Common Tax FAQs

Q1: Why didn’t I receive a tax statement?

A1: There are two reasons why a tax statement hasn’t been received.

1. The total amount of reportable income for the year, does not meet the minimum reporting thresholds (see below):

● 1099-B: All amounts are reportable

● 1099-INT: A total of at least $10 in reportable interest for line 1, 3 or 8

● 1099-DIV: At least $10 in dividends (including capital gains dividends and exempt-interest dividends) or other distribution on stock

2. The account is currently on holdback, as there are additional adjustments needed, and will be available no later than March 14, 2025.

Q2: Why is the cost basis on my 1099-B different that what is shown in the system?

A2: The 1099-B shows the actual cost to purchase the security using the FIFO methodology (First In First Out), along with any wash sale and return of capital adjustments. The app shows the average or distilled cost, which are not approved methodologies to the IRS.

Q3: Why did I receive 2 separate 1099-DIV forms?

A3: There was a change in brokerage accounts from Interactive Brokers to Futu Clearing Inc. One 1099-DIV is for dividends earned while the account was held at Interactive Brokers and another for the remainder of the year for dividends earned while the account was held at Futu Clearing Inc.

Q4: Why did I receive both a 1099 and a 1042-S?

A4: During the year there was a change in tax status from W8 to W9 or vice versa. The 1042-S is for the income subject to withholding for the portion of the year where the W8 was applicable. The 1099 is for the income earned for the portion of the year after the W9 was applicable.

Q5: Who do I contact with questions about the 1099 or 1042-S?

A5: Please contact the Customer Service team who can assist, and any additional 1099 / 1042-S or tax questions can be directed to the tax mailbox at tax@us.moomoo.com. Questions about how to file or where information is reported on tax forms are considered tax advice, which we are not licensed to provide.

Q6: How do I update incorrect cost basis on the 1099-B for a sale?

A6: If the cost basis is incorrect on the 1099-B, please email the tax department at tax@us.moomoo.com. In the email, specifically state which sales on the 1099-B have incorrect cost basis and include supporting documentation showing the correct cost. Supporting documentation can be a trade confirmation, a monthly statement or some other official documentation showing the correct cost basis. Handwritten notes, word documents and spreadsheets will not be accepted as a form of official documentation. Once received, if the documentation supports a cost basis change, the cost basis will be updated and a corrected 1099 will be generated/available in the next wave (if before March 14,2025), or the following week (if after March 14, 2025).

Q7: I haven’t received my tax statement, do you know when I can expect it?

A7: There are two reasons why a tax statement hasn’t been received.

1. The total amount of reportable income for the year, does not meet the minimum reporting thresholds (see below):

● 1099-B: All amounts are reportable

● 1099-INT: A total of at least $10 in reportable interest for line 1, 3 or 8

● 1099-DIV: At least $10 in dividends (including capital gains dividends and exempt-interest dividends) or other distribution on stock

2. The account is currently on holdback, as there are additional adjustments needed, and will be available no later than March 14, 2025.

Q8: Why is my tax statement showing foreign tax paid?

A8: When the issuer of a security and the bank/client are in different countries, foreign tax may be assessed. Please consult a tax adviser on how to report foreign tax paid.

Q9: I received two tax forms. Which one is valid?

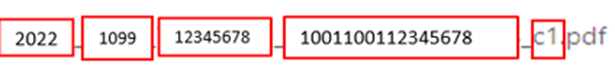

A9: It depends on which forms were received. If a corrected statement was received, the correction is the new and correct statement. The corrected statement will have _c1 or_c2 at the end of the listed account number. The highest number is the most recent.

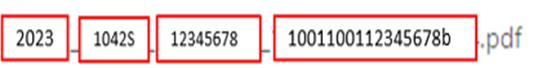

If the client received 2 tax statements (not a correction but 2 separate statements), and one of the two has a B at the end of the account number, both tax forms are valid. At this time, there is no way to combine the tax statements.

Q10: How do I report the information received on my tax statement?

A10: This is considered tax advise, which we are not licensed to provide. Any requests dealing with how to file or how to report information from the tax statement is considered tax advise. For these requests, please consult with a tax professional on how to report. We can only assist with what is reflected on the tax statement.

Q11: My account is currently closed, and I have not received my tax statement. How can I access my tax statement if I no longer have access online?

A11: All tax statements for closed accounts will be physically mailed to the address on file no later than March 14, 2025. If the last address on file is incorrect, please contact us by phone (see below) or email cs@us.moomoo.com.

Phone number is: +1-888-721-0610(English), +1-888-721-0660(Chinese)

Phone support is available: Monday-Friday, 08:30 a.m. – 04:30 p.m. Eastern Time (Closed on weekends and public holidays).

When emailing the address modification request, please include supporting documentation. Supporting documentation includes: a copy of a utility bill, mortgage statement, leasing agreement, a bank statement or state provided identification with the current address (the new address), etc.

Q12: My tax statement has payments from 2025 and the tax form should only reflect transactions from 2024. How do I get this corrected?

A12: The tax statement is correct. These are constructive receipt dividend payments which are dividends that are reportable for one tax year (2024) but paid at the beginning of the following tax year (2025).

Q13: My account is closed, but I no longer live at the last address on file. What do I need to provide to update my address and have a tax statement sent to my current residence?

A13: Provide a copy of a utility bill, mortgage statement, leasing agreement, a bank statement or state provided identification with the current address (the new address) and the account can be updated to reflect the new address and the statement can be sent. For compliance reasons, the tax statement can never be emailed, and will only be mailed for closed accounts.

Q14: I never received the money shown in the Miscellaneous section. Why are you reporting this and how do I get that money?

A14: Promotional/free shares were received during the year and this amount reflects the fair market value of the shares received. The date shown is the date the shares were received in the account and the amount reported is the value of the shares received.

Q15: Why is the Net gain/loss on my 1099 tax statement different than the amount shown for my cash balances or P/L in the app?

A15: The tax statement may not match the cash balances or P/L figures listed in the app. P/L figures are calculated using a different set of factors (see formula below) that are not reflected on the tax statement. The tax statement only shows the actual gain/loss based on the buys and sales for that tax year only. It does not reflect cash movement, or changes in market value.

The formula used to calculate the gain/loss on the tax statement is as follows:

Gross Proceeds - Cost Basis + Wash Sale Loss Disallowed = Net Gain/Loss

Example: 22,876,466.66 - 24,545,623.08 + 1,709,188.34 = 40,031.92

Total P/L = Market value + Total cash inflow-Total cash outflow-Transaction fee

Market value: equal to the number of positions multiplied by the closing price at the end of the period.

Total cash inflow: including the stock sell execution amount, dividends and the value of stocks transferred out (based on the closing price of the transfer date).

Total cash outflow: including the stock buy execution amount, the value of stocks transfer-in (If the initial cost price is not set when transferring in, it will be based on the closing price of the day).

Transaction fees: SEC Fees, Settlement fees and TAF.

Q16: I received a 1099 tax statement, but it only has transactions from the beginning of the year and is missing all of my trades/income after April 2024. Can you correct this to reflect all of my transactions or will I be receiving an additional 1099 tax statement?

Disclaimer: We do not provide tax advice and any tax-related information provided is general in nature and should not be considered tax advice. Consult a tax professional regarding your specific tax situation.

Overview

- Q1: Why didn’t I receive a tax statement?

- Q2: Why is the cost basis on my 1099-B different that what is shown in the system?

- Q3: Why did I receive 2 separate 1099-DIV forms?

- Q4: Why did I receive both a 1099 and a 1042-S?

- Q5: Who do I contact with questions about the 1099 or 1042-S?

- Q6: How do I update incorrect cost basis on the 1099-B for a sale?

- Q7: I haven’t received my tax statement, do you know when I can expect it?

- Q8: Why is my tax statement showing foreign tax paid?

- Q9: I received two tax forms. Which one is valid?

- Q10: How do I report the information received on my tax statement?

- Q11: My account is currently closed, and I have not received my tax statement. How can I access my tax statement if I no longer have access online?

- Q12: My tax statement has payments from 2025 and the tax form should only reflect transactions from 2024. How do I get this corrected?

- Q13: My account is closed, but I no longer live at the last address on file. What do I need to provide to update my address and have a tax statement sent to my current residence?

- Q14: I never received the money shown in the Miscellaneous section. Why are you reporting this and how do I get that money?

- Q15: Why is the Net gain/loss on my 1099 tax statement different than the amount shown for my cash balances or P/L in the app?

- Q16: I received a 1099 tax statement, but it only has transactions from the beginning of the year and is missing all of my trades/income after April 2024. Can you correct this to reflect all of my transactions or will I be receiving an additional 1099 tax statement?

Market Insights

Discussing

Discussing

Discussing

Monetary Policy: Navigating the Fed's Rate Cut Cycle

Earnings Season Underway

- No more -