No Data

SHY250516C92000

- 0.00

- 0.000.00%

- 5D

- Daily

No Data

News

A major reversal in expectations for the bond market! Options Trading traders are increasing bets on the possibility that the Federal Reserve will not cut interest rates at all this year.

Options traders are aggressively establishing hedge positions to guard against the risk that the Federal Reserve may not ease MMF this year, with one increasingly growing position predicting that the Federal Reserve will not cut interest rates in 2025.

Trump's "major concern": the stock market has returned, but the Bonds have not.

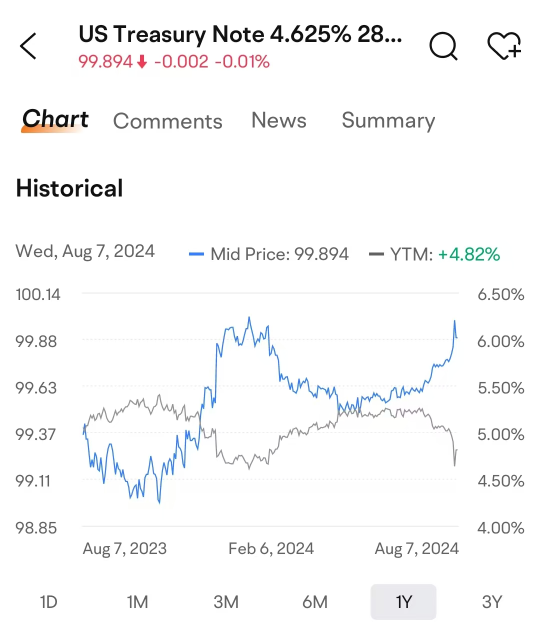

The S&P 500 Index has returned to the level before the tariff shock in April, but the yield on the 10-year US Treasury bond is still above the average level of 4.156% before the tariff announcement in April. Uncertainties such as tariff policy, fiscal outlook, and the White House's criticism of the Federal Reserve's interest rate policy have intensified pressure in the bond market.

The USA Congressional Budget Office is "worried": the turmoil in tariffs will weaken the attractiveness of American Assets.

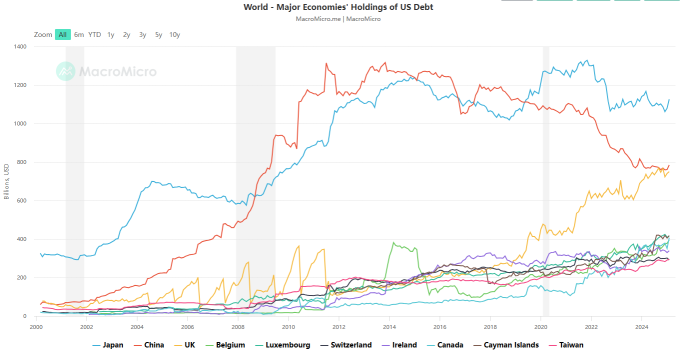

① The Director of the USA Congressional Budget Office (CBO), PHILLIP MM US$D Swagel, warned that the turmoil on Wall Street triggered by the Trump trade war could become a "critical point" that alters foreign investors' willingness to Hold USA Assets; ② He stated, "We are working to assess whether Global investors will develop lasting hesitation when examining the USA in the future."

Evercore ISI: The bear market in the U.S. stock market has ended, and a "marathon-style" bull market is expected under the shadow of tariffs.

The investment bank Evercore ISI pointed out that the latest market rebound marks the end of the bear market in 2025, but unlike in the past, this bull market will not accompany sharp rises, but will instead show a slow and volatile advance.

Tariff "stirring" intensifies the differentiation of U.S. bond yields, making it harder for the Federal Reserve to cut interest rates!

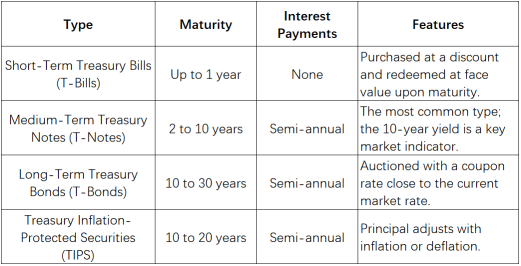

Short-term Treasury yield has decreased due to the market's expectations for the Federal Reserve to cut interest rates, however, the long-term Treasury yield, which is a key benchmark for economic financing costs, has instead risen. This suggests that even if the Federal Reserve lowers interest rates, long-term borrowing costs may remain high, weakening the effectiveness of rate cuts in stimulating the economy and increasing the difficulty of achieving a soft landing.

Upcoming important schedule next week: USA CPI, retail data, Powell's speech, China's social financing, Tencent, Alibaba, and JD.com Earnings Reports.

In addition, the fourth round of indirect talks between Iran and the USA will take place on the 11th. Putin proposed to resume direct negotiations between Russia and Ukraine on May 15. China's financial data will be released irregularly in April. The Eurozone will announce its first-quarter GDP, and the American consumer giant Walmart will release its Q1 Earnings Reports. President Trump will visit Saudi Arabia, Qatar, and the United Arab Emirates.

Comments

U.S. Treasury bonds are issued by the U.S. government to borrow money from the market, promising repayment of princip...

Data is as of August 8 and is for illustrative purposes only and does not constitute any investment advice or guarantee.

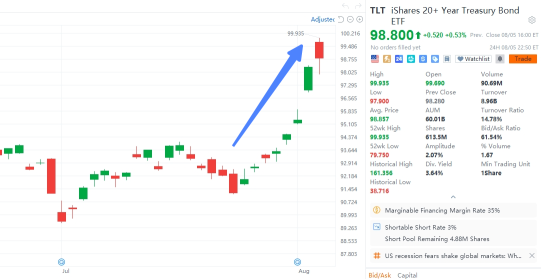

Why did bonds attract investment while stocks were falling? Bonds benefi...

MultiBaggers : KNNBCCB Donald Trump !

mujah Bin Hj yakob : Good master CEO