No Data

SCHO250516C52000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

Federal Reserve Watch for May 12: Tariffs Effects Could Be 'Significant,' Kugler Says

US Treasury April Budget Slightly Larger Than Expected, Wider Than Year Ago

Short-End U.S. Treasurys Lead Rise in Yields -- Market Talk

Treasury Yields Soar as U.S. and China Agree to Slash Tariffs

A major reversal in expectations for the bond market! Options Trading traders are increasing bets on the possibility that the Federal Reserve will not cut interest rates at all this year.

Options traders are aggressively establishing hedge positions to guard against the risk that the Federal Reserve may not ease MMF this year, with one increasingly growing position predicting that the Federal Reserve will not cut interest rates in 2025.

Trump's "major concern": the stock market has returned, but the Bonds have not.

The S&P 500 Index has returned to the level before the tariff shock in April, but the yield on the 10-year US Treasury bond is still above the average level of 4.156% before the tariff announcement in April. Uncertainties such as tariff policy, fiscal outlook, and the White House's criticism of the Federal Reserve's interest rate policy have intensified pressure in the bond market.

Comments

if there is refund, how to claim for it?

Monthly income

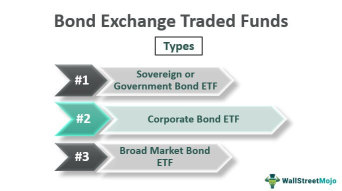

Bond ETFs hold assets with different maturity dates. So, at any given time, some bonds in the portfolio may be due for a coupon payment. For this reason, bond ETFs pay interest each month, with the value of the coupon varying from month to month.

Interest rate risk

Since a bond ETF never matures, there isn't a guarantee the principal will be repaid in full. Furthermore, when interest rates rise, it tends to harm the price of the ETF, lik...

Moomoo Buddy : Dear valued customer, regarding this question, we are still checking with our relevant department, we will follow up to you tomorrow. Have a good day!

Moomoo Buddy : Dear valued customer, as advise by custodian that the 1042-S Income Code listed on DTC for SCHO (808524862) is 06 (Dividends paid by US corporations - general). This indicates that the allocation is subject to withholding. Have a nice day!