No Data

SPXW250421P5190000

- 31.10

- 0.000.00%

- 5D

- Daily

News

Alphabet Leaps Over Nvidia, Tesla in Top Stock Options as AI Threatens Search Revenue: Options Chatter

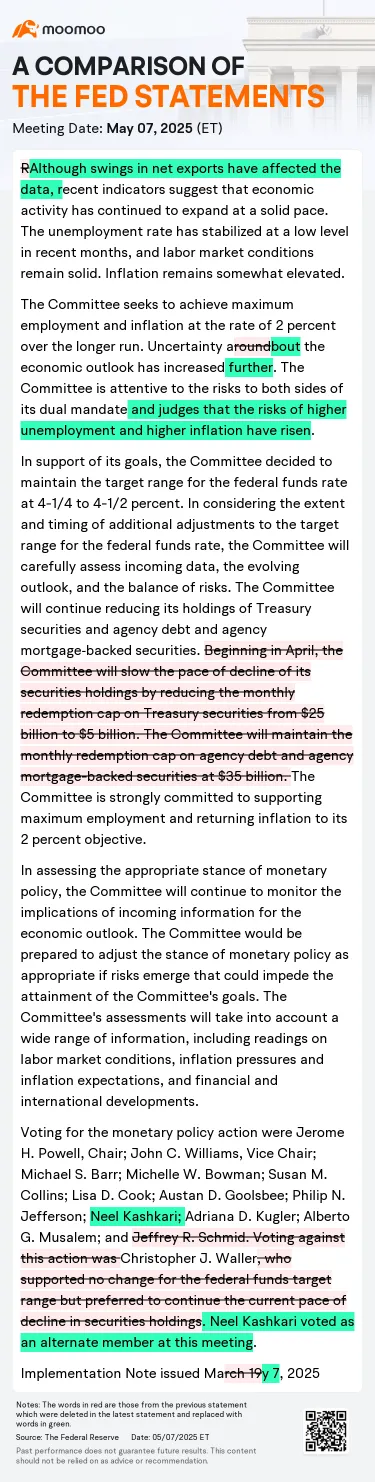

FOMC Keeps Fed Funds Rate Steady, Citing Rising Risks of Unemployment, Inflation

U.S. stocks closed with the three major Indexes fluctuating higher, with Google plummeting more than 7%. The Bullish support from the AI Chip helped NVIDIA.

① Apple is promoting a shift to AI search for Safari, causing Google's stock price to fall over 7%; ② Disney's stock price skyrocketed nearly 11%, with the company's second fiscal quarter profits exceeding expectations; ③ NVIDIA rose over 3%, with reports that the USA is considering lifting AI Chip export restrictions.

S&P 500 Global Sectors ranking: Semiconductors, related manufacturing equipment, durable consumer goods, and Clothing increased.

Closing price Compared to the previous day S&P 500 5631.28 +0.43% ■ Top rising categories Semiconductors and related manufacturing equipment 5093.67 +2.70% Durable consumer goods and Clothing 334.86 +1.68% Retail 4623.67 +1.43% Health Care equipment and services 1952.89 +0.91% Various financials 1420.83 +0.85% ■ Top falling category Broadcasting 1318.59

U.S. Stocks Rise After Fed Holds Rates Steady Again -- Market Talk

Trump Rules Out Scaling Back Tariffs to Jump Start China Trade Talks

Comments

The $Dow Jones Industrial Average (.DJI.US)$ gained 284.97 points (0.7%), while the $S&P 500 Index (.SPX.US)$ added 24.37 ticks (0.4%) to 5,631.28. The $Nasdaq Composite Index (.IXIC.US)$ rose the least in...

"Uncertainty about the economic outlook has increased further," policymakers said in a statement released at the end of its two-day meeting Wednesday afternoon. "The Committee is attentive to the risks to both sides of its dual mandate a...

Expand

Expand

bullbearnme : If the Federal Reservedoes not cutinterest rates at its current meeting, the U.S. stock market could face several potential impacts:

Negative Effects on the Stock Market:Higher Borrowing Costs for Companies:

Companies will continue to face elevated borrowing costs, which can reduce profit margins.

This may lead to lower corporate earnings, potentially depressing stock prices, especially in capital-intensive sectors like real estate, utilities, and manufacturing.

Slower Economic Growth:

High interest rates can dampen consumer spending and business investment, slowing economic growth.

This typically reduces overall corporate revenues, leading to lower stock valuations.

Market Volatility and Sell-Offs:

Investors who were expecting a rate cut may adjust their portfolios, potentially leading to a market correction.

Growth-oriented and tech stocks, which are particularly sensitive to interest rates, might experience sharper declines.

Stronger U.S. Dollar:

Higher interest rates tend to strengthen the U.S. dollar, which can hurt multinational companies by reducing the value of overseas earnings when converted back to dollars.

This can weigh on the stock prices of companies with significant international exposure.

Positive Effects (Possible but Limited):Support for Financial Sector:

Banks and financial institutions might benefit from higher interest rates as they can charge more for loans.

This can boost the profitability of banks, potentially supporting their stock prices.

Reduced Inflation Pressures:

Steady rates could help keep inflation in check, preserving purchasing power and potentially boosting consumer confidence over the long term.

Long-Term Market Stability:

A cautious Fed approach might reduce the risk of financial instability, supporting long-term market confidence.

Historical Context and Market Sentiment:TheS&P 500andNASDAQhave historically reacted negatively to prolonged periods of high interest rates due to compressed profit margins and reduced risk appetite.

affable Blobfish_403 : What does a strong rally in the closing period mean? Who has such great power?