No Data

OXY250425P26000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

Occidental Petroleum Options Spot-On: On May 2nd, 82,687 Contracts Were Traded, With 1.05 Million Open Interest

SA Asks: Which U.S. Energy Stocks, ETFs Are Most Attractive Right Now?

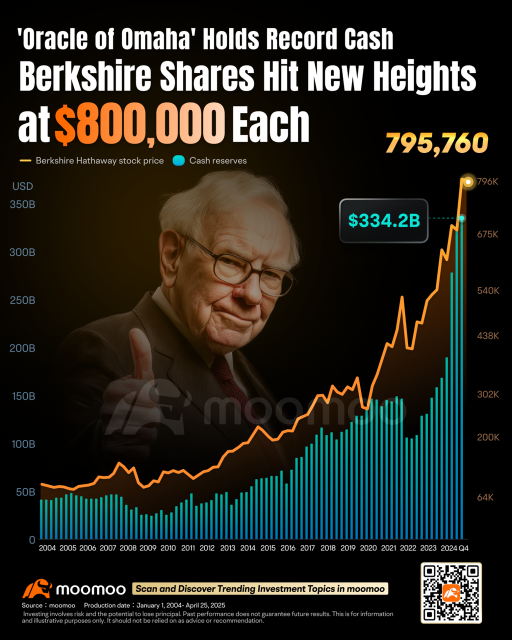

Buffett Poised to Take Center Stage Again at Berkshire Hathaway Annual Meeting

Oil prices plunged, but Exxon Mobil (XOM.US) Q1 performance met expectations, maintaining a commitment to a $20 billion Share Buyback.

Exxon Mobil achieved profit expectations due to increased output from low-cost projects. Despite the recent decline in crude oil prices, the company is still able to maintain its share buyback program. In the first quarter, the company repurchased shares worth $4.8 billion, consistent with its buyback pace aimed at $20 billion annually by 2026.

Investing Pros Haven't Been This Worried About the Stock Market in at Least 28 Years, Our Exclusive Poll Finds

Occidental Petroleum To Go Ex-Dividend On June 10th, 2025 With 0.24 USD Dividend Per Share

Comments

71426715 : Berkshire Hathaway's upcoming earnings release is set for Saturday, May 3, 2025, after market hours. Given the historical volatility surrounding earnings announcements, investors should be prepared for potential fluctuations. Here's a breakdown of what to consider¹:

- *Earnings History*: Berkshire Hathaway's Q4 2024 earnings report showed a strong beat, with actual EPS of $6.73 versus the consensus estimate of $4.43. Revenue also exceeded expectations, reaching $94.92 billion against an estimated $88.30 billion.

- *Stock Price Movement*: Historically, the stock price has shown significant volatility around earnings releases. The last earnings report resulted in a stronger-than-predicted stock price fluctuation of +4.11% compared to the predicted ±1.98%.

- *Current Market Performance*: As of April 30, 2025, Berkshire Hathaway's stock prices are as follows² ³:

- BRK.B: $534.57 (0.68% change)

- BRK.A: $801,340 (0.45% change)

Considering these factors, I'm cautiously optimistic about Berkshire Hathaway's earnings. The company's diversified portfolio, strong track record of beating earnings estimates, and resilient equity investments could contribute to a positive earnings surprise. However, investors should remain vigilant due to potential market volatility and closely monitor the stock's performance around the earnings announcement.

*Key Takeaways*:

- *Earnings Date*: May 3, 2025, after market hours

- *Potential Volatility*: Historically significant price fluctuations around earnings releases

- *Earnings Expectations*: Analysts estimate Q1 2025 EPS of $5.07, with potential for surprises given the company's track record⁴

sunwu79 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

101775147 AL pyen :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

101775147 AL pyen 71426715 : slow

skumaar42 : Great info!