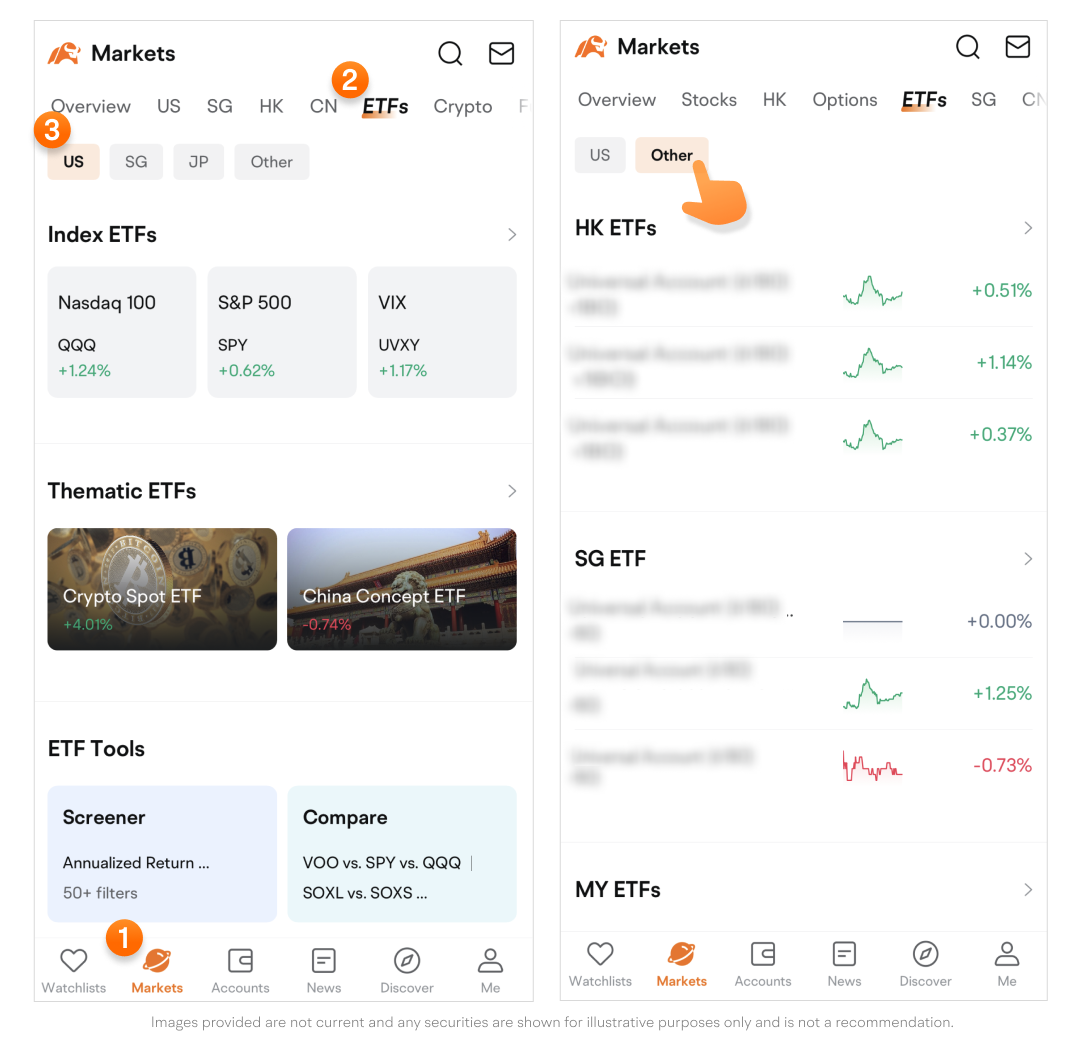

ETFs

-

Tap the > icon to view the full list.

-

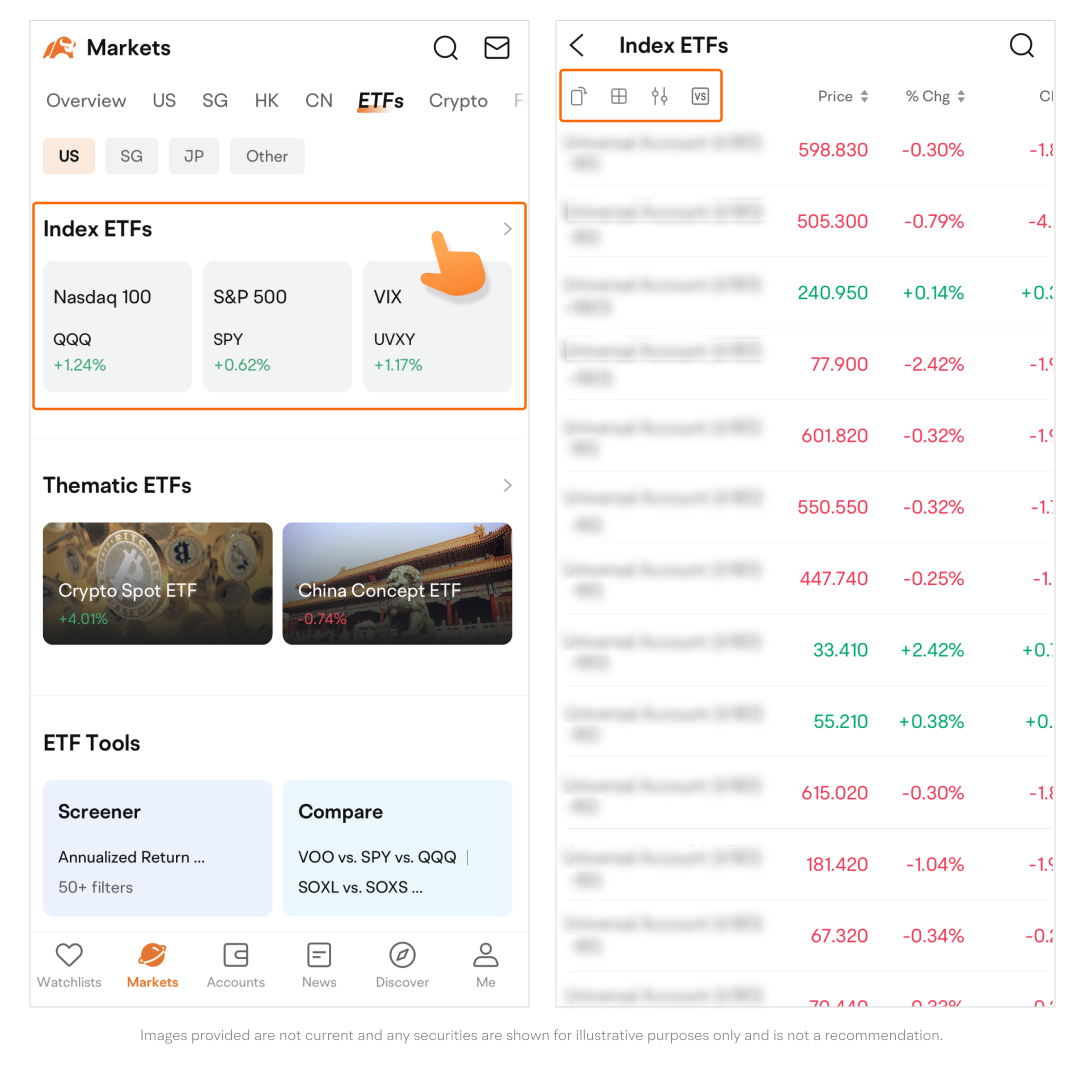

Rotate your phone to enter landscape orientation and easily view more data at a glance.

-

Use Multi-Chart to view ETFs in multiple strands in the same column.

-

Tap the Filter icon to screen ETFs by underlying index and leverage.

-

Tap the VS icon to compare key ETF information side-by-side with other ETFs.

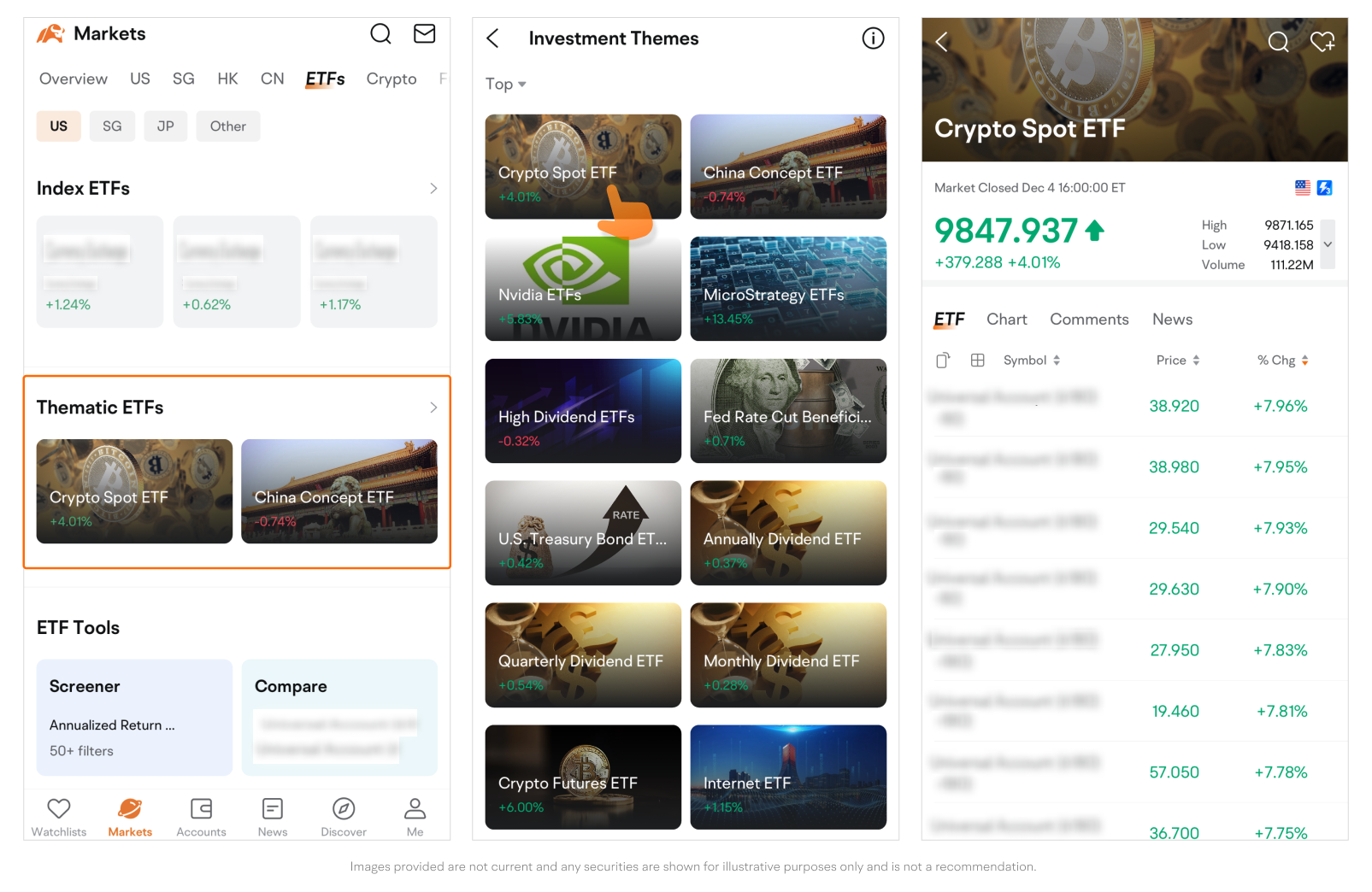

Thematic ETFs

-

Two trending thematic ETFs are shown by default. Tap the > icon to view the complete list.

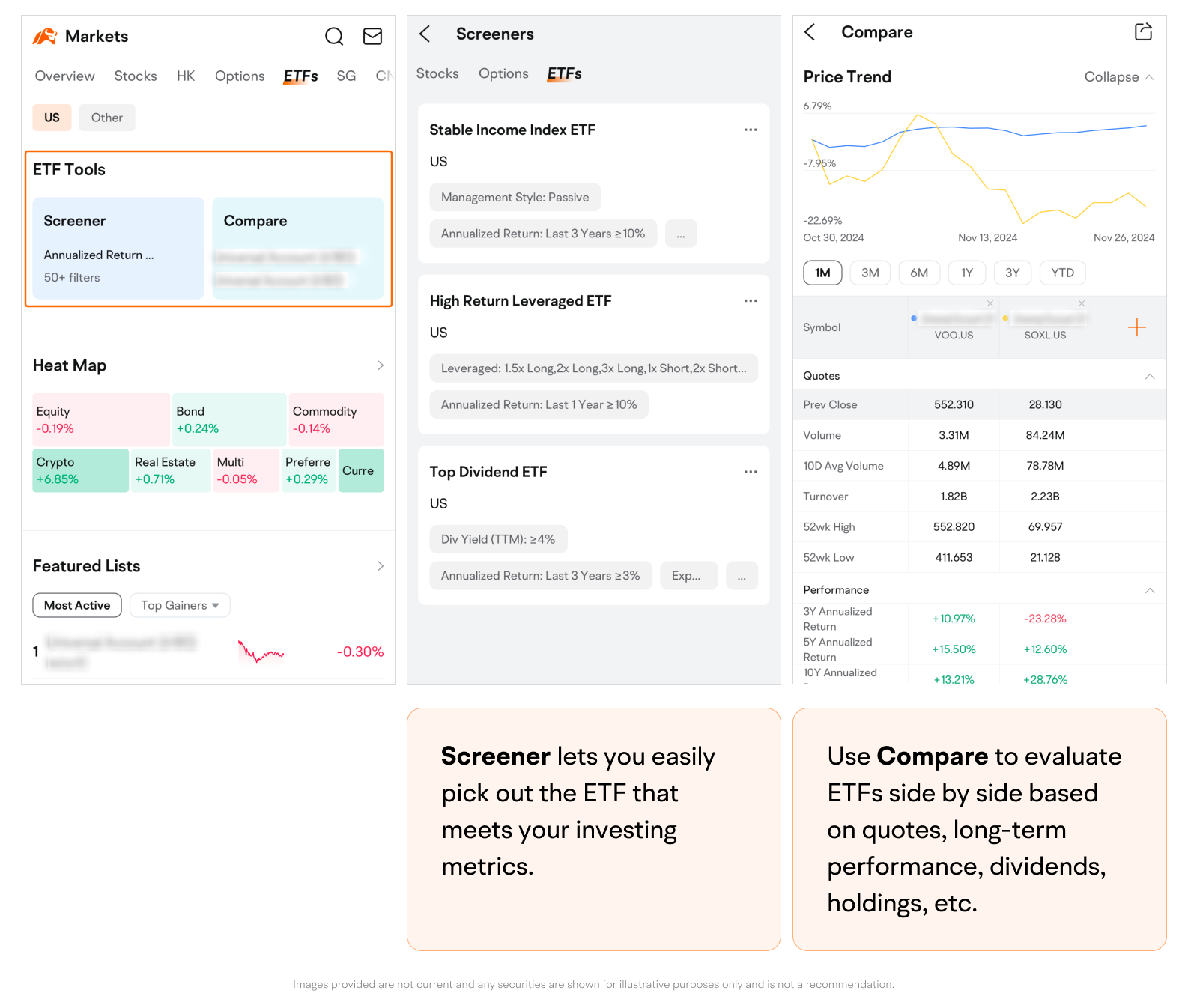

ETF Tools

-

Screener lets you easily pick out the ETF that meets your investing metrics.

-

Tap to enter the feature. Some preset screeners are offered, such as "Stable Income" and "Top Dividend".

-

Tap Create Screener at the bottom to select custom filters such as performance, dividend, and risk profile.

-

Tap Done to see the screening results.

-

You can save the screener for later use by tapping Save and naming it.

-

-

Use Compare to evaluate ETFs side by side based on quotes, long-term performance, dividends, holdings, etc.

-

Tap + to find ETFs for comparison. Swipe left on the symbol row to add more. You can add up to 6 symbols.

-

Tap an item to show a mini chart. For example, tap Prev Close to show the Price Trend chart of the symbols you are comparing.

-

Tap Collapse near the top right to hide the chart. To show it, tap Expand.

-

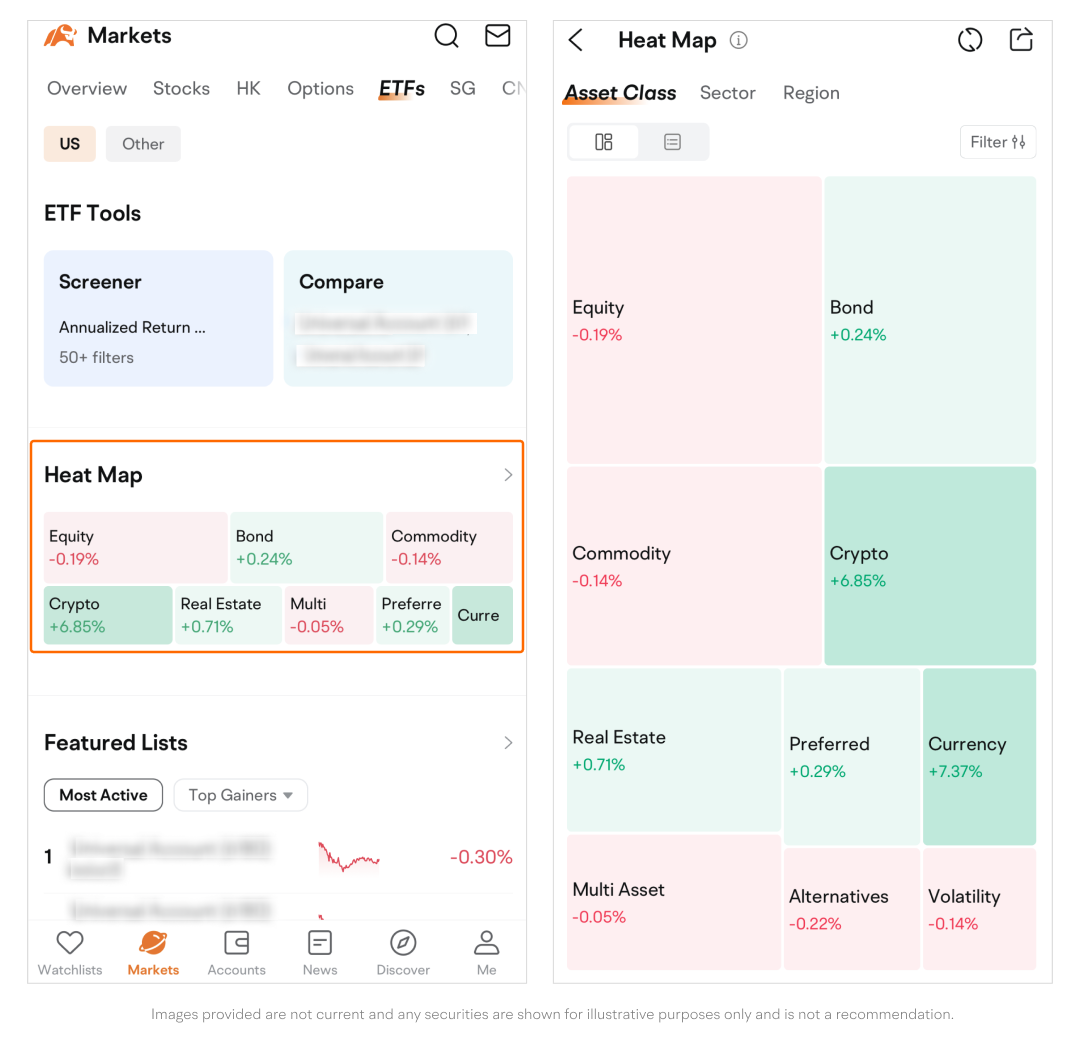

Heatmap

-

Tap a block to view the daily performance of that type of ETF.

-

Tap the > icon to access the main page of the feature.

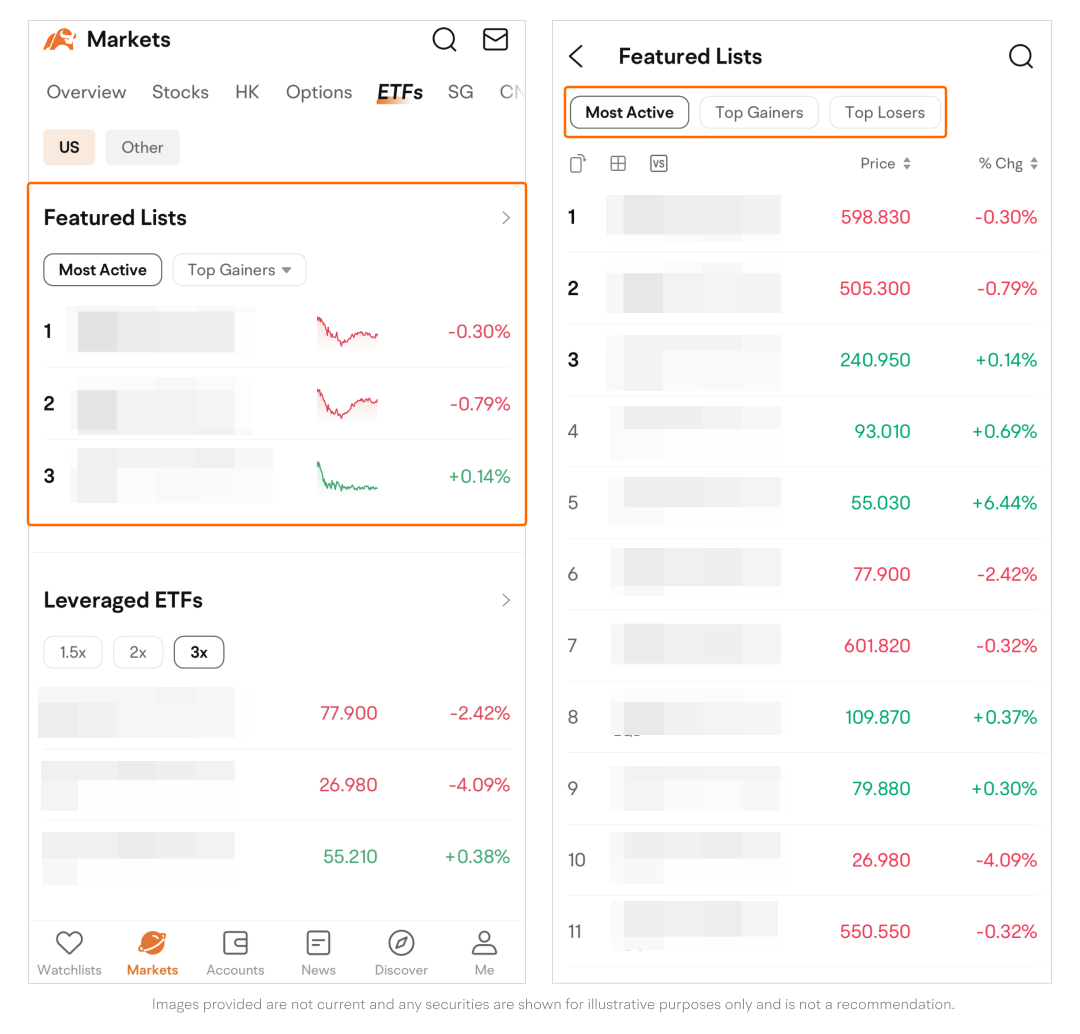

Featured Lists

-

By default, the list shows three most traded ETFs.

-

Tap Top Gainers to see a list of ETFs that have risen the most for the day.

-

Tap again to show a dropdown menu, then tap Top Losers to switch the list.

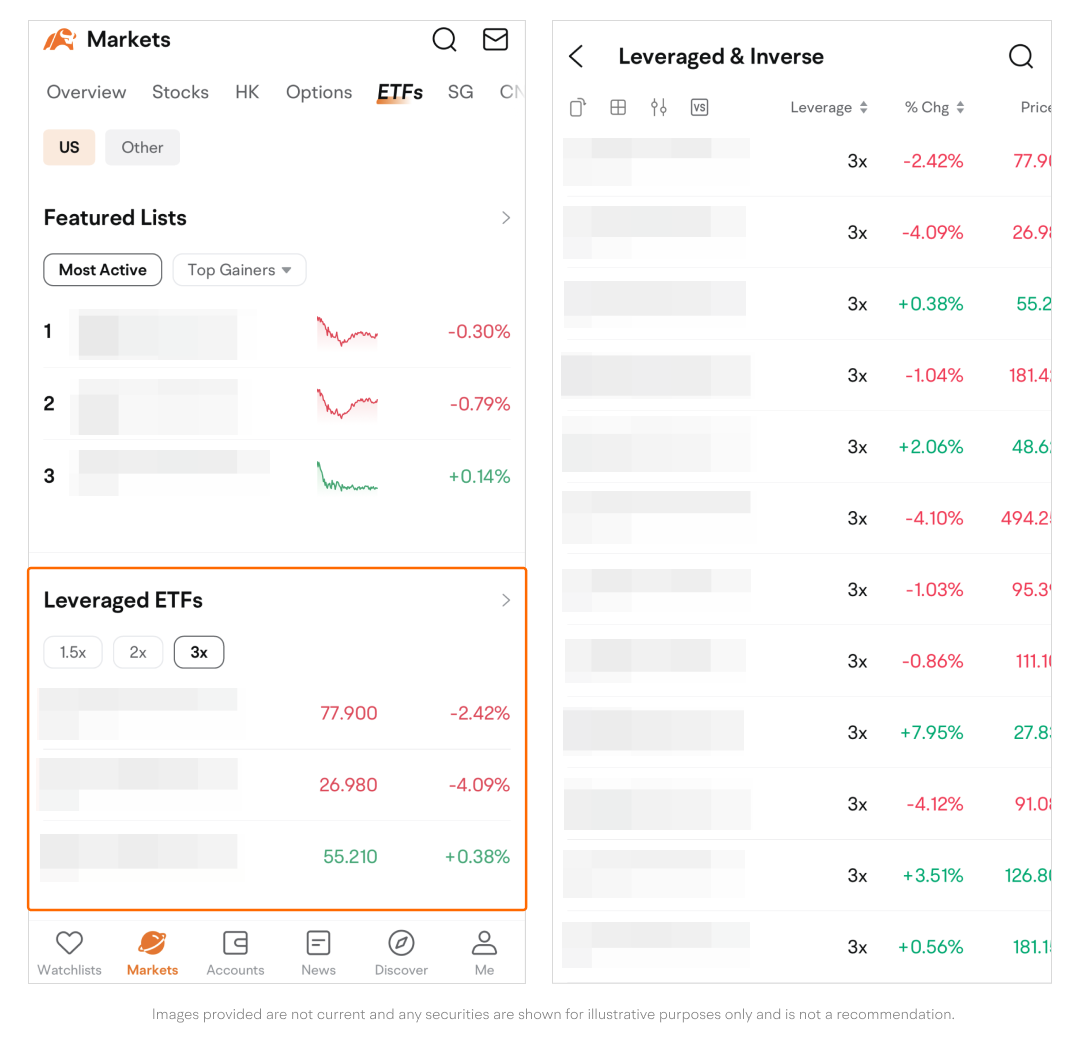

Leveraged ETFs

-

Tap the > icon to see the full list.

-

Tap the filter icon near the top to select your desired leverage and direction.

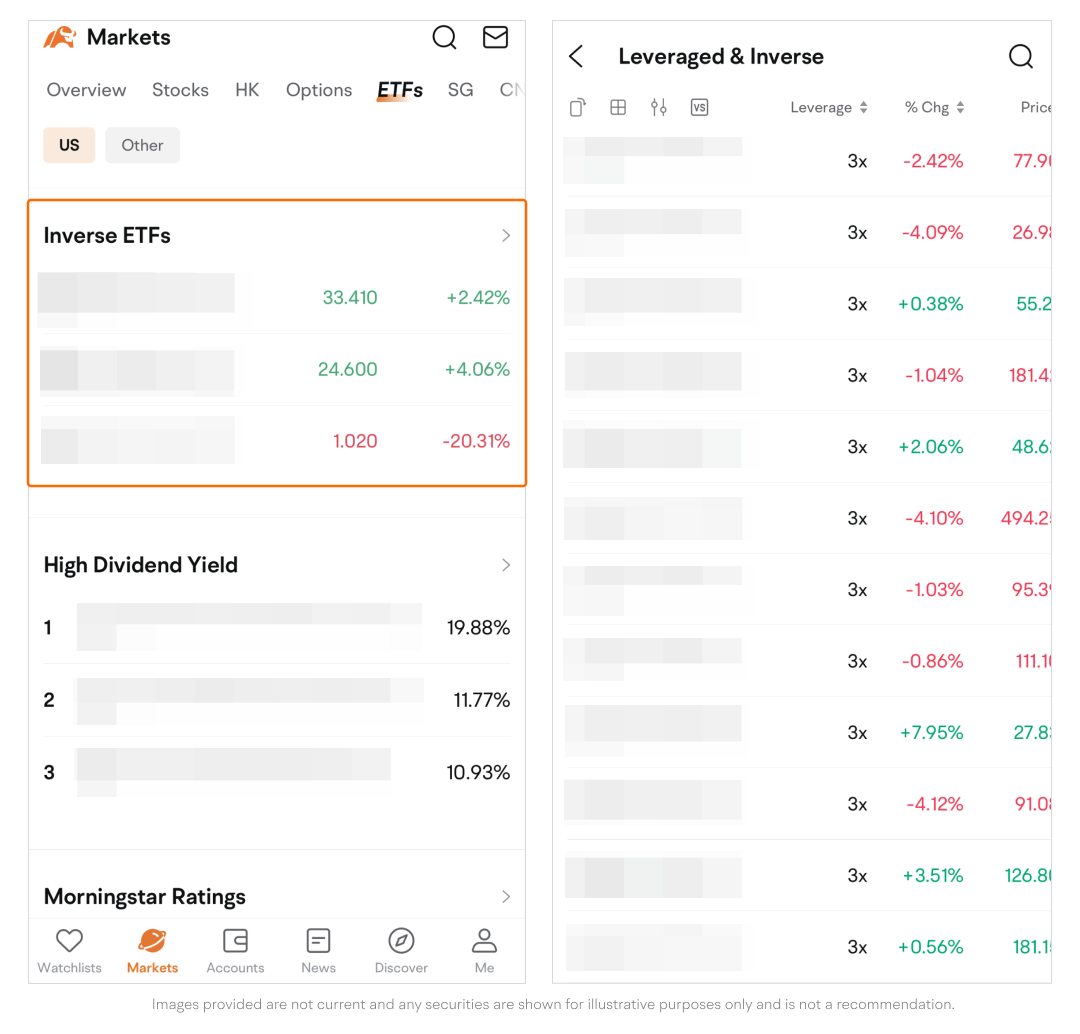

Inverse ETFs

-

Three inverse ETFs are shown by default with their quotes. Tap the > icon to view more.

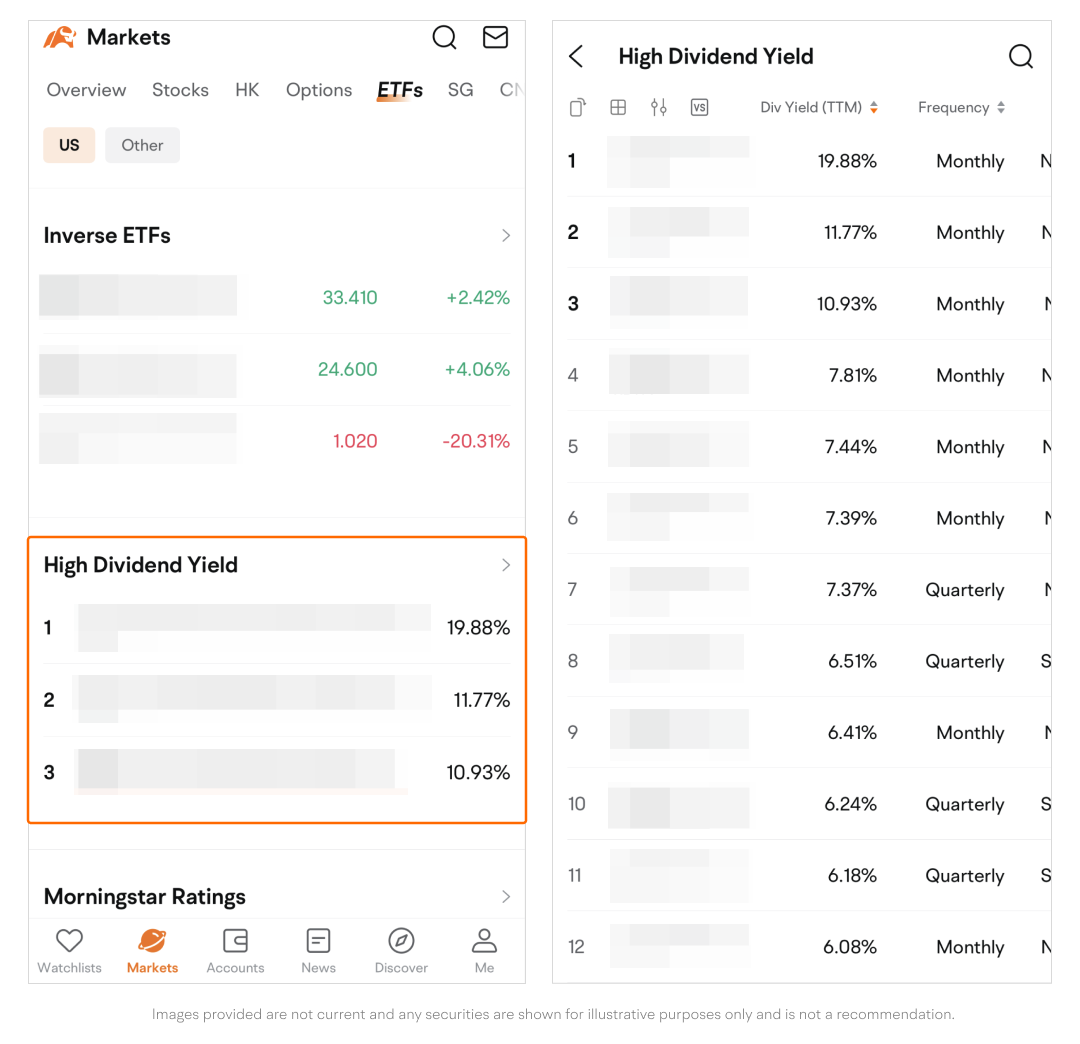

High Dividend Yield

-

Tap the > icon to see the full list and more data, such as dividend frequency, quotes, and AUM.

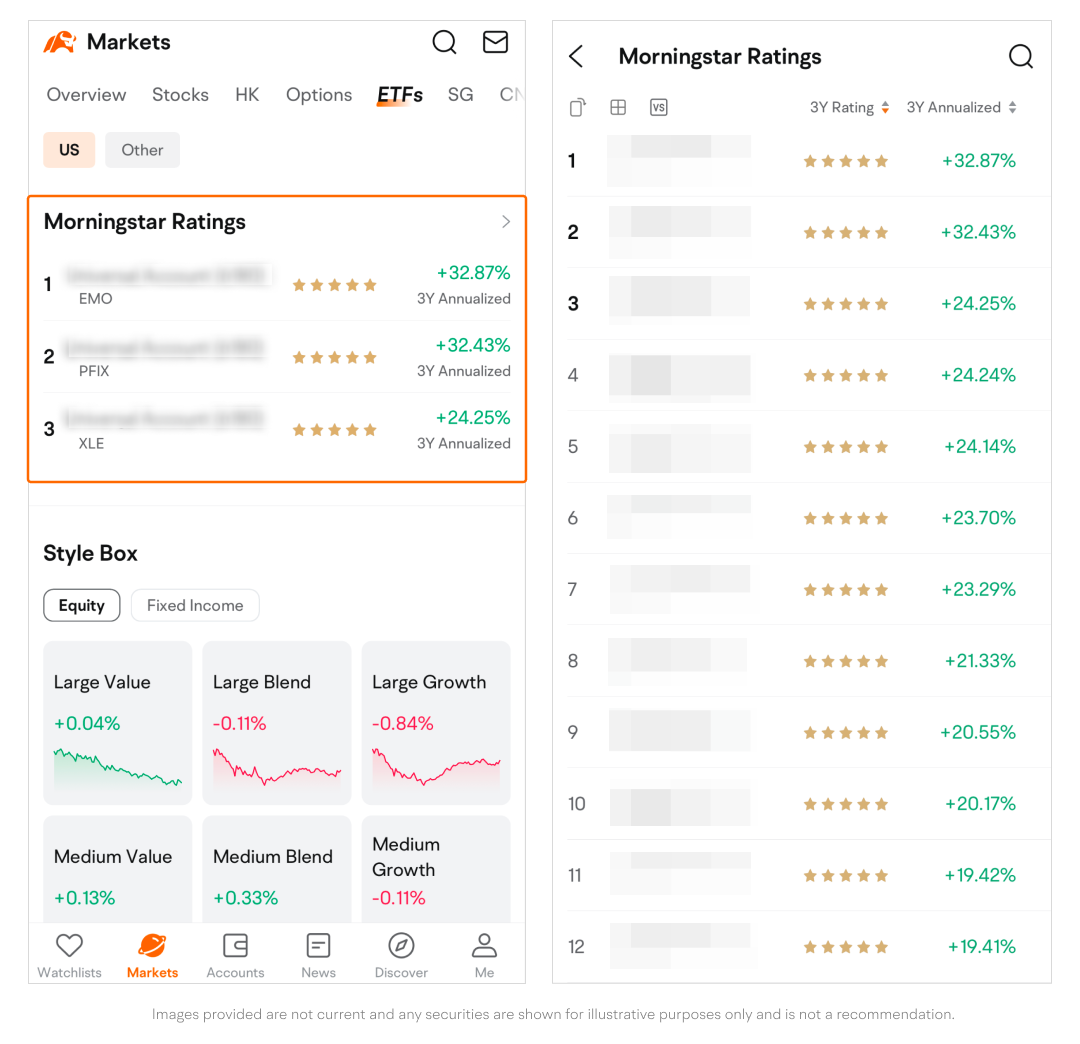

Morningstar Ratings

-

Three funds are shown by default, sorted by 3-year rating and annualized return. Tap the > icon to view more.

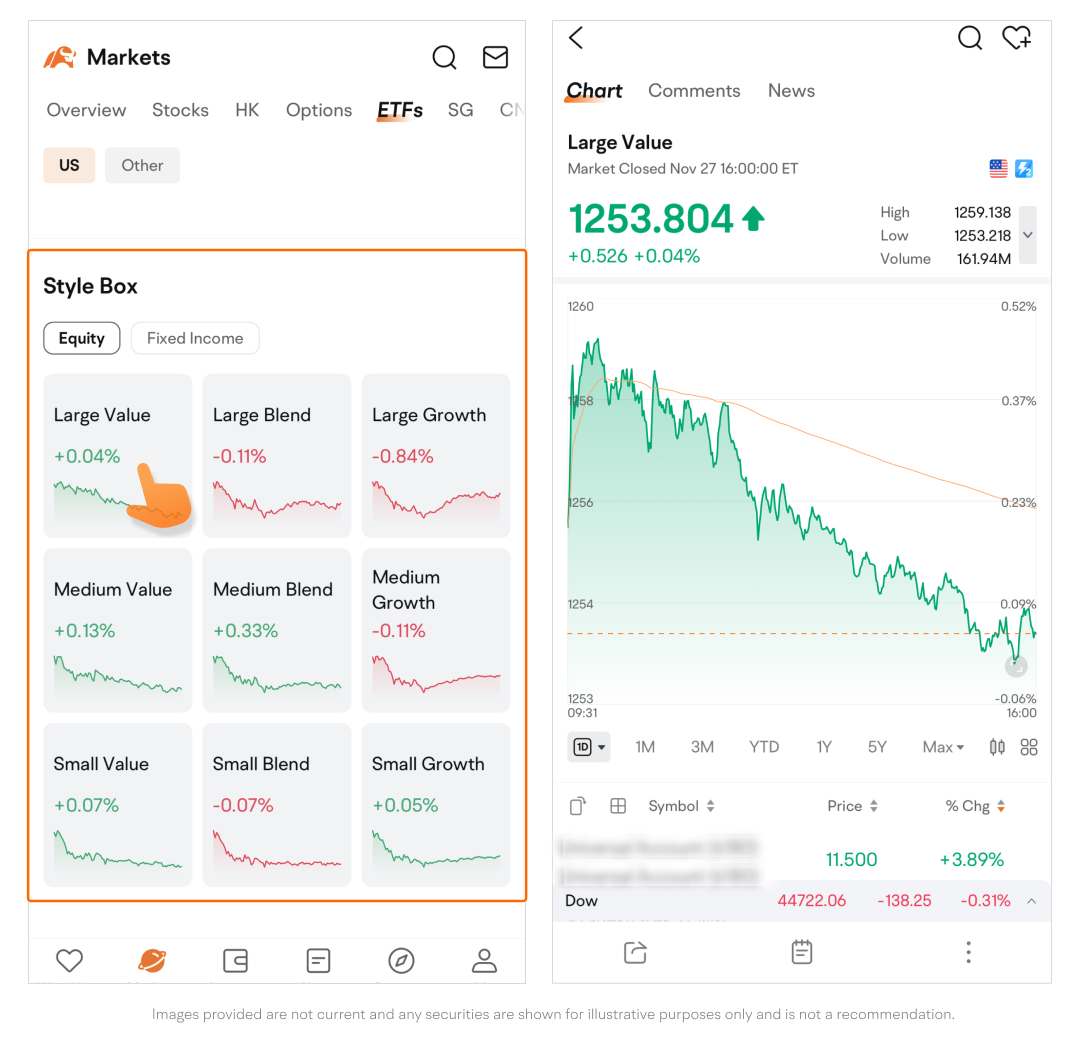

Style Box

-

Tap a box to view the style's daily performance and a list of component ETFs.

This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.