "Buy" rating on JD HEALTH (06618), indicating that the e-commerce channel is becoming a core growth area for the outpatient Pharmaceutical retail market.

Jingwu Finance | Tianfeng Research indicates that the sales of Pharmaceuticals and health products are the core Business of JD HEALTH (06618), with continuous growth in business revenue. In 2024, the Sector's business revenue reached 48.796 billion yuan, a year-on-year increase of 6.88%, reaching a historical high. The number of active users continues to grow, with 2024's annual active users reaching 0.184 billion, an increase of over 11 million compared to 2023. The e-commerce channel is becoming the core growth driver of the off-site Pharmaceutical retail market. The bank points out that, according to Frost & Sullivan's estimates, the online consultation market in China will reach 155 billion yuan in 2024, and

Technology stocks are rebounding, while high-profile stocks are collectively "cooling down". The market may enter a critical period for switching between high and low performances.

Track the entire lifecycle of the main Sector.

Trump's softened stance towards China boosts Hong Kong stocks with two main lines! Leading fruit chain companies surged over 6%, and tech giants followed suit.

① How significant is the profit elasticity of Apple supply chain companies with respect to tariff exemptions? ② How do Institutions view the future performance of Technology stocks?

Comments

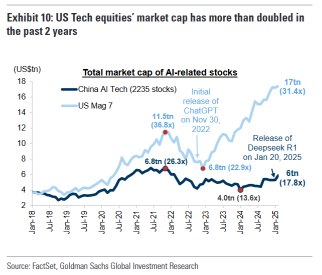

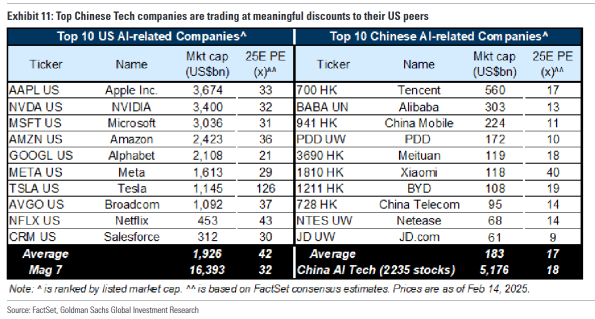

Wall Street banks have issued optimistic reports on Chinese tech stocks, signaling potential revaluation.

Goldman Sachs analyst Kinger Lau published a report titled “AI Changes the Ga...