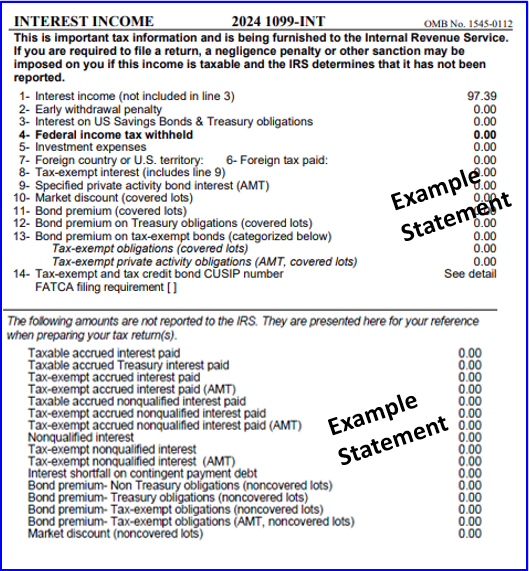

1. What is 1099-INT

Form 1099-INT is used File Form 1099-INT for each person:

● Reportable Interest paid in boxes 1, 3, and 8 of at least $10.

● Foreign tax paid on interest.

● Backup withholding regardless of the amount of the payment.

2. Key Terms for 1099-INT INTEREST INCOME

Interest Income (not included in line 3)

● Interest income is money earned by an individual or company for lending their funds, either by putting them into a deposit account in a bank or by purchasing certificates of deposits.

*Most accounts will not have interest activity, but for some accounts, it is due to the sweep account interest.

● A sweep account is a kind of bank or

brokerage account. If the customer’s daily account balance gets above the average limit set by the customers, the excess amount gets transferred to a high interest-bearing money market account. This interest is reported on line 1.

Disclaimer: We do not provide tax advice and any tax-related information provided is general in nature and should not be considered tax advice. Consult a tax professional regarding your specific tax situation.