No Data

US Stock MarketDetailed Quotes

POOL Pool Corp

- 306.690

- +10.340+3.49%

Close May 2 16:00 ET

- 306.690

- 0.0000.00%

Post 16:39 ET

11.53BMarket Cap28.72P/E (TTM)

307.130High298.174Low365.85KVolume299.020Open296.350Pre Close111.40MTurnover1.01%Turnover Ratio27.14P/E (Static)37.59MShares394.21552wk High9.31P/B11.12BFloat Cap284.27552wk Low4.80Dividend TTM36.27MShs Float560.081Historical High1.57%Div YieldTTM3.02%Amplitude0.714Historical Low304.493Avg Price1Lot Size

Full Hours

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Unit: --

Capital Trend

IntradayDayWeekMonth

No Data

News

How Is The Market Feeling About Pool?

Pool Corp To Go Ex-Dividend On May 15th, 2025 With 1.25 USD Dividend Per Share

Is Pool Corporation (POOL) the Best Buy-the-Dip Stock to Buy Now?

Pool Raises Quarterly Dividend to $1.25, Increases Share Buyback

Pool Corp Raises Qtr Dividend to $1.25 Vs. $1.20 >POOL

Pool Corp | 8-K: POOL CORPORATION ANNOUNCES AN INCREASE IN ITS SHARE REPURCHASE PROGRAM, GROWTH OF ITS QUARTERLY CASH DIVIDEND AND 2025 ANNUAL MEETING OF STOCKHOLDERS VOTING RESULTS

Comments

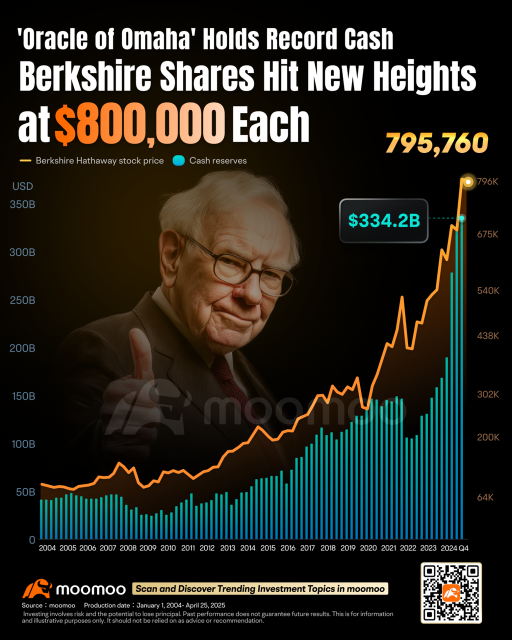

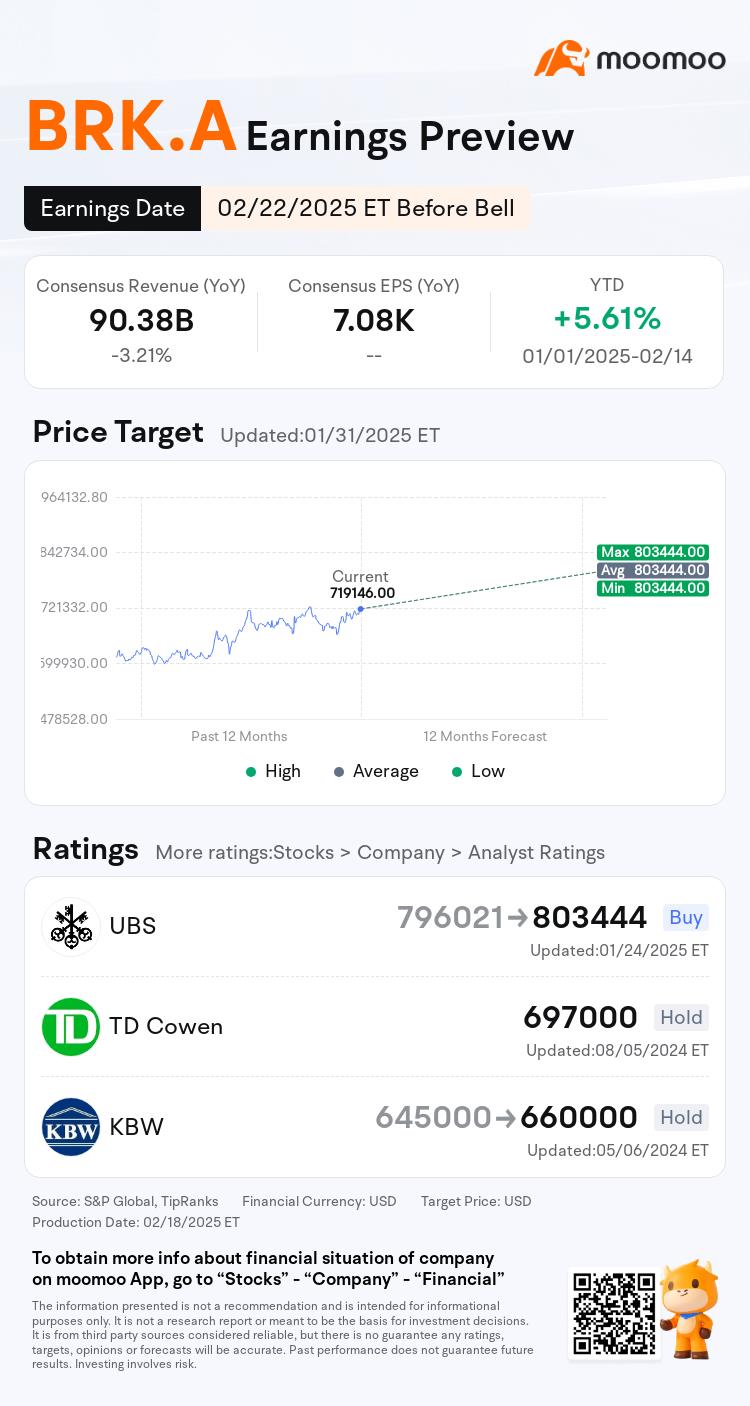

$Berkshire Hathaway-B (BRK.B.US)$is about to release its Q1 2025 earnings. According to Zacks data, analysts expect the earnings per share (EPS) to be $4.81, which is a 7.32% decrease from the same period last year. The revenue is projected to be $92.21 billion, showing a 2.6% increase YoY. The average target price set by analysts is $557, while the current share price is $534.57. Based on the analysts' forecasts, this implies...

+5

41

5

22

As a diversified financial holding company, $Berkshire Hathaway-B (BRK.B.US)$'s business spans a variety of commercial activities, including insurance and reinsurance, utilities and energy, freight railroads, manufacturing services, and retail. Serving as a benchmark in the global investment community, its quarterly earnings report is highly anticipated. As of February 19, BRK's shares have risen by 6.6% since the beginning of the yea...

+3

34

12

$Pool Corp (POOL.US)$ LOL I know exactly why Buffett bought this recently, iykyk

1

2

Investing in Domino’s Pizza $Domino's Pizza (DPZ.US)$ and Pool Corp. $Pool Corp (POOL.US)$ requires strategic thinking and a little inspiration from the great Warren Buffett, whose philosophy revolves around finding businesses with moats 🏰, solid growth, and shareholder value. Let me share how Moomoo Desktop makes this journey easier and more engaging for investors like you! 🚀💻

1️⃣ Domino’s Pi...

1️⃣ Domino’s Pi...

20

Berkshire Hathaway’s most recent portfolio update, based on filings as of Q3 2024, reveals several key holdings and recent changes:

Top Holdings:

1. $Apple (AAPL.US)$ 26.2% of the portfolio, valued at $69.9 billion. Despite recent trimming of the stake, Apple remains the largest holding.

2. $American Express (AXP.US)$ 15.4%, valued at $41.1 billion.

3. $Bank of America (BAC.US)$ 11.9%, worth $31.7 billion, though the stake was reduced by 23% in Q3.

4. $Coca-Cola (KO.US)$ 10.8%, va...

Top Holdings:

1. $Apple (AAPL.US)$ 26.2% of the portfolio, valued at $69.9 billion. Despite recent trimming of the stake, Apple remains the largest holding.

2. $American Express (AXP.US)$ 15.4%, valued at $41.1 billion.

3. $Bank of America (BAC.US)$ 11.9%, worth $31.7 billion, though the stake was reduced by 23% in Q3.

4. $Coca-Cola (KO.US)$ 10.8%, va...

17

3

13

Read more

71426715 : Berkshire Hathaway's upcoming earnings release is set for Saturday, May 3, 2025, after market hours. Given the historical volatility surrounding earnings announcements, investors should be prepared for potential fluctuations. Here's a breakdown of what to consider¹:

- *Earnings History*: Berkshire Hathaway's Q4 2024 earnings report showed a strong beat, with actual EPS of $6.73 versus the consensus estimate of $4.43. Revenue also exceeded expectations, reaching $94.92 billion against an estimated $88.30 billion.

- *Stock Price Movement*: Historically, the stock price has shown significant volatility around earnings releases. The last earnings report resulted in a stronger-than-predicted stock price fluctuation of +4.11% compared to the predicted ±1.98%.

- *Current Market Performance*: As of April 30, 2025, Berkshire Hathaway's stock prices are as follows² ³:

- BRK.B: $534.57 (0.68% change)

- BRK.A: $801,340 (0.45% change)

Considering these factors, I'm cautiously optimistic about Berkshire Hathaway's earnings. The company's diversified portfolio, strong track record of beating earnings estimates, and resilient equity investments could contribute to a positive earnings surprise. However, investors should remain vigilant due to potential market volatility and closely monitor the stock's performance around the earnings announcement.

*Key Takeaways*:

- *Earnings Date*: May 3, 2025, after market hours

- *Potential Volatility*: Historically significant price fluctuations around earnings releases

- *Earnings Expectations*: Analysts estimate Q1 2025 EPS of $5.07, with potential for surprises given the company's track record⁴

sunwu79 :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

101775147 AL pyen :![undefined [undefined]](https://static.moomoo.com/nnq/emoji/static/image/default/default-black.png?imageMogr2/thumbnail/36x36)

101775147 AL pyen 71426715 : slow

skumaar42 : Great info!