US OptionsDetailed Quotes

SPXW250505P5425000

- 0.03

- 0.000.00%

15min DelayClose May 7 17:00 ET

0.00High0.00Low

0.03Open0.03Pre Close0 Volume1.56K Open Interest5425.00Strike Price0.00Turnover958.35%IV3.66%PremiumMay 5, 2025Expiry Date0.00Intrinsic Value100Multiplier-1DDays to Expiry0.03Extrinsic Value100Contract SizeEuropeanOptions Type-0.0014Delta0.0001Gamma187709.33Leverage Ratio-233.5004Theta0.0000Rho-256.64Eff Leverage0.0004Vega

S&P 500 Index Stock Discussion

The Dow industrials, S&P 500 and Nasdaq Composite all ended slightly higher Wednesday even though the Federal Reserve left interest rates unchanged and hinted at possible "stagflation" risks to the U.S. economy.

The $Dow Jones Industrial Average (.DJI.US)$ gained 284.97 points (0.7%), while the $S&P 500 Index (.SPX.US)$ added 24.37 ticks (0.4%) to 5,631.28. The $Nasdaq Composite Index (.IXIC.US)$ rose the least in...

The $Dow Jones Industrial Average (.DJI.US)$ gained 284.97 points (0.7%), while the $S&P 500 Index (.SPX.US)$ added 24.37 ticks (0.4%) to 5,631.28. The $Nasdaq Composite Index (.IXIC.US)$ rose the least in...

7

2

3

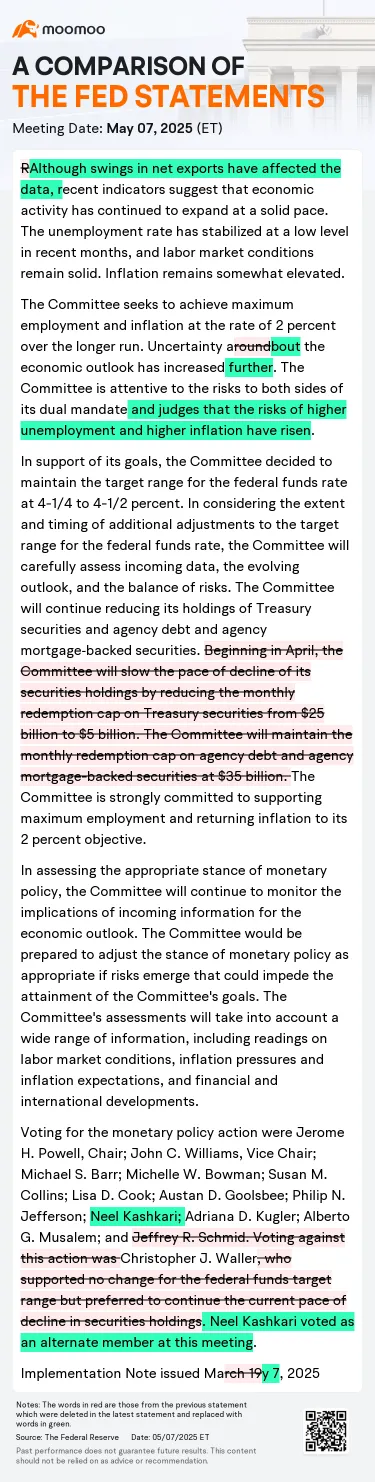

The Federal Open Market Committee kept the target fed funds rate steady at its current level of at of 4.25% to 4.5%, citing rising risks of unemployment and accelerating inflation.

"Uncertainty about the economic outlook has increased further," policymakers said in a statement released at the end of its two-day meeting Wednesday afternoon. "The Committee is attentive to the risks to both sides of its dual mandate a...

"Uncertainty about the economic outlook has increased further," policymakers said in a statement released at the end of its two-day meeting Wednesday afternoon. "The Committee is attentive to the risks to both sides of its dual mandate a...

Expand

Expand 25

7

13

Market Wrap – Wednesday, May 7

Anticipation is high as Wall Street holds its breath ahead of the FOMC rate decision. While the broader market edged cautiously higher, the Magnificent 7 delivered a split performance as investors positioned themselves for potential monetary policy signals.

Winners:

• AMZN $Amazon (AMZN.US)$ +1.64% and META $Meta Platforms (META.US)$+1.30% led the pack, showing resilience in consumer and tech sectors.

• NVDA $NVIDIA (NVDA.US)$...

Anticipation is high as Wall Street holds its breath ahead of the FOMC rate decision. While the broader market edged cautiously higher, the Magnificent 7 delivered a split performance as investors positioned themselves for potential monetary policy signals.

Winners:

• AMZN $Amazon (AMZN.US)$ +1.64% and META $Meta Platforms (META.US)$+1.30% led the pack, showing resilience in consumer and tech sectors.

• NVDA $NVIDIA (NVDA.US)$...

3

The Fed will be announcing its latest monetary policy decision at 2am SG times

The market expects the Fed to hold the rate at current level.

What’s gonna the market is Jerome Powell's post-decision press conference. Wall Street will be looking for insights on where the interest rates could go moving forward.

This event comes after Trump has been pressing for a rate cut a few weeks ago

Let’s see how hawkish Powell is.

$Dow Jones Industrial Average (.DJI.US)$ $SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Invesco QQQ Trust (QQQ.US)$ $Tesla (TSLA.US)$ $NVIDIA (NVDA.US)$ $Alphabet-C (GOOG.US)$ $Meta Platforms (META.US)$ $Microsoft (MSFT.US)$ $Palantir (PLTR.US)$ $Apple (AAPL.US)$ $Amazon (AMZN.US)$ $Bitcoin (BTC.CC)$

The market expects the Fed to hold the rate at current level.

What’s gonna the market is Jerome Powell's post-decision press conference. Wall Street will be looking for insights on where the interest rates could go moving forward.

This event comes after Trump has been pressing for a rate cut a few weeks ago

Let’s see how hawkish Powell is.

$Dow Jones Industrial Average (.DJI.US)$ $SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Invesco QQQ Trust (QQQ.US)$ $Tesla (TSLA.US)$ $NVIDIA (NVDA.US)$ $Alphabet-C (GOOG.US)$ $Meta Platforms (META.US)$ $Microsoft (MSFT.US)$ $Palantir (PLTR.US)$ $Apple (AAPL.US)$ $Amazon (AMZN.US)$ $Bitcoin (BTC.CC)$

From YouTube

13

4

No comment yet

bullbearnme : If the Federal Reservedoes not cutinterest rates at its current meeting, the U.S. stock market could face several potential impacts:

Negative Effects on the Stock Market:Higher Borrowing Costs for Companies:

Companies will continue to face elevated borrowing costs, which can reduce profit margins.

This may lead to lower corporate earnings, potentially depressing stock prices, especially in capital-intensive sectors like real estate, utilities, and manufacturing.

Slower Economic Growth:

High interest rates can dampen consumer spending and business investment, slowing economic growth.

This typically reduces overall corporate revenues, leading to lower stock valuations.

Market Volatility and Sell-Offs:

Investors who were expecting a rate cut may adjust their portfolios, potentially leading to a market correction.

Growth-oriented and tech stocks, which are particularly sensitive to interest rates, might experience sharper declines.

Stronger U.S. Dollar:

Higher interest rates tend to strengthen the U.S. dollar, which can hurt multinational companies by reducing the value of overseas earnings when converted back to dollars.

This can weigh on the stock prices of companies with significant international exposure.

Positive Effects (Possible but Limited):Support for Financial Sector:

Banks and financial institutions might benefit from higher interest rates as they can charge more for loans.

This can boost the profitability of banks, potentially supporting their stock prices.

Reduced Inflation Pressures:

Steady rates could help keep inflation in check, preserving purchasing power and potentially boosting consumer confidence over the long term.

Long-Term Market Stability:

A cautious Fed approach might reduce the risk of financial instability, supporting long-term market confidence.

Historical Context and Market Sentiment:TheS&P 500andNASDAQhave historically reacted negatively to prolonged periods of high interest rates due to compressed profit margins and reduced risk appetite.

affable Blobfish_403 : What does a strong rally in the closing period mean? Who has such great power?