US OptionsDetailed Quotes

SPY250507C320000

- 0.00

- 0.000.00%

15min DelayClose May 9 09:30 ET

0.00High0.00Low

0.00Open0.00Pre Close0 Volume0 Open Interest320.00Strike Price0.00Turnover7648.04%IV-43.30%PremiumMay 7, 2025Expiry Date244.34Intrinsic Value100Multiplier-3DDays to Expiry0.00Extrinsic Value100Contract SizeAmericanOptions Type0.9947Delta0.0001Gamma--Leverage Ratio-262.3098Theta0.0000Rho0.00Eff Leverage0.0003Vega

SPDR S&P 500 ETF Stock Discussion

Heard about people talking about options trading? Wonder what’s options?

If you’re new to the options world, it will be best to learn the basics before you start trading options

$NVIDIA (NVDA.US)$ $Tesla (TSLA.US)$ $SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Invesco QQQ Trust (QQQ.US)$ $Palantir (PLTR.US)$ $Apple (AAPL.US)$ $Meta Platforms (META.US)$

If you’re new to the options world, it will be best to learn the basics before you start trading options

$NVIDIA (NVDA.US)$ $Tesla (TSLA.US)$ $SPDR S&P 500 ETF (SPY.US)$ $S&P 500 Index (.SPX.US)$ $Invesco QQQ Trust (QQQ.US)$ $Palantir (PLTR.US)$ $Apple (AAPL.US)$ $Meta Platforms (META.US)$

From YouTube

2

2

1

$SPDR S&P 500 ETF (SPY.US)$

The trade war is having a catastrophic impact on China's already struggling economy. US companies are leaving the country and relocating to other low-cost-labor countries, such as India and South Korea. But how will this affect US consumers, at least in the short-term?

The trade war is having a catastrophic impact on China's already struggling economy. US companies are leaving the country and relocating to other low-cost-labor countries, such as India and South Korea. But how will this affect US consumers, at least in the short-term?

From YouTube

2

5

$SPDR S&P 500 ETF (SPY.US)$ Mind games lol. Several sources said US may cut tariffs to 50-60% while Trump posted “80% seems right”.. so that when he turn it down to 50% on Mon, he can call it a BIG WIN ![]()

1

3

Any recommendations for non-US ETFs with quarterly dividends? Thinking about diversifying my ETF profile.

1

$SPDR S&P 500 ETF (SPY.US)$ Apple is already paving the way. This week's mid-term bear market peak is here. It's time to escape.

$SPDR S&P 500 ETF (SPY.US)$ headed between 572-590 next week. rip all your puts

3

1

$NVIDIA (NVDA.US)$ $Advanced Micro Devices (AMD.US)$

$SPDR S&P 500 ETF (SPY.US)$

Nvidia leads with 90% of market share

"As of 2025, the market share for AI GPUs is largely dominated by NVIDIA, with AMD gradually gaining traction. Here's a breakdown of the current market share based on the most widely used AI GPU solutions in data centers and machine learning:

1. NVIDIA AI GPU Market Share (2025)

Estimated Market Share: ~85%–90%

Key Factors: NVIDIA remains the dominant player...

$SPDR S&P 500 ETF (SPY.US)$

Nvidia leads with 90% of market share

"As of 2025, the market share for AI GPUs is largely dominated by NVIDIA, with AMD gradually gaining traction. Here's a breakdown of the current market share based on the most widely used AI GPU solutions in data centers and machine learning:

1. NVIDIA AI GPU Market Share (2025)

Estimated Market Share: ~85%–90%

Key Factors: NVIDIA remains the dominant player...

+4

5

1

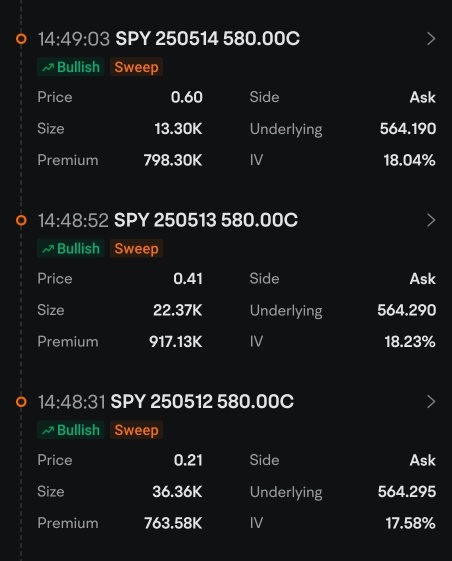

$SPDR S&P 500 ETF (SPY.US)$

Humm... Seems like a lot of money to be gamble, more like somebody knows something about a certain meeting happening.

Humm... Seems like a lot of money to be gamble, more like somebody knows something about a certain meeting happening.

8

No comment yet

Mr Long Kok : just learn from Togi

_Giggity_ Mr Long Kok : Ttooggiiii togerson