No Data

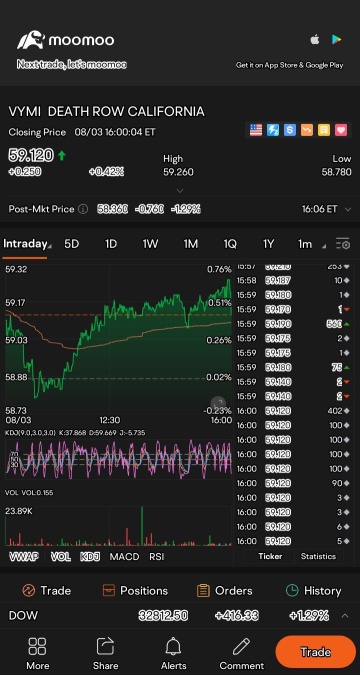

VYMI Vanguard International High Dividend Yield Etf

- 76.200

- -0.240-0.31%

- 5D

- Daily

- Weekly

- Monthly

- 1Q

- 1Y

Trade Overview

Capital Trend

No Data

News

Yamazaki Baking, Nomura Real Estate HD ETC (additional) Rating

Upgraded - Bullish Code Stock Name Securities Company Previous Change After -------------------------------------------------------- <7731> NIKON CORP SPONS Macquarie "Neutral" "Outperform" Downgraded - Bearish Code Stock Name Securities Company Previous Change After -------------------------------------------------------- <4205> Zeon SMBC Nikko "

SBI securities (before the close) has a strong Sell on Toyota Motor, and a strong Buy on Mitsubishi Heavy Industries.

Sell Code Stock Name Trading Amount (7012) Kawasaki Heavy Industries 28,059,227,720 (7011) Mitsubishi Heavy Industries 21,218,923,493 (1570) NEXT FUNDS Nikkei Average Leverage Listed Investment Trust 19,909,274,385 (6146) Disco 16,961,081,650 (5803) Fujikura 16,025,776,830 (7013) IHI 12,125,

Toyota, Chiyoda Corporation, etc. [List of stock materials from the newspaper]

*Toyota Motor Corporation <7203> projects an operating profit of 3.8 trillion yen for the fiscal year, burdened by U.S. tariffs and a strong yen (Nikkan Kogyo, page 1) -○*Nidec Corporation Sponsored ADR <6594> withdraws its tender offer, fearing losses due to countermeasures from Makino (Nikkan Kogyo, page 1) -○*Shibaura Electronics <6957> raises to 6200 yen, Shibaura Electronics' tender offer exceeds Minebea (Nikkan Kogyo, page 3) -○*JUKI <6440> supports sewing and industrial IoT, improving factory productivity (Nikkan Kogyo, page 3) -○*Chiyoda Corporation <6366> average net profit of 15 billion yen, three-year medium-term plan,

Chinese Tech Earnings Season Kicks Off: Will JD.com, Tencent, or Alibaba Lead the Rally?

SBI Certificate (Nittsu) Super Sell, Toyota Motor Super Buy.

Sell Code Stock Name Trading Value (6146) Disco 43,529,889,950 (7011) Mitsubishi Heavy Industries 43,100,477,039 (7012) Kawasaki Heavy Industries 38,799,662,290 (5803) Fujikura 37,384,413,114 (7013) IHI 29,731,588,400 (1570) NEXT FUNDS Nikkei Average Leverage Listed ETF 24,28

Kao, Mitsubishi Motors, NINTENDO CO LTD, SoftBank (8th)

※The above Calendar is merely a schedule and may be subject to change due to corporate circumstances. --------------------------------------- May 8 (Thursday) <1382> Hobe <1768> Soneck <1869> Meiko Construction <2009> Torigoe Flour <2060> Feed One <2136> Hip <2206> Glico <2226> Koikeya <2326> Digiar.

Comments

Taking the SPDR S&P Dividend ETF as an example, this fund tracks the S&P High Dividend Aristocrats Index, which gathers a group o...

US based: SCHD, VYM, VIG, DGRO, DGRW

International: SCHY, VIGI, VYMI, IGRO

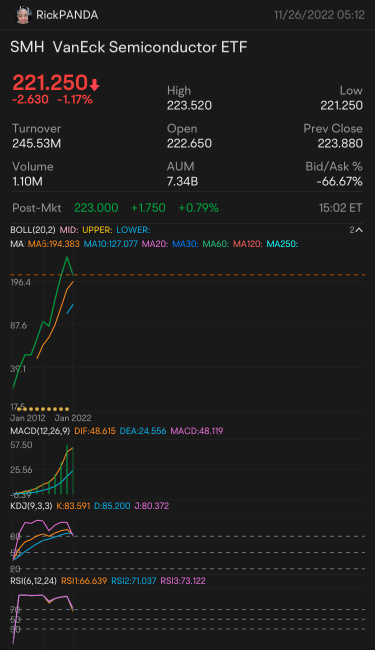

PCT (Pandas Coffee Talk): today bullshits me PANDA is going to talk on how me is going to invest main bulk of coming Dec2022 GST Voucher. The amounts is about 630.00SGD after -10% Anglican Church Tithes.

Note: this is outdated not 100% updated post. But principles are still valid and guide my investments styles. Most important is all governments will tax a ticker heavily if that ticker is only super hype. So principles of cross s...

102159783 : why schd still drop while another ef up